We have now had a chance to review the Energy Security Board’s (ESB) final National Energy Guarantee (NEG) design sent to COAG Energy Ministers this week, which has not been made public but is widely available.

The bad news for the clean energy industry is that the restrictive and discriminatory features in the design of the NEG have not been addressed.

These include:

• the ESB is still not recognising emission reductions from roof-top solar, whereas those from pre-existing large-scale hydro gets recognised;

• only electricity retailers can register and carry forward emission reductions, which disadvantages renewable generators and potentially hands windfall gains to electricity retailers; and

• allows electricity retailers the use of Australian Carbon Credit Units (AACUs) to meet their emissions liability but does not allow renewable generators and energy efficiency projects to create ACCUs.

This paper, however, is not going to deal with the above issues in detail but rather focus on the ESB’s claim that the NEG will deliver lower power prices and lower greenhouse emissions than would otherwise be the case.

The ESB’s NEG is claiming credit for the emission and price reductions associated with renewable projects that are already contracted or subject to tenders that would have happened anyway.

ESB still understates the level of renewables and emissions reductions that would be implemented in the absence of the NEG

ACIL Allen has undertaken modelling for the ESB and under their “Business as usual” scenario (without the NEG) have assumed that only those renewable projects that have already reached financial close would proceed.

They have included the initial Victorian and Queensland government renewables tenders but exclude any other tenders and also exclude any other projects that have been contracted but not yet reached financial close (refer to ESB’s Chart below).

The ESB have assumed that 7,800MW of large-scale renewable and battery projects come on line between 2018-19 and 2020-21.

The ESB claim that anything that is delivered beyond this is attributable to the NEG. This is false and misleading, as there will be considerably more renewables and emission reductions that will take place from 2020-21 in the absence of the NEG.

The ESB is claiming the NEG policy will deliver more than 5 million tonnes of emission reductions in 2020-21 alone (refer to the ESB’s chart below). This would require very roughly 2000MW of new wind and solar capacity to achieve.

This is all rather interesting given:

• The NEG emission liability does not come into force until 2020-21;

• The ESB will allow retailers to defer compliance for their entire liability in this first year to a later period;

• The scheme is still yet to be legislated and the regulatory rules remain to be drafted; and

• It typically takes around 18 to 24 months for a significant renewable energy project to move from being contracted to construction and then fully operational.

From analysing our detailed database of renewables projects and reconciling it with the ESB’s numbers above we estimate that:

• They’ve omitted from their non-NEG scenario 1,180MW of projects that have already been contracted under long-term power purchase agreements with credible off-takers (but have not yet reached financial close);

• The Snowy Hydro (800MW) and AGL (500MW) tenders for renewable energy are credited to the NEG. It seems unreasonable to include Snowy Hydro 2.0 (as the ESB has done) as a business as usual project when it has not yet been committed, while not also including the announced 800MW renewables tender. Similarly, ESB has included the closure of Liddell power station under its BAU scenario, but doesn’t include AGL’s 500MW renewables tender which was to form part of the resources to replace it; and

• They appear to have omitted from the non-NEG scenario any large solar system (above 100kW) capacity being installed. We’d expect at least 100MW per annum of embedded solar PV generation above 100kW to be installed over the next four years (55MW have been registered in the first six months of 2018 alone).

Electricity emission reductions and ACCUs

The NEG design provides a mechanism for retailers to use Australian Carbon Credit Units (ACCUs) to meet their NEG emissions liability, but does not allow renewable energy and energy efficiency project proponents to use their emission reductions for voluntary surrender or to create ACCUs that could be used outside of the NEG.

With the surge in renewable energy investment, the level of additional renewable energy to be produced significantly exceeds the Renewable Energy Target (RET) target.

As a result, the forward price of Large-scale Generation Certificates (LGCs) has dropped dramatically. Pricing for LGCs to be delivered at end of January 2021 is now at $23.50 with pricing for future years considerably lower.

The spot market for ACCUs is currently trading at $15 per tonne ($12.30 per MWh assuming 0.82 t/MWh emission intensity).

The demand for ACCU’s is primarily determined by the Government’s purchasing requirements under the Emission Reductions Fund, the voluntary market and the compliance market under the Safeguard Mechanism.

Longer term, the demand for ACCUs may also be determined through international carbon markets where the Government seeks to link with other countries.

This market could, over time, become quite large and effectively provides an alternative support mechanism for low emission power generation projects.

There are currently 48 projects registered under a range of energy efficiency methodologies to create ACCUs. Several power generation projects have also been registered under the Industrial Electricity and Fuel Efficiency Methodology and have created ACCUs.

A separate methodology for grid-based renewable power generation has not yet been developed as the support provided by LGCs exceeded the value available through ACCUs. As the price of LGCs plummets the ACCU pathway becomes a viable option to support new renewable power projects.

In the absence of the NEG, ACCUs would have continued to be a pathway for energy efficiency and renewable generation projects that reduce emissions.

In our analysis we have assumed that projects that reduce emissions by 500,000 tonnes per annum come on stream each year from 2022 onwards.

However, the NEG restricts the ability for parties other than retailers to claim emission reductions and there is no mechanism to cancel emissions reductions so that retailers are not able to use them to meet their NEG liability.

As a result, emission reductions are not additional and parties are not able to claim the emissions reductions for ACCUs or in the voluntary market.

This means that the NEG results in higher emission than would have happened anyway.

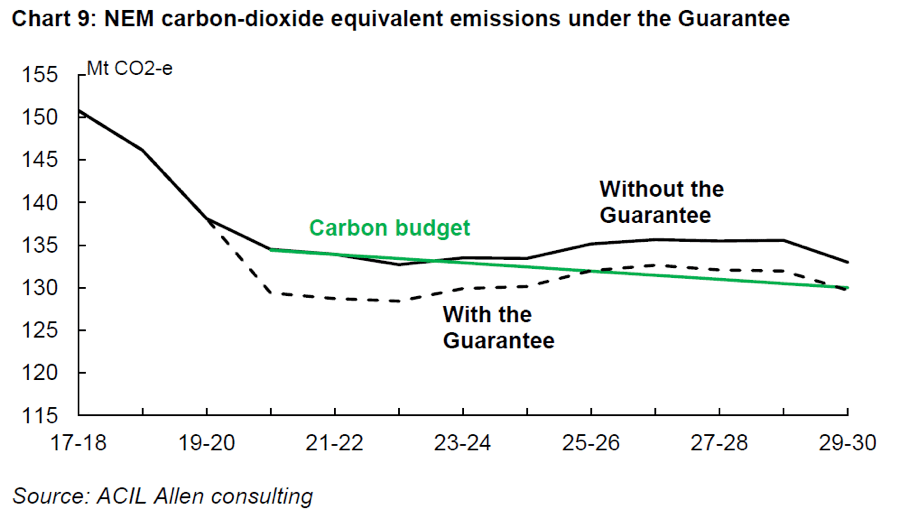

Our alternative estimate of emissions in the absence of the NEG is detailed in the green line in the chart below.

By way of comparison the dark blue represents the NEG emissions target and the dashed blue line is what the ESB is claiming to be the level of emissions if the NEG is implemented.

From an emissions perspective the NEG design makes things worse

The NEG design does not allow project proponents to register and claim the emission reductions associated with their projects to create ACCUs.

This means that an avenue that supports emissions reductions into the future will be cut off by the NEG. As a result, the NEG will result in higher emissions than would have happened anyway.

In terms of reducing electricity prices, the price reductions claimed by the NEG are due to the surge in renewables generation that would have happened anyway and not by any new investment triggered by the NEG.

While a future government might choose to increase the emissions reduction target the proposed NEG design (i) locks out roof-top solar as a cost-effective emission reduction activity and (ii) provides windfall gains to existing old hydro generators.

Both impacts mean that electricity prices would be higher than would otherwise be the case.

Ric Brazzale is Director of Green Energy Markets