GFG Alliance, owned by British industrialist Sanjeev Gupta, and which recently re-emerged – at least partially intact – from the wreckage of the collapse of a key financial backer, is looking for buyers for its Australian clean energy projects as part of its restructuring.

A spokesperson for GFG Alliance told RenewEconomy that the company was looking to find a potential buyer or development partner for the company’s Cultana Solar Farm and Playford big battery projects, each to be located in South Australia.

The two projects are being developed by GFG Alliance’s energy arm, Simec Energy, and are set to supply clean energy to GFG’s Whyalla steelworks.

The Simec group has brought the 280MW Cultana solar project to the point where it is now “shovel-ready”, ready for construction with relevant approvals and licenses secured.

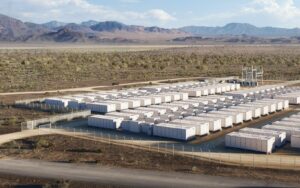

The company is also progressing plans for the 100MW Playford big battery, with a site secured near Port Augusta and planning is well advanced, and is expected to supply both energy services to GFG’s operations, as well as grid support services to the wider grid, and deliver on a procurement deal from the state government.

GFG has engaged consultancy EY to assist in the process of finding a buyer or development partner to progress the projects to completion.

“The projects have been designed to supply and store renewable energy to power GFG’s Whyalla Steelworks, as well as supply renewable energy to the national energy grid,” the GFG Alliance spokesperson said.

“The partnership and sale options under consideration will include SIMEC retaining an interest and with GFG retaining priority access to this energy for its Whyalla development plans.”

The Gupta owned GFG Alliance faced an unexpected threat earlier in the year following the collapse of its key funding partner Greensill.

It is understood that Gupta took on around £4 billion (A$7.2 billion) in loans to finance the expansion of the GFG Alliance, around three-quarters of which had been loaned by Greensill.

Greensill, founded by Australian investor Lex Greensill, came unstuck after its own finance and insurance partners baulked at the amount of unsecured debt the group had amassed, and instigated legal action to recover the company’s debts, which threatened to see the GFG Alliance broken up.

Greensill had been a major financial backer of Gupta’s global industrial ventures, and the collapse of Greensill threaten to see Gupta’s empire of heavy manufacturing assets broken up.

But GFG Alliance announced on Wednesday that it has been able to secure an alternative funding partner, allowing the company to re-finance its debts and shield itself from the fallout of the Greensill collapse.

GFG said its European and Australian operations will likely continue, and had been making “record profits”.

“Most of GFG Alliance’s businesses across its global portfolio are performing well and generating positive cash flows, supported by the operational improvements we’ve made and strong steel, aluminium and iron ore markets,” GFG said in a statement.

“Our Primary Steel and Mining operations in Europe and Australia are booking record profits and we have adequate funding for our current needs. In light of Greensill’s collapse, we are taking prudent steps across our global portfolio to manage resources while we bridge to new financing for our businesses. ”

Following the refinancing, the GFG Alliance has sought potential buyers of its clean energy projects as a way to improve the financial sustainability of the business going forward, while ensuring the development of the solar and battery storage projects can still proceed.

“This is a practical step to explore ways to power our Whyalla operations with low cost renewable energy sooner, which is key to our future ambitions,” the GFG spokesperson said.

“These projects are not only important for GFG’s own needs but all also contribute clean and green energy back into the national power grid.”

Gupta purchased the then troubled Whyalla steelworks in 2017, pledging to return the works to profitability and to make significant investments in local renewable energy projects to supply lower cost and zero emissions electricity to the plant.

Gupta has built a successful business through the purchase of otherwise ‘distressed’ heavy manufacturing facilities, such as steel and aluminium production facilities, and returning them to profitability, often through investments in low cost supplies of renewable energy.