Neoen, the French renewable energy developer that has built the two biggest batteries in Australia, says it is looking to nearly double the average storage duration of its big battery installations as it adds more services to its projects and as more customers look for a 24/7 supply of renewable power.

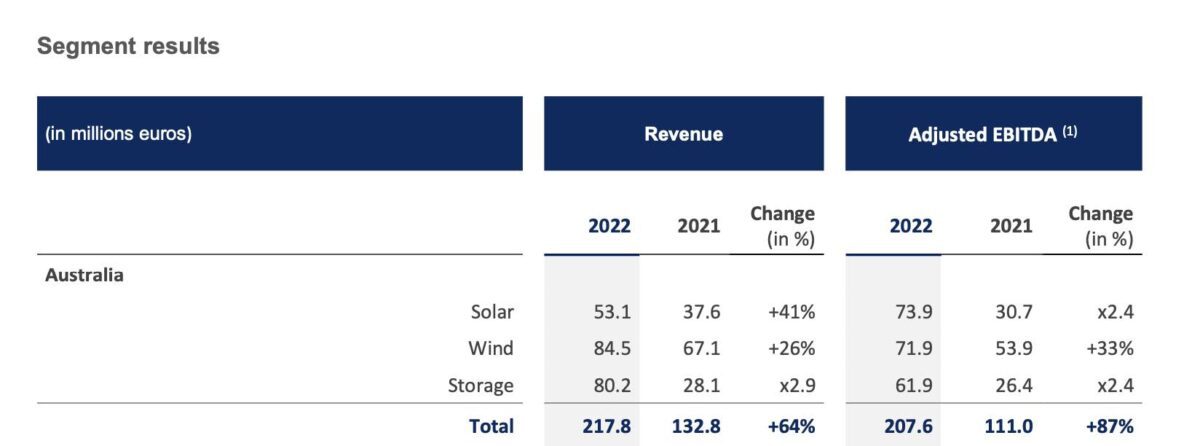

Neoen on Wednesday announced a 37 per cent lift in operating profits (Ebitda) to €410 million ($A645 million) for the 2022 calendar year, with one of the standouts being a dramatic lift in earnings from its Australian big batteries, which more than doubled their collective earnings to €61.9 million ($A97.4 million).

The improved battery result was driven by strong performances from the Victoria Big Battery, now the country’s biggest at 300MW and 450MWh, which came into operation just over a year ago.

Its predecessor as the biggest battery in Australia, the 150MW/193MWh Hornsdale Power Reserve, also posted strong earnings after being called on to intervene in numerous grid events during the year.

Australia was the highlight for the company with its growing portfolio of wind, solar and storage combining to nearly double annual operating profits to €207 million, up from €111 million earlier.

Its assets also include the Hornsdale wind farms, and the nearly complete Western Downs solar farm – which will be the country’s biggest at 400MW – and a host of other wind and solar projects either operating or under construction.

Neoen CEO Xavier Barbaro says the company is expected to meet its target of reaching 10GW of installed capacity by 2025 – a capital spend of nearly $10 billion – and has now set a new target of 20GW of capacity installed or under construction by 2030.

Nearly half of that 20GW target will come from Australia. Its existing and under construction assets are mapped below.

“We have been able to capitalise on our storage assets and our energy management expertise to successfully develop innovative yet competitive projects that accentuate Neoen’s differentiation,” Barbaro said in a statement.

“With over 10GW of assets in operation or under construction by 2025, and the prospect of reaching the 20GW milestone five years later, Neoen is now truly establishing itself among the world’s leading energy producers.”

Australia will be a major focus of this expansion, and battery storage will be too. It had some 1.1GW of battery capacity installed at the end of 2022 – mostly in Australia – with 16 assets in operation or under construction.

It had intended to have an average storage capacity of one hour under its original five year plan for 2021-25, but has now decided to double that duration to at least two hours to provide more services to the market.

The two early big batteries – at VBB and Hornsdale – had relatively short duration times because their focus was on markets such as frequency control and network services, acting as a kind of giant shock absorber, that required little storage time.

But the new markets are opening in energy arbitrage and providing firm renewable contracts to major corporate and industrial customers, and these contracts require long duration batteries, from two to four hours.

Other developers have already flagged four-hour batteries, although so far the initial development of those projects are pitched at a single hour of storage, because the longer duration markets are still immature. Neoen, however, is ready to make its move.

Neoen says the increased storage capacity will cost an extra €150 million over and above its planned budget, but it says that the revenue options are also greater, even if battery storage project costs have also jumped by around 60 per cent in the last two years.

“Neoen intends to increase the size of its battery portfolio while extending the duration of its new batteries to 2 hours (i.e. 2 MWh per MW),” the company said in a statement.

“Originally, the Group had planned to continue installing batteries with an energy capacity of between 1 hour and 1.5 hours (as per Hornsdale and the Victoria Big Battery).

“Thanks to the increase in the duration of its future batteries, combined with its energy management expertise, to date deployed mainly in Australia and Europe, Neoen will be able to offer a wider range of value-added services with every new battery.”

The company cited the successful signing last year of Neoen’s first baseload renewables contract with Australian mining group BHP as a catalyst for this. The battery that will help deliver that contract, the Blyth battery in South Australia, will be sized at 200MW and 400MWh.

Another of its new battery projects, the Canbera big battery that is already under construction, and mostly contracted to the ACT, will be sized at 100MW and 200MWh. And the Western Downs big battery in Queensland will also be sized at 200MW/400MWh.

The market would also move to four-hours of storage, but this would require maturity in the energy arbitrage market, which remains undeveloped at lower levels of renewables, and which remains difficult to finance in the absence of firm contracts.

Barbaro noted that the Hornsdale battery had been the first in the world to provide grid-scale inertia, using Tesla’s virtual machine mode technology, and it was now able to provide a financial product that allows clients to obtain the same financial result as if they were piloting their own physical battery.

Barbaro told investors that Hornsdale had delivered a “super” internal rate of return, and had already paid back its original investment, in just five years of full operation. “We had a great payback,” he said, but declined to give further details.