Thermal storage, redox batteries, compressed air, solar thermal and even gravity storage – two new reports have underlined the growing number of long-duration storage technologies that are emerging to challenge the dominance the pumped hydro and its assumed successor lithium ion batteries.

The reports – a global study by BloombergNEF, and an Australian focused study from the Clean Energy Council, say there are now many technology choices for policy makers and market operators, but – particularly in Austarlia – there is no time to lose to create the market signals to get the projects built.

“The need for these solutions is on us right now,” CEC chief executive Kane Thornton says. “As each coal generator exits we need to find new ways of providing energy to meet customer demand. Energy storage, coupled with bulk renewables, is the fastest and lowest cost way to deliver this as the exit of coal generation accelerates.”

Australia’s long duration needs have mostly been thought of in terms of pumped hydro, but the blow out in costs at Snowy 2.0, and the inability of many other smaller pumped hydro projects to get across the line has opened up the opportunity for other technologies.

Battery storage has grabbed the lion’s share of the first long duration storage tenders run by the NSW government, although there is a rethink now about whether so much eight hour storage is needed.

This is generally thought of as “medium storage” but some very long storage (more than 12 hours) will be required, and other technologies are now being looked at to fill that role, and the question is how this can be built on time to replace the coal fired generators that are exiting the system.

The CEC has released a new report that looks at compressed air storage – already with a foothold in the market with the planned 200 MW/1600 MWh Silver City project near Broken Hill in western NSW – as well as redox flow batteries, and thermal storage, which includes both solar thermal and other technologies that store energy as heat.

CEC’s Christiaan Zuur says the technologies fit well into Australia because they represent part of what he calls the “missing middle” in the Australian energy landscape between lithium ion and pumped hydro, and in some instances can work with those technologies. And all have some form of pilot or early stage projects in Australia.

“We need to find a mix of technology solutions,” Zuur says. “In the era of the solar duck curve we need to be able to charge and discharge more frequently.”

Zuur says CEC modelling shows that more of this storage reduce dependence on fossil gas, and will be cheaper. Gas will be both expensive and unpalatable in a carbon constrained world, and while it may play a role at the margin, long durations storage technologies will allow even greater penetration of wind and solar.

The CEC report also looks at scenarios where more solar is built – largely because of its significantly lower costs. This requires more regular long duration storage – to cover for nights etc – which these technologies could deliver.

A model that assumes more wind power suggest more gas generation is required, because of even longer seasonal output lulls. However, there is a big problem with gas in such a role, because of the potential supply issues and pipeline constraints.

“Nuclear and gas are not the solution. Nuclear is an uneconomic technology and is a poor fit for Australia. Gas generation may play a small role in the energy transition, however, it simply cannot provide enough energy while staying within carbon budgets,” the report says.

Zuur says more policy measures are needed, because the current Capacity Investment Scheme is not addressing long duration storage. “We need an energy reserve service,” he says. “That should be a zero carbon solution.”

Zuur says the CEC has not settled on a final design, because of the complexity in accounting for wind droughts, transmission limitations, coal plant outages etc, but some form of “out of market” mechanism needs to be developed soon.

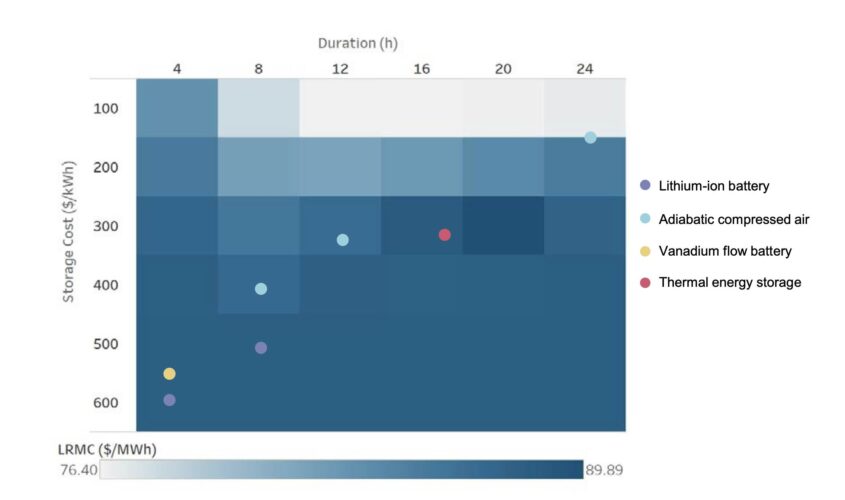

The BNEF report, meanwhile, says the least expensive technologies such as thermal energy storage and compressed air storage are already offering cheaper storage than lithium-ion batteries for durations over eight hours.

It puts the average capital expenditure, or capex, of thermal energy storage was $US282/kWh, while capex for compressed air storage was $US293/kWh.

For comparison, lithium-ion battery storage systems had an average capex of $US304/kWh for four-hour duration systems in 2023, demonstrating a clear gap in cost and capability with long-duration-specific technologies.

Other technologies such as flow batteries have had significant commercial success, which BNEF expects will help to ensure further cost reductions as the technology matures.

However, the cost reduction rate of long-duration storage technologies will depend largely on expanding deployment of said technologies and the development of routes to market in major regions.

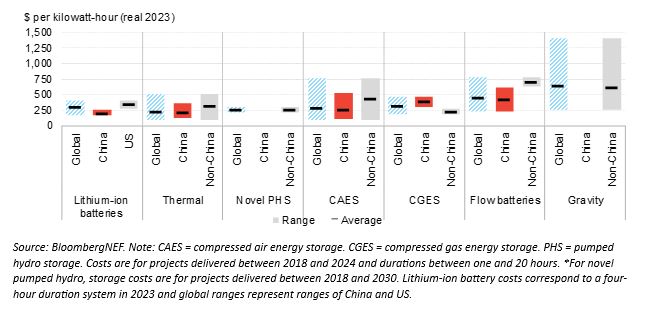

However, according to BNEF, the cost of long-duration technologies are unlikely to fall as fast as those of lithium-ion batteries during the remainder of this decade, given that lithium-ion batteries are used extensively in both the transport and power sectors, ensuring that increased demand continues to drive down costs.

As with most everything in today’s clean energy transition, BNEF found that China leads the way on cost-effectiveness for established technologies like compressed air energy storage, flow batteries, and thermal energy storage.

It notes that the average capex for these technologies in non-Chinese markets is more costly by anywhere from 50 per cent to 70 per cent.

“The significant cost disparity is largely due to China’s far greater adoption of LDES technologies,” said Yiyi Zhou, BloombergNEF’s clean energy specialist and co-author of the report.

“While other nations are still in the early stages of commercializing LDES technologies, China is already developing gigawatt-hour scale projects, driven by favorable policies.

“This is particularly true for compressed-air energy storage and flow batteries, where China has set new project size records in the past two years. The rate of LDES installations in China is astounding.”

Conversely, BNEF found that long-duration energy storage technologies may actually end up struggling to compete with lithium-ion batteries produced in China, given that they are the cheapest available in the world.

Currently, only a few long-duration technologies, like natural cavern-based compressed air storage, are able to outcompete lithium-ion batteries in terms of per-unit capital costs.

“While costs for LDES technologies outside of China are higher, the US, and Europe have a chance to invest in their own industries and drive innovation and deployment,” said Evelina Stoikou, energy storage senior associate at BloombergNEF and co-author of the report.

“Markets outside of China are developing a wider range of technologies compared to China, including more technology types within flow batteries, compressed air, compressed gas, thermal, gravity and novel pumped hydro,” she said.

” We’ve seen interest in those regions driven by ambitious clean energy targets, higher lithium-ion battery costs and an effort to develop alternative technologies that do not rely on lithium.”