The reputation of coal as a source of cheap and reliable baseload has been further damaged by the latest official quarterly market report that squarely blames coal plant outages and coal market bids for the sharp jump in electricity prices in the March quarter.

Australia’s climate policy over the last decade has been repeatedly hijacked by conservatives and the fossil fuel industry who have insisted that coal is essential for a low cost and reliable grid, and that more renewables will lead to higher prices and more outages.

But the market’s recent lived experience – and the 141 per cent jump in electricity prices in the March quarter (over the same period a year earlier) – shows the opposite to be true.

The two states most dependent on coal – Queensland and NSW – now suffer significantly higher wholesale prices than those states further south, Victoria and South Australia, where renewables have a far greater share.

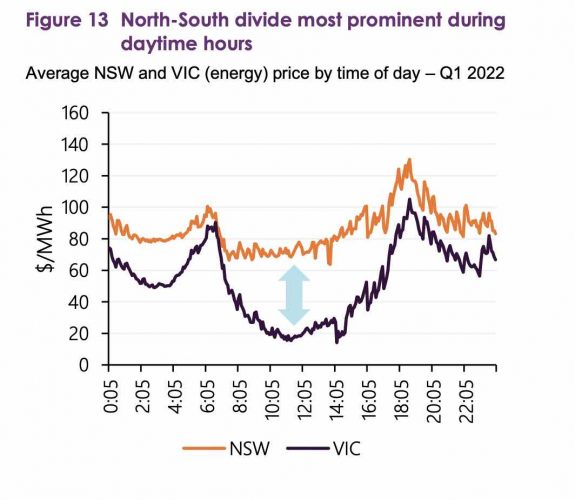

This north-south divide was first identified by the Australian Energy Market Operator last year and in its latest Quarterly Energy Dynamics report, AEMO says it is getting more pronounced.

“Energy prices were again substantially higher in Queensland and New South Wales than in the southern NEM regions,” it says, and coal was primarily to blame, not helped by constraints on the flow of power from Victoria to NSW that might have relieved the pressure.

The north-side divide is worse during the day. Daytime prices in NSW, for instance, were more than double those of Victoria in the March quarter, exceeding them by an average of $48/MWh, or 146% of the Victoria price (see graph below).

The network constraints left the northern states hostage to the pricing set by their coal generators, which dominate their grids and the pricing of wholesale power.

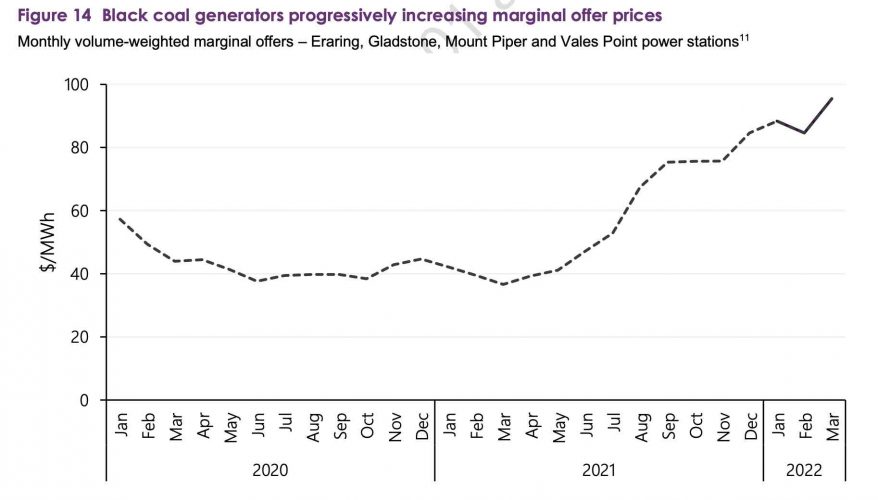

And because the price of coal has soared, so has the bidding practices of the coal generators, which – just to make things worse – had their lowest availability rates in 20 years because of outages and are keen to cash in when they can.

“Wholesale prices in Queensland and NSW were again significantly higher than in southern states,” AEMO’s general manager Reform Delivery, Violette Mouchaileh, said in a statement accompanying the latest QED report.

“This was due to the larger price-setting role of black coal generation and system security constraints limiting daytime electricity transfers from Victoria into NSW, despite an average energy price difference of $48/MWh.

“Compared to the first quarter of 2021, over 3,000 MW of black coal offers shifted from lower-price bands to above $60/MWh – the largest year-on-year quarterly change since 1998.”

The federal Coalition government was quick to blame international price rises, but AEMO made it clear that the higher price bidding by Australia’s coal generators had started to occur well before the lift in international coal prices.

“While higher quarterly offer prices coincided with the surge in international coal prices to record levels, offers had already trended upwards in the months leading up to Q1 2022,” Mouchaileh said.

“Coinciding with unplanned coal generation outages, Queensland experienced significant episodes of high demand, with overall price volatility contributing $47/MWh of the region’s average Q1 price of $150/MWh, its second highest for any quarter since 1998.”

Contrast this with the renewables-dominated South Australia, which has a world leading share of around 64 per cent wind and solar.

“Volatility in other NEM regions was less significant, adding $11/MWh to South Australia’s quarterly average price and $3/MWh or less elsewhere.”

AEMO says that in South Australia, middle of day prices were frequently set by offers from renewable generation and batteries, with black coal offers setting price in only 17% of dispatch intervals between 0700 hrs and 1900 hrs, and 26% across all hours.

“The relatively high frequency of South Australian price setting by hydro offers reflects the influence of Tasmanian generation bidding on southern NEM prices.”

Queensland, it should be noted, experienced some of its highest ever pricing during the quarter, the result of higher temperatures and surging demand, along with multiple coal plant outages.

This was largely driven by high volatility in Queensland, where average daily spot prices on February 1 and March 8 were amongst the highest 10 values recorded since the market started more than two decades ago.

The shortage of power on February 1 in a state powered 80 per cent by coal caused AEMO to intervene with emergency reserves and resulted in $51 million of added costs.

It wasn’t all bad news in the March quarter. The share of renewables overall rose to 33.7 per cent, and black coal fell to its lowest first quarter average output since the NEM was created, thanks mostly to unplanned outages and notwithstanding its dominant influence over prices.

A couple of milestones of note:

The highest ever output of wind and large scale solar of 8,375MW at 10am (AEST) on March 31, and highest grid scale solar output of 4,493MW in the half-hour ending 1030 (AEST) on February 14.

NEM emissions – thanks to more renewables and less coal – fell to a record first quarter low of 30.4 million tonnes carbon dioxide equivalent (MtCO2-e), which was 4% lower than a year ago despite increased operational demand.

The fall of emissions in the NEM over the last few years has been significant since 2017 as wind and solar deployment boomed after the Abbott-era investment drought.

Other items of note from the QED report:

The number negative pricing events jumped significantly, particularly in South Australia (16.4 per cent of all intervals) and Victoria (12.5 per cent), often because renewables were unable to service markets further north because of those transmission constraints.

Battery storage and pumped hydro revenue jumped significantly, batteries to $12 million and pumped hydro to a record $56.5 million, largely due to the actions of Wivenhoe cashing in on price volatility in Queensland.

The introduction of four synchronous condensers had a significant impact in South Australia, reducing the cost of directions by AEMO by some $30 million in the quarter, while also significantly cutting the amount of gas generation needed to provide grid services.

And, for the first time in the NEM, Wholesale Demand Response (WDR) capacity was dispatched as Victorian and South Australian afternoon spot prices spiked to high levels in January.

“WDR enables large commercial and industrial businesses to participate in the spot market by committing to lower usage, assisting power system security and reliability, including peak demand days and periods of high wholesale electricity prices, and increasing competition with potential flow-on price benefits to consumers,” Mouchaileh said.

See also: SA syncons deliver big savings as they set wind free and cut gas output

And: Graph of the Day: Australia’s main grid sets new wind and solar output record