The Grattan Institute think tank says the federal government should establish a $10 billion industrial transformation future fund to start “bending the curve” on industry emissions.

Grattan’s energy and climate change program director, Tony Wood, told RenewEconomy that its new report Towards net zero, is an attempt to “step away” from the debate around targets, and instead focus on practical solutions for “bending the curve” on Australia’s growing emissions towards net zero.

Wood says this is critical because “outside of electricity, most of our emissions are expected to keep growing, or at best, stay flat between now and 2030”.

Grattan’s report bundles together mining, manufacturing, construction and industrial facilities, which together make up 31 per cent of national emissions.

Industrial emissions have grown from 130 million tonnes in 2005 to 162 million tonnes in 2019, and are projected to remain high, the report states.

Grattan’s main policy proposals include a proposed industrial transformation future fund, improvements to the federal government’s Safeguard Mechanism and better alignment among state based energy efficiency schemes.

The $10 billion future fund would start in 2023 and be topped up with an extra $1 billion annually. It would be independent from government, similar to the Clean Energy Finance Corporation, but with a stronger risk appetite for funding transformational change.

The report points to a number of similar future funds set up by the federal government for public sector pensions, drought and natural disaster assistance.

Tim Buckley, director of energy finance studies at IEEFA supported the idea of a future fund for industry provided it was implemented together with Grattan’s other recommendations and formed part of a wider industry transformation strategy.

Buckley says the fund would be an an investment in getting industry ready for the “inevitable future”.

He says Australia’s trading partners “are moving at an enormous rate of knots” towards net zero, and we need to get ready for “massive acceleration”.

Grattan’s report points to the same problem, noting that 85% of Australia’s liquefied natural gas, 74% of thermal coal and 54% of metallurgical coal exports are currently to countries with net zero emissions targets.

Wood says this means “the decisions on what happens to our LNG and our coal will be made by other countries, not by us”, and those decisions will have significant economic consequences in terms of exports and jobs.

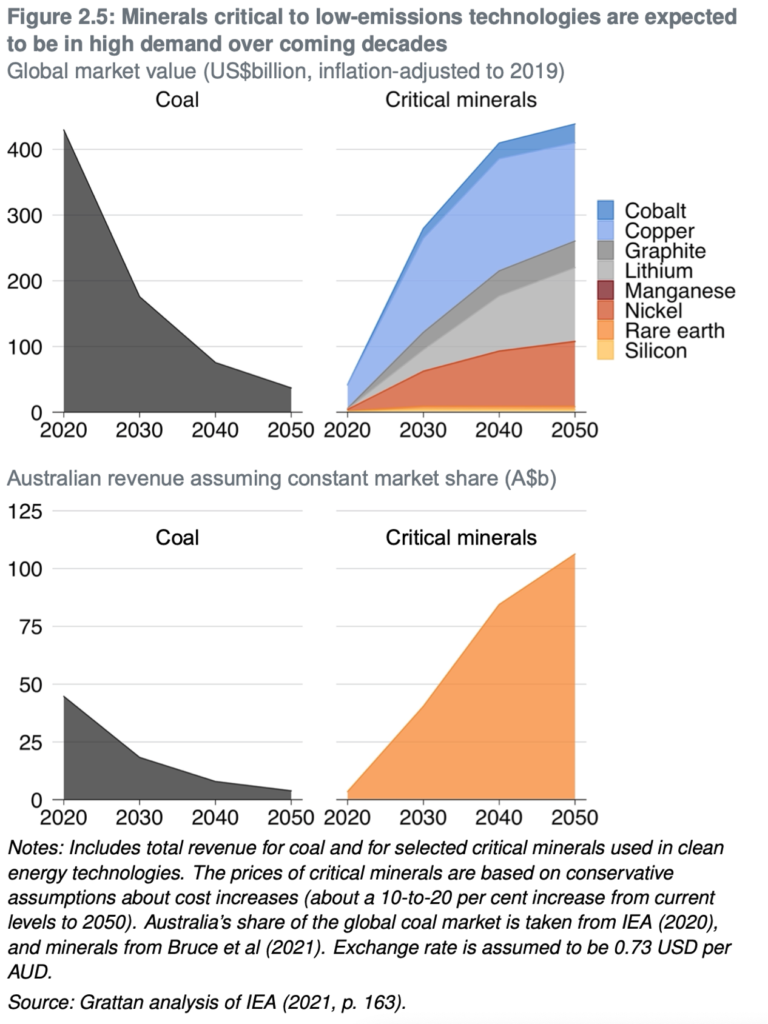

As demand for Australian coal and gas declines, the global shift to net zero emissions also presents new growth opportunities, such as in the export of critical minerals and metals.

“If Australia maintains a constant market share of the critical minerals market as it grows, this market will be worth roughly double what coal is worth today”, the report states.

According to Wood, areas likely to benefit from growth in minerals and metals include parts of central Queensland and Western Australia given access to resources and the presence of existing industrial hubs and facilities like ports for exports.

With the publication of its report, Grattan Institute joins other organisations working on industry emissions including Beyond Zero Emissions and ClimateWorks.

ClimateWorks Australia’s Australian Industry Transitions Inititative released a report in June that identified similar technologies for reducing industrial emissions to those outlined by Grattan Institute. A key difference in emphasis was the focus ClimateWorks placed on green hydrogen as an abatement opportunity.

Wood is more cautious on renewable hydrogen’s role in getting industry to net zero.

He says having worked in hydrogen in the energy industry many years ago, he sits on the “skeptical side” because of the cost involved and its complexity.

“If we’re complaining about the cost of gas today, well, the cost of hydrogen today is five or six times that”, Wood says.

He says renewable hydrogen can be a valuable resource which should be reserved for areas like high temperature heat or as a feedstock for fertilisers and explosives, where other solutions either don’t exist or are very expensive.

The industry report is the second in a series of five planned by the Grattan Institute outlining “practical policies” towards net zero. Future reports are expected to cover agriculture, offsets and electricity.