The New South Wales government has awarded contracts to six new big battery projects, including the biggest in the country to date, as it builds on the foundations of a grid that will soon be without coal.

The government is hailing the tender as the biggest and most successful battery tender of its type, both in terms of scale and number of projects, and also because of the falling costs of the technology and the bids.

The winning projects, which must be built by the end of the decade, include the massive 300 MW and 3,500 megawatt hour Great Western battery project, to be built by Neoen Australia at the site of the shuttered Wallerawang coal fired power station near Lithgow.

Neoen currently owns and operates the biggest battery in Australia, the 560 MW, 2240 MWh Collie battery in Western Australia, although that will be overtaken in coming years by both the Supernode and Eraring batteries once their second and third stages are complete.

Great Western will assume that title, although other even bigger projects are in the pipeline, and existing battery projects are also being upsized, at least in terms of storage capacity, because of the falling cost of battery cells, and the growing need for more storage to cover the evening peaks and times of low wind and solar output.

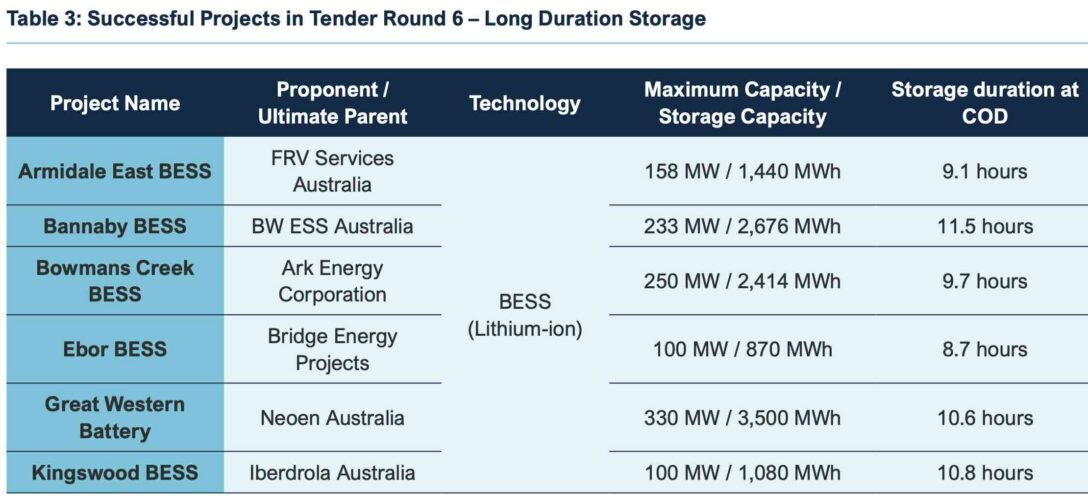

The other winning projects named by NSW on Thursday are:

- – The Bannaby battery in the Southern Tablelands (BW ESS), sized at 233 MW and 2,676 MWh

- – The Bowmans Creek battery in the Upper Hunter (Ark Australia), sized at 250 MW and 2,414 MWh.

- – The Armidale East battery (FRV Services Australia), sized at 158 MW and 1,440 MWh

- – The Kingswood battery near Tamworth (Iberdrola Australia) sized at 100 MW and 1,080 MWh

- – The Ebor battery, also near Armidale (dev eloped by Bridge Energy with buy option for Energy Vault) sized at 100 MW and 870 MWh

All are due to be completed by 2030, and some are supersized above eight hours of storage to ensure that the battery storage capacity remains at the required size (eight hours) for the duration of the 14-year contract, in case of degradation.

Some batteries, such as Armidale East, may end up bigger to service other markets. Almost all of them, with the exception of Ebor, started out in their development process as four hour batteries, but have made adjustments as a result of market opportunities and lower battery prices.

“These six big batteries mean we’re on track to smash our storage targets, harvesting the sun and the wind, so we can power NSW around the clock and put downward pressure on prices,” NSW energy minister Penny Sharpe said in a statement.

“We’re not stopping here – NSW will support more projects, so we’re ready for a grid powered by renewable energy, supported by gas.”

The six batteries bring some 1.2 GW and 12 GWh of long duration storage into the system, more than the 1 GW and 8 GWh originally sought in the tender.

They follow the 13.7 GWh contracted through the last tender announced a year ago. That tender, however, was dominated by the Phoenix pumped hydro project, which accounted for 12 GWh on its own.

The latest results also underline the growing ability of battery storage to deliver much longer duration storage than most experts had imagined, and which is filling a critical gap left open by the crippling civil construction costs that are hampering pumped hydro.

“This project will provide firm and dispatchable energy over extended periods, enable longer duration energy shifting, and make a decisive contribution toward the decarbonisation objectives of both the state and the country,” FRV Australia country head Carlo Frigerio said in a statement.

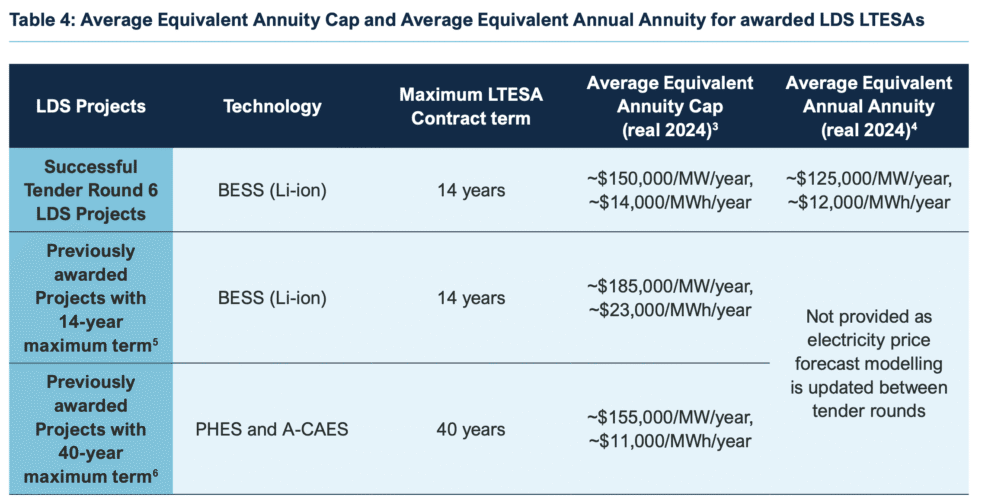

The tender results and market briefing paper, released by ASL, which is managing the process, show that the total cost of the LTESA’s – the Long term energy security agreements – have fallen significantly since last year.

Each project has undisclosed distinct bids, but ASL reveals that the average annual annuity cap (a key measurement that represents the government’s maximum exposure) has fallen to $150,000/MW and $14,000/MWh.

The average is significantly lower than the $180,000/MW and $23,000/MWh caps in the previous tender for battery storage, and while still more extensive that the $11,000/MWh in the tenders involving pumped hydro and advanced compressed air storage, the total cost is less because of the shorter contract lift – 14 versus 40 years.

“It’s encouraging to see that proponents are continuing to utilise and value the flexibility of the LTESA product to suit their project’s needs,” ASL CEO Nevenka Codevelle said.

“These agreements also deliver value to consumers by unlocking investment into additional capacity that can reduce price volatility.

“We’re about to see the first LDS projects contracted through these tenders come online. These are eight-hour-plus storage projects that would not otherwise have reached financial close or delivered energy for NSW consumers.

“It’s a very exciting time for the NSW energy transition.”

The result means that NSW will easily meet its 2030 target of having 2 GW and 16 GWh of long duration storage in place by 2030, and help it to meet the newly expanded 2034 target of having 42 GWh of long duration storage as it prepares to say goodbye to the last of its coal fired power generators.

Another tender for 12 GWh of storage will be launched within the next few months, and the results of a special tender of 500 MW of dispatchable capacity will also be announced in May. Another long duration storage tender will be held in 2027, with two large scale generation tenders, both at 5 GW, scheduled for this year.

See Renew Economy’s Big Battery Storage Map of Australia for more information.

If you would like to join more than 29,000 others and get the latest clean energy news delivered straight to your inbox, for free, please click here to subscribe to our free daily newsletter.