The Queensland electricity grid – as predicted – smashed its demand records on Monday in the middle of the heatwave. The market operator reported no issues with supply, prices by and large were relatively moderate, and solar was hailed by the state energy minister as it continued to eat into the coal industry’s lunch-bag.

The Queensland grid is getting interesting for a number of reasons. It has the most rooftop solar in the country (it is the first state to pass more than one million installations), yet it remains the most dependent on coal (in terms of percentage – 68.9 per cent over the last year).

It also has the least ambitious renewable targets of any state on the eastern seaboard – even though those targets do call for a 50 per cent share in 2030, 70 per cent in 2032 and 80 per cent in 2035 – and it has a government that rarely stops talking about the green energy transition, along with an opposition that really wants nuclear.

The severe heatwave was seen as a test of the grid’s credentials.

It didn’t disappoint. In the early afternoon, at 1355 AEST “native demand” (including the power consumed by homes and businesses from their own rooftop solar) hit a peak of 12.975 GW, smashing the previous record set just three days earlier by more than 1.2 gigawatts.

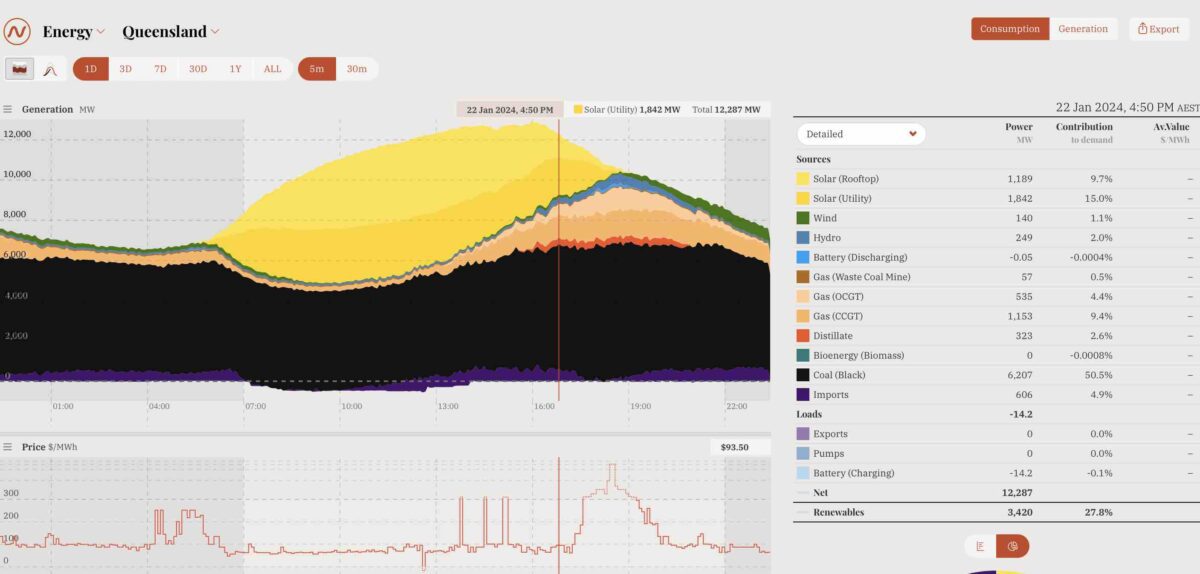

A few hours later, at 1650 AEST, grid demand (without counting rooftop solar) peaked at a new record of 11.036 GW, also smashing the previous record set last Friday by nearly a gigawatt.

Interestingly, at both peaks, the wholesale electricity price was sitting under $100/MWh. Consumers can probably thank the dominant role of solar for that outcome. State energy minister Mick de Brenni certainty did.

“We didn’t just surpass the previous record we absolutely smashed it,” he told ABC on Tuesday morning.

“About a 10 per cent of increase of demand for power, but supply got us through, and that’s in part due to a large amount of solar.”

At the peak of “native demand” in the early afternoon the combination of rooftop and utility scale solar was accounting for more than 47 per cent of demand, and from 9am local time to after 1pm solar accounted for more than 50 per cent of total demand.

Solar did not release its dominance until after 4pm when its share fell below 40 per cent, but even at the new peak of “grid demand” it was still accounting for one quarter of all supply. The role of rooftop solar is critical in that grid, and it took a sizeable chunk out of the demand for coal doing the daytime hours.

There were a couple of other interesting things to observe about the day of record demand. One was that wind contributed little throughout the day. Queensland only has about 1,000 MW of wind capacity currently in operation, but the wind output never breached the 200MW mark from shortly after 6am until after 7pm.

Queensland doesn’t yet have many big batteries – in fact only two at Wandoan and Bouldercombe. Interestingly, they were charging at the moment of peak grid demand in the late afternoon, but by 6pm they had started to discharge as prices jumped above $300/MWh in the evening peak.

More big batteries are currently on their way – at Western Downs, Chinchilla, Swanbank, Tarong, Greenbank, and Stanwell, among others – and battery storage capacity will increase at least 10-fold in the coming years. That will create new dynamics in the evening peak.

For the moment, however, the peaking gas generators still remain supreme – although they might not have been needed at all had their not been yet further delays in the re-start of the broken Callide C coal generators – and wholesale prices jumped only once cheaper imports from neighbouring NSW dried up.

But unlike the previous days, when prices hit the price cap of more than $16,500/MWh, the price on Monday peaked short of $10,000/MWh, and only briefly.

The outcome justified the confidence of the state government, and de Brenni, who had predicted no reliability issues – although you never know when a series of incidents and equipment failures can change the game.

As it turned out, local storms damaged transmission lines and other local infrastructure and about 40,000 customers reportedly lost power for a time.

One of the reasons for de Brenni’s confidence was that the bulk of generation is state owned, so it doesn’t find itself pressured by private companies over accelerated closure timetables or, in the case of South Australia in early 2017, just not making their plant available when needed.

Note: State transmission company PowerLink said “actual demand” peaked at 5pm at 11,005MW, an increase of 9.3 per cent over the previous record set in March last year. (The difference in megawatts and previous records is due to the 30 minute period calculations as opposed to five minute periods cited above).

“Powerlink’s network has performed well and has provided Queenslanders with reliable power while they beat the heat,” Powerlink CEO Paul Simshauser said in a statement.

“All parts of the energy sector across the State have worked tirelessly through a day which promised to challenge the entire network. Keeping our network operating safely in extreme conditions is an outcome we plan for and are proud of.”