Origin Energy has become the latest big Australian energy utility to admit that its future is split between the traditional grid-based assets and distributed generation, where consumers continue their rapid uptake of rooftop solar and, soon enough, battery storage and electric vehicles.

In a major presentation to analysts and institutional investors in Melbourne on Wednesday, Origin Energy said it intended to become the biggest installer of rooftop solar in Australia.

Even though 1.4 million homes had already installed solar, it said there were still at least five million homes (both owner-occupied and rented) that could add solar in coming years. This would be followed by battery storage and electric vehicles, along with smart meters and other technologies that its consumers would be demanding in coming years.

Origin Energy is just the latest utility to recognise that future growth lies in distributed generation. AGL Energy said its growth would lie in solar and storage, and international utilities have recognised the same, although some like E.ON are splitting their businesses because they concluded that pushing a model based around distributed generation is not compatible with defending existing centralised generation assets.

Because Origin’s investor day is only open for investors, and it only released a slide presentation with no accompanying commentary, we have to rely on the tables provided.

This table above shows how Origin Energy sees its business model in the future. It reasons it has a potential advantage over other utilities in that it has less exposure to baseload coal assets, and needs to buy much of its electricity needs. Fortunately for Origin, though, wholesale prices are falling, due to oversupply and the influx of renewables.

Origin Energy plans to become the number one solar installer in Australia and it is targeting 170MW of rooftop solar installed by 2018. But it may have to lift its game to stay number one. AGL Energy said two weeks ago it was aiming for 400MW of rooftop solar by 2020.

Like AGL, Origin is creating a division to focus on new energy products. It aims to break even by 2017 (a year earlier than AGL) and expects a $25 million loss next financial year (AGL is expecting a $45 million loss this year from its new energy division).

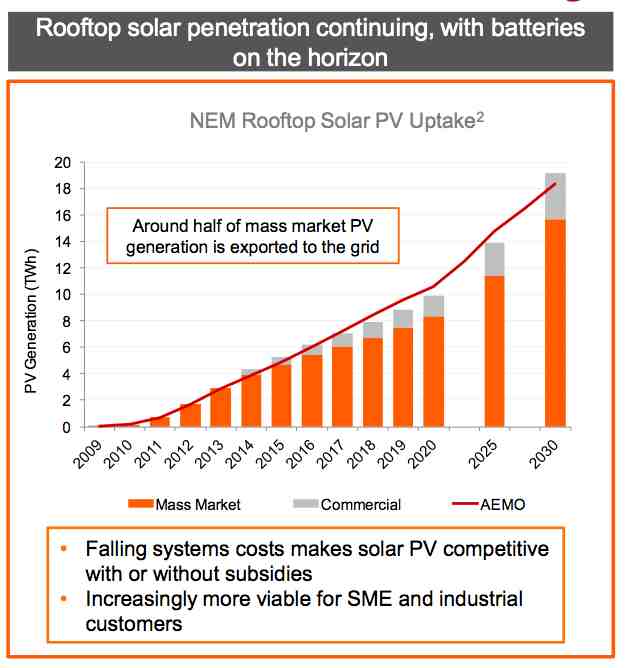

Origin says the falling cost of solar PV means that the systems are now competitive without subsidies (it has previously argued that the subsidies should be removed), and increasingly viable for small business and industrial customers.

It says it has already rolled out power purchase agreements for consumers, offering tariffs that are 30-70 per cent below average retail offers. This includes an 11c/kWh tariff in Queensland for consumers who install 5kW of rooftop solar and sign on for 15 years. It says more than half of its solar sales are in the form of PPAs.

Origin Energy says the next technologies in its solar business model will be battery storage and electric vehicles.

“(We aim) to effectively integrate battery storage and electric vehicles into customers’ energy mix,” it said in notes accompanying a slide presentation.

Origin Energy is already trialling a 3.6kWh Samsung battery storage unit for its consumers, although it says it is evaluating a range of potential suppliers, based on flexibility, economics and customer experience.

Origin says its investigations over the past 12 months suggest that customer needs for battery storage vary substantially, from retrofits to existing rooftop solar installations, and installations with new solar arrays, for customers on flat or time-of-use tariffs.

The trials have occurred in three states that it believes battery storage makes most economic sense – Queensland, NSW and South Australia. It plans to launch its battery storage products later this year or early next year.

The company says that grid defection is unlikely, due to the economics. AGL Energy has a similar view (or hope). However, Origin Energy says the uptake of battery storage – and the closure of manufacturing industries – represent further risks to its model, along with an even higher uptake of solar than it expects.