Oh, the irony. NSW is one of the most coal-dependent states in Australia, with renewable energy contributing less than 10 per cent to its electricity mix on average. Over the weekend, however, wind and solar may just have helped keep the lights on.

It is now clear that solar (rooftop and large scale) was contributing more than 1GW to the grid during much of the day, and around 500MW in the late afternoon on Friday when the Australian Energy Market Operator had flagged the possibility of rolling blackouts.

The strong performance of wind and solar came despite the loss of more than 1GW of capacity of coal fired power and the sudden withdrawal of two of the biggest gas fired generators on Friday afternoon – at the height of the heatwave and supply-demand crisis.

NSW energy minister Don Harwin praised all fuels for their efforts, but singled out wind and solar. “It’s the biggest day ever for solar,” he said in a statement, and added there was “plenty of wind power generation coming in from the wind turbines along the great dividing range.

That turned out to be useful, even crucial for consumers at risk of blackouts. Two 500MW units of one of the state’s biggest coal generators – Liddell in the Hunter Valley – had gone out of service earlier in the week due to problems with the boiler tube leaks..

That likely contributed to the decision by AGL Energy to cut power to the state’s biggest consumer of electricity, the Tomago aluminium smelter in the Hunter Valley on Friday. The AGL supply contract allows it to do that,

That “load shedding” removed more than 300MW of demand, and with the contribution of solar probably saved consumers from the type of rolling blackouts that afflicted South Australia last week when the country’s most efficient gas-generator sat idle.

It was a bad week for AGL and fossil fuel generators in general. Not only did Liddell lose half its production, with one unit returning on Saturday after the crisis had passed, a unit of its Torrens Island gas generator in South Australia also failed early last week – on the same day as Liddell.

The 120MW capacity from that Torrens Island unit may have helped South Australian consumers, many of them clients of AGL, from losing power last Wednesday in the rolling blackouts or load shedding.

Of course, many consumers – particularly those of Simply Energy, may be asking why the Pelican Point gas fired generator – touted as the most efficient in the country, and owned by the same company, Engie, chose to stand idle while they lost power. Or why the Australian Market Operator chose not to instruct it to fire up.

But more questions are emerging about the role of gas fired generators in NSW at the height of the supply crunch. Two of them, Colongra and Tallawarra, stopped generating in the afternoon peak on Friday, as these graphs provided by Dylan McConnell, from the Climate and Energy College in Melbourne, illustrate.

The 435MW Tallawarra gas station is owned by Energy Australia, owner of the Mt Piper coal plant, which (like all other generators) would have benefited from the $14,000/MWh power prices that occurred after Tallawarra stopped generating. It appears that Tallawarra had a fault that caused it to trip and damage some valves.

The 667MW Colongra power station is owned by Snowy Hydro. See our story last week – High power prices? Blame fossil fuel generators, not renewables” of how Snowy Hydro and Origin Energy acted to push up prices in NSW late last year.

This is what happened when the two power stations stopped generating. Remember, this is when NSW was facing a supposed critical shortfall, and when the Tomago smelter had been forced to shut its pot lines, risking catastrophic damage and safety issues, according to its CEO.

This is what happened when the two power stations stopped generating. Remember, this is when NSW was facing a supposed critical shortfall, and when the Tomago smelter had been forced to shut its pot lines, risking catastrophic damage and safety issues, according to its CEO.

Interestingly, AEMO issued a “non conformance” notice to Tallawarra on Friday evening, apparently because it did not follow instructions.

Asked for further details, a spokesman said: “AEMO does not comment on reasoning behind the generator non-conforming with their dispatch instruction as that is an issue for the generator.”

Meanwhile, the supply/demand issue remained critical in Queensland on Monday, which was expecting record power demand and potential shortfalls in supply.

Rooftop solar also played a critical role in that state over the weekend, when the state hit extraordinarily high levels of demand for a Sunday. Solar vastly reducing the peaks on grid use, as the AEMO warned of supply shortfalls.

This graph from Global Roam, providers of our excellent and popular NEM Watch widget, illustrates.

The fact that rooftop solar was delivering so much power during the day would have limited the number of price spikes in the state. Notice how the price did not spike until demand fell, and rooftop solar was on a downward trajectory.

As we reported exclusively last Wednesday, Queensland prices have spiked more than 40 times more often in South Australia this year and have averaged more than $240/MWh. As ITK analyst David Leitch pointed out earlier last week, the afternoon prices have averaged more than $1,000/MWh.

In the last week it averaged more than $450/MWh and over the last 24 hours averaged more than $800/MWh, according to McConnell.

The Australian Energy regulator said on Monday that it would investigate eight different spikes above $5,000MWh in NSW and Queensland over the last three days, as it is required to do.

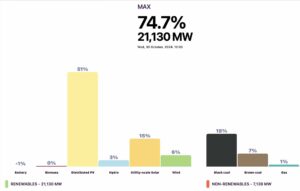

Back to NSW, energy minister Harwin said that renewable energy was providing 25 per cent of power needs during some of the daylight hours – when solar was strong and wind also blew, and Paul McArdle notes that it provided around 16 per cent of total production during the 24 hours on Friday.

Wind and solar provided more than 7 per cent but could, of course, have provided more but NSW has been deemed the worst place for large scale solar investment.

The AEMO provided this data for NSW at peak demand, but note that this is peak grid demand, not total demand, which is disguised from the grid operator because much of the rooftop solar is consumed within the households.

(We are seeking comment from AEMO, EnergyAustralia and Snowy Hydro).