The NSW Treasury has concluded in a technical paper underpinning the 2021 NSW Intergenerational Report that “global demand for coal is expected to weaken considerably”.

The report further notes that “Declining global demand for coal will reduce New South Wales’ economic growth over the projection period and will have impacts both on employment and the fiscal outlook.”

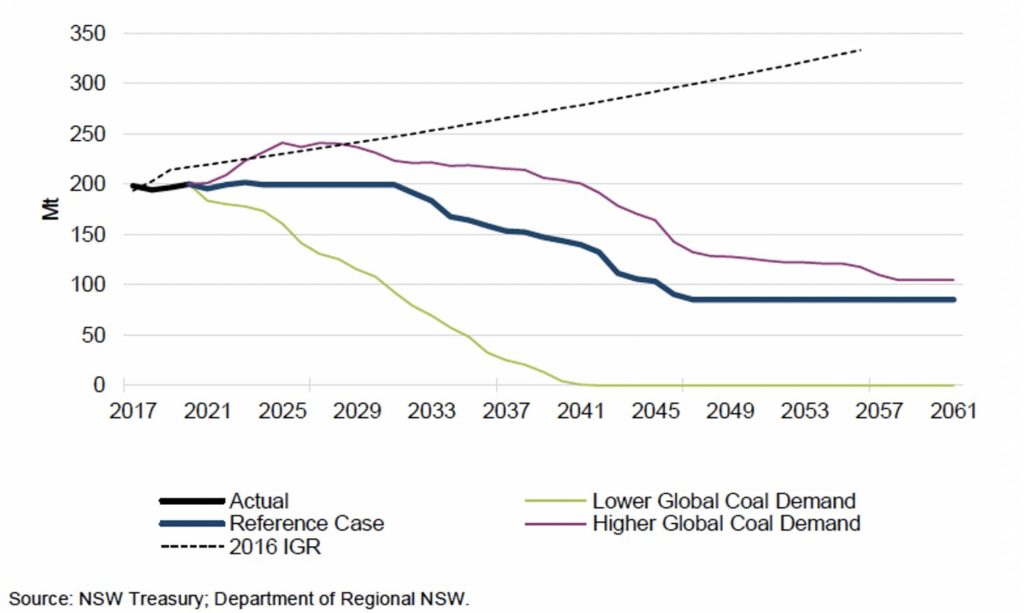

This is a major change in outlook for the government of Australia’s main thermal coal-producing state since the last NSW Intergenerational Report in 2016. Back then the NSW government was projecting continuing, long term coal volume growth at 1.2% per annum out to 2056.

In contrast, the NSW Treasury’s 2021 lower global coal demand scenario projects that coal volumes will fall to zero by 2042 (Figure 1). Even under the reference scenario, coal volumes will fall to less than half current volumes by the mid 2040s.

Figure 1: NSW Treasury and Department of Regional NSW Projected Coal Volumes 2021 vs 2016 (Million tonnes)

Given the pace of energy technology transition and accelerating diplomatic pressure on reducing carbon emissions – in addition to how wrong the 2016 projection was – there is now a real risk that we are heading in the direction of the low coal demand scenario rather than the reference case.

The NSW Treasury acknowledges that thermal coal’s worsening outlook “is being driven by a combination of policy measures at a global scale aimed at reducing greenhouse gas (GHG) emissions, and technological development which is lowering the cost of renewable generation.

This will impact the New South Wales economy and budget, and because it is driven by global factors, is largely outside the control of the New South Wales Government.”

The NSW Treasury is absolutely right on that. Ultimately, demand for Australian thermal coal will be set by the policies and actions of governments and companies in coal-importing Asian nations.

The current status and outlook for coal-fired power in these nations has far more impact on the future of Australian thermal coal than the policies and ambitions of the Australian coal industry and state and federal governments.

The Treasury makes clear that its worsening projection has been driven to a large extent by the fact that NSW’ top three thermal coal export markets (Japan, China and South Korea) all committed in 2020 to reach net zero emissions by the middle of this century.

In fact the situation is worse than that. The new coal power project pipelines in South and Southeast Asia – supposedly the new demand centres for Australian thermal coal to replace Japan, China and South Korea – are drying up rapidly after an 80% decline since 2015, and we believe this is set to accelerate as the capital subsidies from export credit agency underwritings of new coal proposals have now largely been withdrawn.

There has been some suggestion that recent thermal coal price rises indicate that the outlook is not entirely grim. Australian thermal coal operations were loss-making in 2020 when prices reduced to US$50/t although they have recovered now that spot prices are above US$120/t.

However, higher coal prices are now a double-edged sword for thermal coal miners – from this point of the energy transition onwards, high thermal coal prices will kill long term demand as it makes coal-fired power even more expensive compared to ever-cheaper renewable energy, even before considering the costs of pollution and carbon emissions.

Furthermore, the focus on coal prices hides the decline in Australian thermal coal export volumes so far in 2021. Over the first four months of this year, export volumes are down 10% as higher shipments to places like India have failed to make up for the decline in volumes to China and Vietnam.

Impact on coal royalties and jobs

NSW Treasury acknowledges that the declining outlook for coal will have a significant impact on the state’s finances. Coal royalties contributed A$1.5 billion to the state budget in 2019-20.

Under the NSW Treasury’s lower global coal demand scenario, coal royalties decline to zero by 2042. Even in the reference case, annual coal royalties decline to around a third of current levels over the coming decades.

These projections are significantly below the royalty projections in the 2016 Intergenerational Report which projected A$73 billion of cumulative coal royalties between 2020-21 and 2055-56. This has now been revised down to A$35 billion in the 2021 reference case and A$11 billion in the low coal demand scenario.

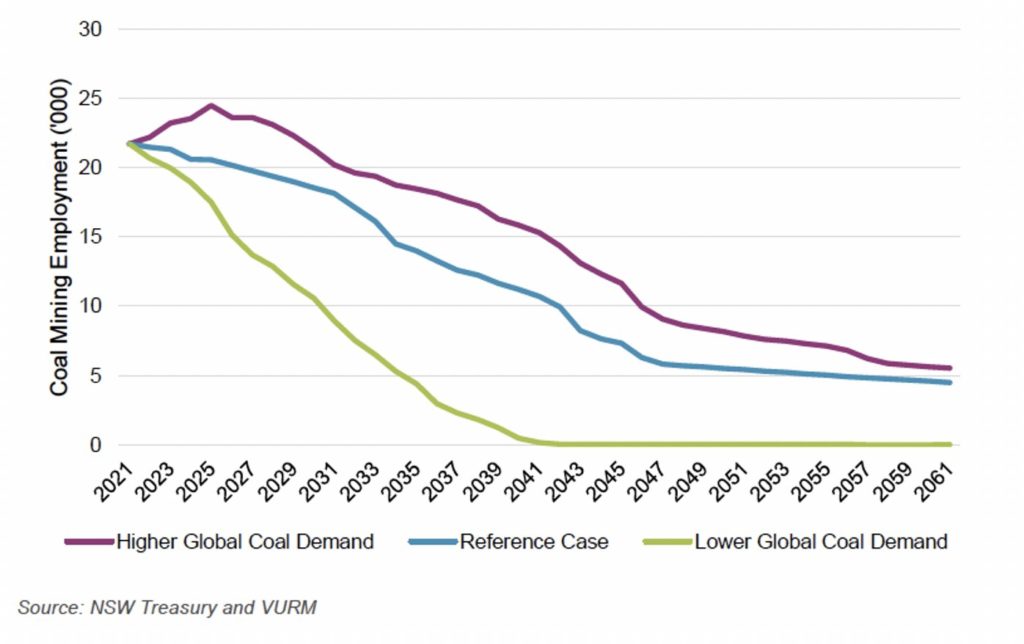

Similarly, NSW Treasury projects a major decline in coal mining jobs – between 75% and 100% fewer jobs in the sector by 2061 (Figure 2). Under the reference case, NSW Treasury projects that employment in coal mining will decline by an average of 600 jobs per year over the next two decades.

Figure 2: NSW Government 2021 Employment in Coal Mining Forecasts

The accelerating pace of the energy technology transition has significant implications for the Australian coal industry and questions the sense of adding more coal supply by opening new mines or extending existing ones.

In a market set for long term decline, new mining capacity only steals market share from existing operations, putting existing mining jobs at risk. It is in Australia’s national interest as a key coal exporter not to flood the seaborne market with excess supply as demand progressively diminishes.

A transition away from reliance on coal over the coming decades is certain. The only question remaining is whether that transition will be orderly or chaotic.

A moratorium on new thermal coal mine capacity is required to avoid a chaotic impact on coal mining employment, and to divert new capital investment and efforts into building alternative zero emissions industries and jobs of the future.

Simon Nicholas is an energy finance analyst with IEEFA