A battery cell maker in the US says is on the cusp of commercialising long awaited solid state battery technology after claiming to solve two key problems with its own savvy design.

Ion Storage Systems plans to produce 1 megawatt hour (MWh) of its 4cm by 4cm battery cells by the end of this year, ramping up to 10 MWh in 2025 – after which it hopes to be able to deliver them to both electric vehicle and stationary storage uses.

Solid state batteries have long been held up as a long term solution to questions about lithium ion batteries – their size, duration and fire risk – because they can provide, at least in theory, more energy density in a smaller package and, in the case of EVs, deliver longer range.

However, the technology has also been plagued by its own persistent challenges, namely the growth of dendrites or lithium spikes that can short the battery when they touch an electrode.

Squashing the layers together using a lot of pressure seemed to fix the problem a few years ago, but it also added issues such as seals that degraded at the edges.

Furthermore, solid state batteries expand and contract when they charge and discharge, more so than lithium batteries with liquid electrolytes, yet the solid structure isn’t as tolerant of volume changes.

Ion Storage says it’s solved both the expansion issue and the dendrite issue, and has tested its cell to 800 cycles – the benchmark required by consumer electronics makers.

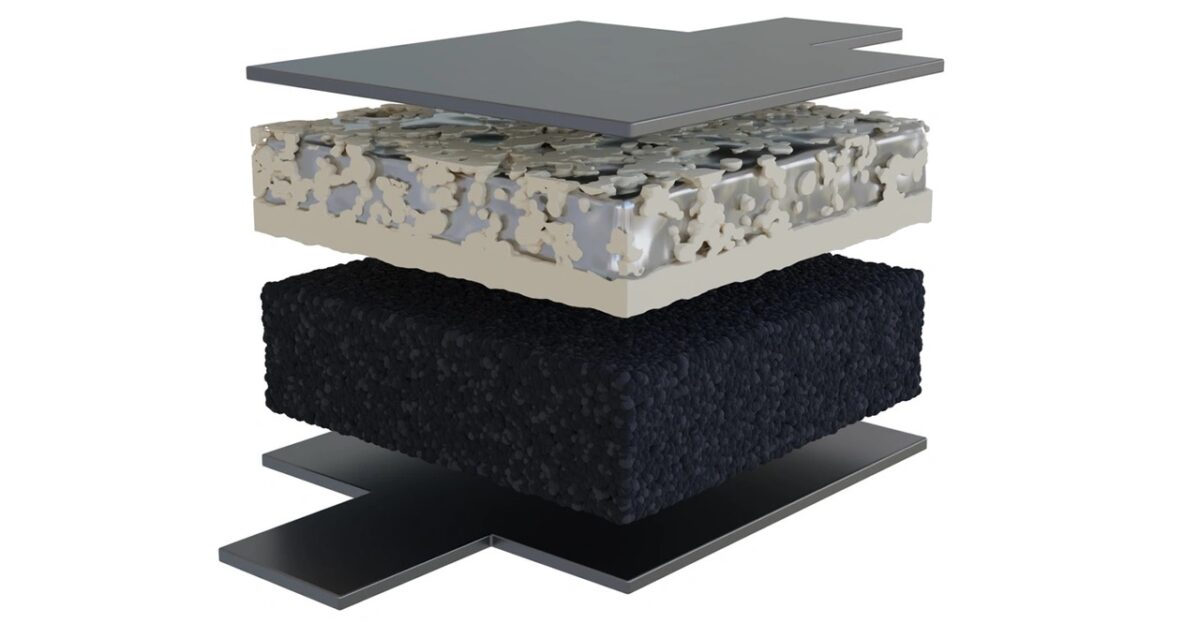

The company uses a coral–like ceramic structure into which lithium can expand when the battery is being charged. It means the final battery doesn’t need to allow for expansion because the cell itself is a little larger to account for that.

The ceramic structure also limits dendrite growth, as ceramic electrolytes are strong enough to resist being punched through by lithium spikes.

Much like Australian company Li-S Energy, Ion Storage uses layers to increase energy density in its cells.

The company’s ceramic electrolyte design means it uses solid lithium metal as the anode rather than a separate electrode, a factor that also helps to prevent dendrite growth, and can work with any cathode.

Looking for first buyers

The electrolyte design means Ion Storage can ramp up or down the size of the battery as customers want, but they’re targeting first the consumer electronics, defence and aerospace sectors, says head of business development Richard Ming.

The technology could work in electric vehicles, but given carmakers have their own battery plans Ion Storage plans to attack lower hanging fruit first, Ming says.

“Our goal isn’t to spend billions of dollars building out gigafactories. Our goal is to work with partners around the world to work with our core IP, a ceramic bilayer design,” he says.

Ion Storage’s investors do include Toyota, however, which invested in the company’s Series A capital raise, and the company has a $20 million grant from ARPA-E in the US (the Advanced Research Projects Agency–Energy).

That company’s long pursuit of solid state batteries is cited as one reason why it hasn’t moved to EVs with any speed, and is focused more on its internal combustion engines and popular hybrid technologies.

Ion storage is still feeling out potential customers, and expects to be able to offer a cost-comparable product to lithium-ion alternatives once it is able to scale up its operations. But until then, it’s selling itself on fire safety, being light weight, and having a higher energy density.