Back in January Green Energy Markets came to the reluctant conclusion, detailed in RenewEconomy, that it was extremely unlikely we could avoid falling short of the large scale Renewable Energy Target by 2018.

At the time, we estimated there was a need for roughly 4,400 megawatts (MW) of new project capacity to be committed to construction this year to avoid falling short in 2018. This 4,400MW figure assumes capacity was all wind, but in reality we’ll need more capacity given solar projects are part of the mix.

Now we find ourselves half way through the year and so far less than 300MW has been committed. Another 630MW of projects have power purchase agreements and are likely to be committed this year.

However, only 430MW will actually contribute towards meeting power retailers’ obligations under the national Renewable Energy Target (RET). This is because 200MW will be used by the ACT Government to meet its own separate target and will be voluntarily surrendered to the regulator.

That leaves us with a very big gap of approximately 3,700MW to bridge in the next 6 months, which just isn’t going to happen. A few hundred megawatts could come from government procurement initiatives. But so far there’s been little progress evident on this front, with no contracts signed outside of Ergon Energy’s deal with the Mt Emerald wind farm.

Victoria’s recent target announcement that involves an auction to procure 1,800MW will make a big difference, but is unlikely to add much new capacity before 2019. Also, the capacity the Victorian Government will procure beyond this to meet its 2025 target will be quarantined from contributing to the existing RET according to Energy Minister D’Ambrosio.

It prompts the obvious question – which power retailers are going to be left short of their legal obligations under the Renewable Energy Target and by how much?

The answer is just about all of them are short of renewable energy certificates or LGCs, and by a very wide margin. Powershop and Hydro Tasmania (which includes Momentum) being two of a small number of exceptions.

Green Energy Markets has assessed each company’s holdings of LGCs and also the LGCs they can expect to receive in the future from projects they own, or have contracted with under long-term power purchase agreements.

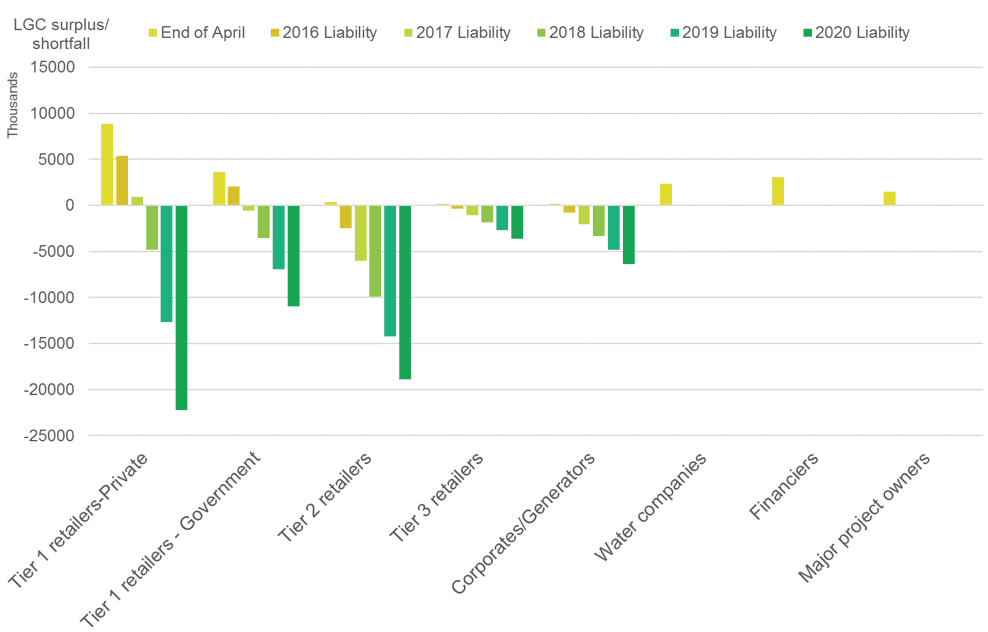

The chart below illustrates that no matter the category of liable party, almost all have failed to do their homework of ensuring a long term, secure supply of LGCs.

LGC position of power retailers and other parties over time

Assumes 2015 market share of LGC liability held constant into future

The Tier 1 private sector retailers are in the best position, but they have only a narrow buffer in 2017 and are deep in deficit by 2018. Some of their certificates are held by financiers and will ultimately be returned, but this doesn’t notably improve their short position.

Tier 3 retailers meanwhile are almost all living hand to mouth and completely reliant on the wholesale market for LGCs, while Tier 2 isn’t much better.

And the Government-owned retailers are definitely not setting much of a good example, with the exception of Hydro Tasmania who is more a producer than a buyer of LGCs.

Water companies are an interesting exception that are accumulating LGCs. It is not clear why they haven’t been either voluntarily surrendering them to meet voluntary green energy targets or on-selling them to others.

As we’ve noted previously, as have the Clean Energy Regulator and the Clean Energy Council, there are plenty of approved renewable energy project development sites that could address these customers’ requirements. But they can’t be constructed and connected to the grid overnight and face a range of lags.

Perhaps, more importantly, the finance doesn’t appear to be available at reasonable scale to construct them without a retailer agreement to buy the LGCs over a long period.

Yet retailers don’t appear to be in any great hurry to sign such agreements. For many Tier 2 and 3 retailers such an agreement isn’t much help because banks don’t deem them as a sufficiently credit-worthy counter-party. Meanwhile the Tier 1 retailers can rest reasonably easy knowing that even if they’re short of LGCs, the competitors who cause them the most pain in squeezing margins -Tier 2 and 3 – are in an even worse position.

In addition, Tier 1 retailers could be at least partly excused of being wary of fully contracting their LGC liability to 2030. Given the renewable energy industry’s history of impressive cost reductions, overshooting targets, and regulatory uncertainty, you can understand why the idea of locking in prices for the next ten years may not be that appealing.

So the market seems stuck in a holding pattern.

This naturally presents an opportunity for those investors prepared to take merchant risk that can construct projects reasonably quickly, such as in the commercial rooftop solar space. They should be able to capture LGC prices determined by the tax effective penalty of $92.86 for at least a few years.

But it isn’t without risks. The greatest of which is that we get past this impasse and after a lag manage to overshoot the 33,000GWh target, leading to a plunge in LGC prices.

Of course this would also mean Malcolm Turnbull or a future Labor Government will ignore any commitments made under the Paris Climate Agreement, which necessitate a far larger share of renewables than current 2020 renewables target. Is that likely? One would hope not.

Tristan Edis is Director – Analysis & Advisory with Green Energy Markets. Green Energy Markets assists clients make informed investment, trading and policy decisions in the areas of clean energy and carbon abatement.