Origin Energy has made a clean sweep of Australia’s big three electricity utilities cashing in on the surge in wholesale electricity prices in the past year, with a trebling of profits in its electricity markets division underpinning a huge boost in annual earnings.

The company, the country’s biggest energy retailer with 4.6 million customer accounts, reported an underlying net profit of $1.18 billion for the 12 months to June 30, an increase from $747 million a year earlier.

It is a result that is almost entirely driven by the increase in profits from its energy business, which – like the other members of the “gen-tailer” troika, AGL and EnergyAustralia – enjoyed high prices and lower fuel costs.

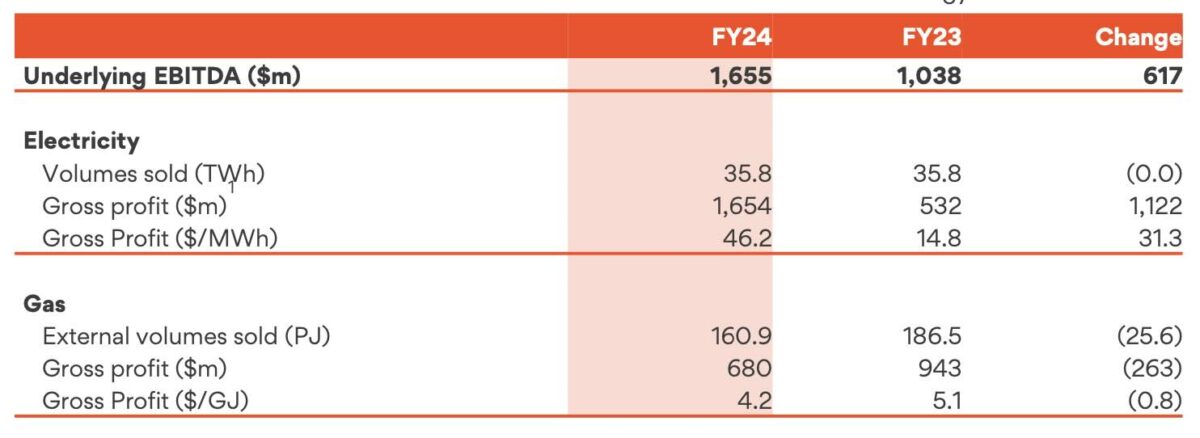

The energy business returned pre tax earnings of $1.65 billion, a $617 million boost from the previous year. It was “primarily driven by increased electricity profit as higher wholesale costs were recovered following a period of under recovery,” CEO Frank Calabria noted. “In addition, fuel costs were lower due to the legislated coal price cap.”

Indeed, looking at just the electricity side of the business, earnings jumped more than three-fold – from $532 million in 2022/23 to $1.65 billion in 2023/24.

That, as the table above makes clear, represents a gross profit of $46 a megawatt hour, up from just $14.80/MWh.

A decade ago, $46 was the average price of wholesale electricity across a whole year, now – thanks to the surge in the costs of fossil fuel generation and the lack of competition in the market – it is the profit margin.

Origin, like the other big utilities, says the increase in profits puts it in a better position to invest in the future of the green energy transition. But the market, and customers, have heard this before.

A decade ago, the then head of AGL, Michael Fraser, defended the purchase of its first coal fired power stations, saying it would give it the cash flow to invest in renewables. But it was a laughable claim and did not hold true.

And not a lot has happened in the other big utilities either, even though AGL is finally showing signs of actions as the influence of software billionaire Mike Cannon-Brookes slowly takes effect.

Origin announced the early closure of Eraring, the country’s biggest coal generator, in early 2022, but did little to replace that capacity, and recently secured an underwriting deal from the state government – worth up to $450 million – to keep the station open for at least two more years.

Origin is unlikely to be able to repeat that coup in two years, so it now finally looking to accelerate investment in new assets.

But, like AGL and EnergyAustralia, its efforts are focused less on much needed bulk energy from wind and solar, and more on storage, which are crucial for the big gentailers to maintain their control over the markets and limit competition.

So far it has committed to 1.5 GW of battery storage assets, mostly at Eraring itself where it will build a 700 MW, 2,100 MWh facility over two stages, and at Mortlake in Victoria. A battery in South Australia is also being considered.

Origin also treasures the 3 GW of capacity it has in peaking gas assets, and its growing capacity of consumer assets in its “virtual power plant”, now at 1.4 GW.

As for large scale renewables, it has committed only to 4 GW of new wind and solar assets by 2030, a fraction of what was proposed by its spurned bidder, Brookfield.

Most of Origin’s initial focus is on the massive 1.5 GW Yanco Delta wind project in southwest of NSW, which has joined a multiple other gigawatt scale projects in the same area bidding for access rights to the grid.

“We think between the combination of the gas fired peakers, the batteries and the VPP, in addition to operating Eraring for as long as it’s needed in the market and makes sense, puts us in a good position,” CEO Frank Calabria told analysts in a webcast after the release of its annual results.

And the market is very keen that Origin doesn’t get ahead of itself, and will be able to make handsome dividend distributions as well as invest in new projects – just not too money.

This appeared to be the focus of many of the stock analysts, like those whose fretting about the health of shareholders has forced Fortescue Metals to also pull back on its green energy transition.

No one in the markets wants a company to have too much of a vision of the future, even if the long term rewards are so much better – for the shareholders, the community and the planet – than short term sugar hits.

It’s why there are no longer any renewable energy firms listed on the ASX. The stock market has as much trouble digesting renewable energy companies and long term visions as the mainstream media has getting its mind around minority governments.

It’s also why the most successful renewable and storage developer in Australia, Neoen, has agreed to a takeover – ironically, by Brookfield itself. These things are better done in private ownership, it seems.