Australia’s biggest utility, Origin Energy, says it is focused on building and contracting new wind, solar and battery projects in coming years, but has also flagged potential new gas generators as coal continues its drawn out exit from the Australian grid.

Origin delivered a detailed presentation at the release of its first half results on Thursday, which revealed that higher costs of coal for the giant Eraring coal generator crimped earnings from the electricity market, although bigger gains from its LNG business helped the company lift overall earnings in the first six months.

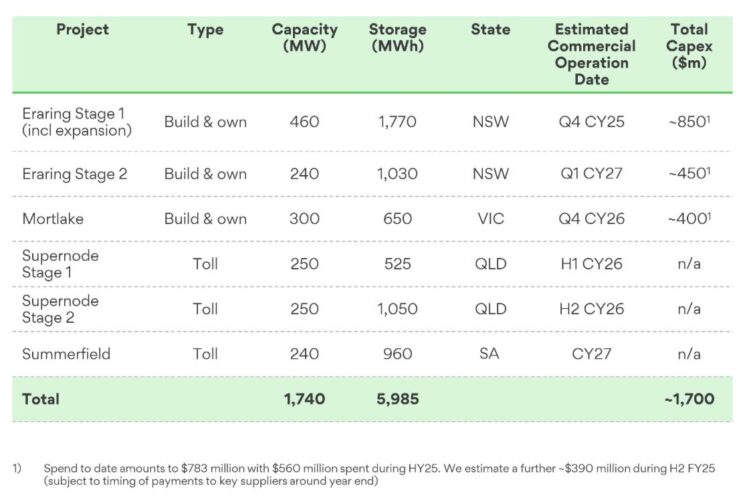

The company is investing around $1.7 billion – including nearly $1 billion this fiscal year – on its first big battery projects, comprising the 700 MW/ 2,800 MWh Eraring battery in NSW next to the newly extended coal generator, and the 300 MW, 650 MWh Mortlake battery in Victoria, next to its gas generator.

It has also signed contracts with two other big batteries that are under construction – the 500 MW, 1500 MWh Supernode in Queensland and the 240 MW, 960 MWh Summerfield in South Australia.

The other big ticket item in this plan is the 1.5 GW Yanco Delta wind project in south-west NSW, which is rumoured to be one of the winners of the grid access rights in that new renewable energy zone, although this is yet to be confirmed by either Origin or the NSW government agency EnergyCo.

Origin’s commitment to these projects means that the additional wind and solar projects planned till the end of the decade may be as little as 0.8 GW, or as high as 1.8 GW – arguably still relatively small given the scale of the investment needed to push Australia’s main grid towards its target of 82 per cent renewables by 2030.

The company last year announced the purchase of Walcha Energy, and a portfolio of wind and solar projects, and it has also purchased a huge property in the New England region that gives it land to support a major wind farm. But there was no mention of these projects in the latest presentation.

And, it should be noted, Origin’s target for new projects are still considerably less than the stretch goals outlined by the now US-based Brookfield before its agreed takeover was shot down by shareholders and it turned its attention, and its targets, instead to France’s Neoen, which it now controls.

Origin confirmed on Thursday that it is likely to seek a third party to fund the construction of the multi billion dollar Yanco Delta project, but will ensure it has the offtake contract for what would be one of the, if not the, biggest wind projects on the main grid.

Like AGL, Origin is seemingly more focused on boosting its portfolio of dispatchable resources as more renewables enter the grid, which ensures that they can also retain market and pricing power even as their existing coal assets are wound down.

CEO Frank Calabria noted that battery storage costs have fallen sharply and continue to fall, and the company sees batteries playing a key role in quick response to market price moves, and short term supply needs. The first of those battery projects at Eraring is expected to come online by the end of this year.

It is still heavily invested in gas – particularly as a shareholder in the huge APLNG business, and head of operations Greg Jarvis says the company is also considering new investments in “mid merit” gas generators at three locations, at Mortlake in Victoria, Darling Downs in Queensland, and in NSW.

A big focus of the company’s efforts to adapt to what is hopefully an accelerating green energy transition is through the retail side. It is delighted with its investment in innovative UK-based retailer Octopus Energy, which is now the biggest in that market and expanding into Europe.

One of the biggest challenges for Origin – and other electricity retailers – is how they adapt their business models to the changing energy options of its customers, in particular rooftop solar, household storage and electric vehicles.

It has 1.4 GW of assets that it describes as a “virtual power plant” and intends to grow that to 2 GW in the next financial year, and it has 1,100 EVs “under management.”

It has also invested in companies such as Solar Quotes, and sees a growing push into electrification. “One of the great opportunities that we have is that we actually deal with a lot of customers now through our partnership with Solar Quotes that are looking to electrify their home,” said Jarvis.

“And we see that, over time, that provides us with a bit of a distinct advantage.”

Origin’s half year report reveals a boost in net profit to $1.02 billion from $995 million and a bigger rise in underlying profit to $995 million from $746 million, largely a a result of its LNG business that offset falls in the electricity market and its investment in UK energy retailer Octopus.

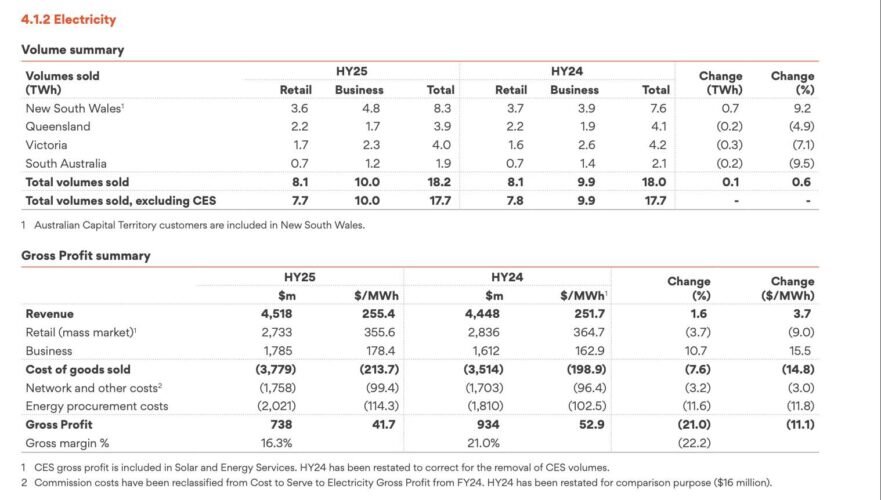

The underlying earnings from its energy business slumped sharply to $738 million from $1,044 million in the prior first half, despite a solid growth in customer numbers. The main reasons were a rise in coal costs due to the removal of the price cap in NSW, and falling gas prices and volumes in the Australian market (who knew!?!).

The accounts reveal some interesting titbits. Eraring produced 6.6 terawatt hours, just over one third of its total sales of more than 18 TWh. Its average profit margin from the sale of electricity is around $41/MWh.

It receives an average $355/MWh from retail customers (or 35.5c/kWh) and $178/MWh from business customers, and pays an average $91/MWh for renewable energy (including certificates), and an average $62.50 for solar feed in tariffs. The average cost of its own thermal generation is $103/MWh. Eraring earned an average $161/MWh on the wholesale market.