A US company is looking hard at research out of the University of New South Wales in Sydney that wants to simplify how the performance of individual perovskite solar cells are tested.

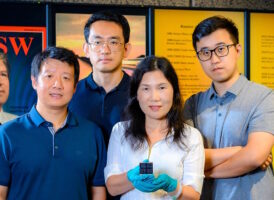

Caelux, a pre-revenue startup in California which is building a 100 megawatt (MW) perovskite solar glass manufacturing facility, has partnered with the UNSW’s Artificial Intelligence, Characterisation, Defects, and Contacts (ACDC) Research Group to try out the latter’s tech.

The University of New South Wales (UNSW) group is running an ARENA-funded project, due to wrap up in 2028, developing “high-throughput inspection techniques”.

In other words, it’s a camera that can capture short (450nm – 635nm) wavelength light coming from a perovskite solar cell on a production line.

Because perovskite cells are made by printing, coating or vacuum-depositing a layer of liquid inks between films the liquid can move, making parts of the cell more and less effective at producing energy.

Testing for problems on a large-scale production line to ensure uniform quality is not easy – or cheap – which is why companies like Caelux are interested in ACDC’s tech and figuring out how to integrate it into commercialised production lines.

Shot in the dark

The ACDC Research Group’s camera captures the peaks and intensity of electroluminescence and photoluminescence emitted when the cells are ‘excited’ by light.

A narrow but intense photoluminescence wavelength peak suggests the dye or perovskite substance is spread uniformly across the cell and there are few defects. Narrow electroluminescence wavelength peaks show the same thing, but a high intensity actually indicates how efficient the cell is performing – also a sign of defects.

But interpreting the images is more than just reading how intense and how often the light wavelengths peak, which adds to the complexity.

Temperature and the type and intensity of the light that the cell is exposed to are just a few conditions that must be taken into account.

Others include photon reabsorption and recycling, where photons that initially escaped being used for energy production are able to either be captured later or bump around in a cell to continuously create energy and improve efficiency.

It’s a long way to the top

The benefits of perovskite cells have been touted for the better part of a decade, ever since they emerged as a possible competitor to silicon solar cells.

In recent years the efficiency of these cells has risen from just over 3 per cent to improve slightly on the maximum of silicon panels, which hovers just above 24 per cent.

Crystalline perovskite materials absorb sunlight and convert it into electrical energy and some perovskites are even better at doing this than silicon. Some are cheaper to make than silicon, they can be flexible, they can be wrapped around uneven surfaces and turned into transparent glass.

But doing so at scale has defeated many researchers and companies, including Dyesol in Australia, which turned into Greatcell Solar and then Greatcell Energy when its technology was rescued from liquidation in 2019.

The US Department of Energy lists improved cell durability as critical for commercialisation, as perovskites decompose when in contact with moisture and oxygen, or when they spend extended time exposed to light, heat, or applied voltage – in other words, anything outside a lab.

“Producing uniform, high-performance perovskite material in a large-scale manufacturing environment is difficult, and there is a substantial difference in small-area cell efficiency and large-area module efficiency,” it said.

The future of perovskite manufacturing will depend on solving this challenge, which remains an active area of work within the PV research community.”

Money talks

But these are challenges that researchers and companies are finding solutions to, to the point where companies and investors are sinking serious money into the technology.

Today, a number of companies are building pilot lines with Microquanta, GCL Perovskite, Utmolight, and Oxford PV (which was mentioned in the Lux Research analysis in 2016) already having commissioned 100 MW pilot lines.

Caelux recently landed $US12 million ($18.6 million) in Series A funding to build its pilot line.

Consultancy Rethink Energy named 42 perovskite manufacturers globally, in a report where it suggested the industry could be viable as early as 2026.

Earlier this month it said perovskite solar might be able to deliver almost 1 terawatt (TW) of production each year by 2040.

In their Global Perovskites Forecast 2023-2040, Bristol-based Rethink Energy says if the industry can solve the stability and durability issues, it could transition into a “viable force” in solar in another two to three years.

By 2026, Rethink Energy expects global perovskite manufacturing output to pass the 2GW mark, before escalating quickly to 10GW in 2027 and 100GW by 2030.

Come 2040, over 90 per cent of solar manufacturing by 2040 will be perovskites “in one form or another” including 1,040GW of manufacturing from 1,615GW of production capacity, the company said.

This kind of prediction has been made before, of course.

In 2016 a company called Lux Research expected solar cells that used perovskite semiconductors to be in commercial production between 2019 and 2021.