The return of the LNP government in Queensland, as we reported on Monday, presents a big question mark about the future of the renewable energy industry in Queensland.

The state has the country’s most coal dependent grid – with a share of 66 per cent in the last 12 months – but it was starting to catch up with the other states with a strong pipeline of projects that made it one of the busiest regions in terms of construction starts and commissioning.

That could change soon if the LNP delivers on its promise to repeal the legislated renewable energy targets – of 50 per cent by 2030, 70 per cent by 2032 and 80 per cent by 2035. It has also suggested it is not in favour of wind farms.

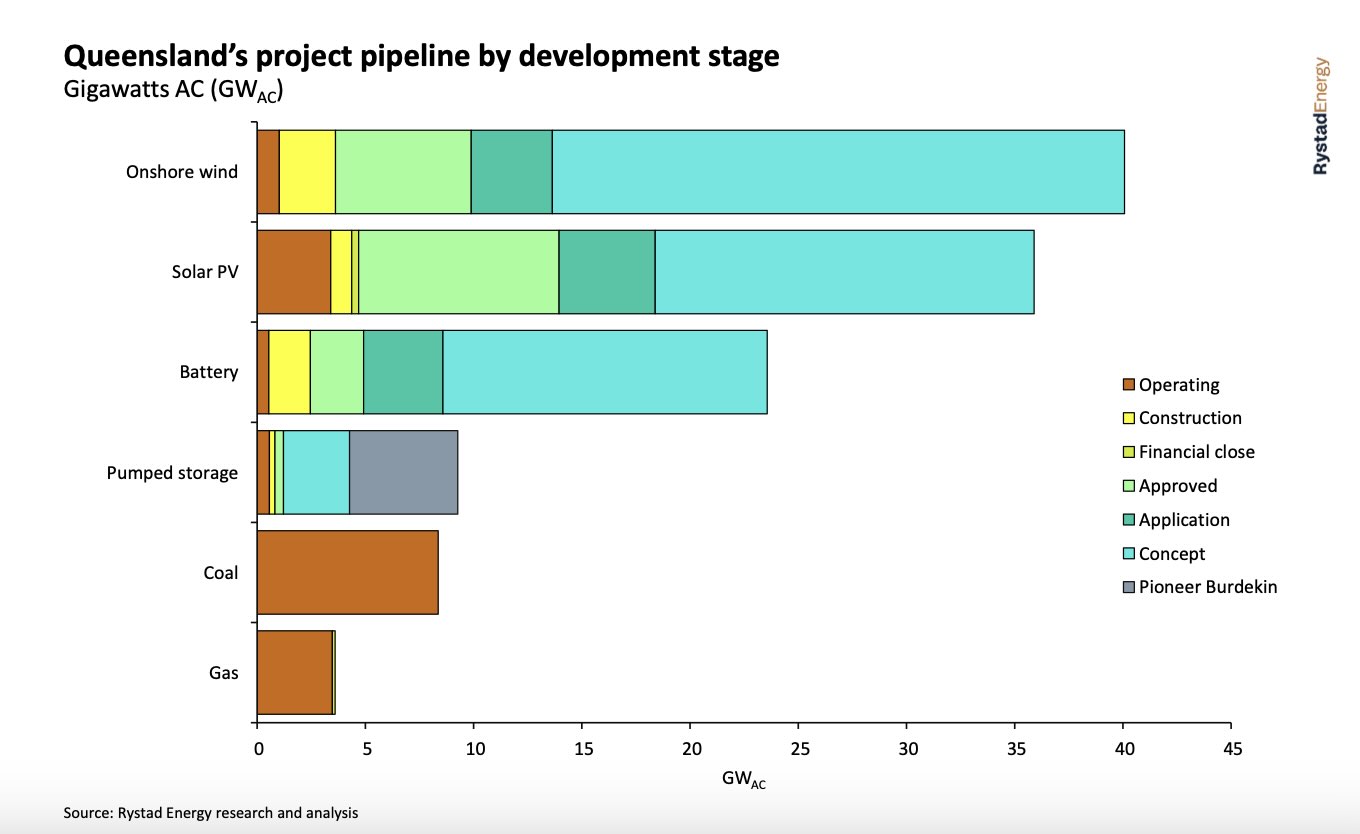

This table above highlights the huge pipeline of projects in the state, particularly in onshore wind, large scale solar and battery storage. The LNP has already indicated it will nix the country’s biggest pumped hydro project at Pioneer Burdekin, although it may go ahead with the smaller Borumba and other pumped hydro projects.

“Queensland currently has a pipeline of over 120 gigawatts (GW) of projects, with 97 GW pending financial closure, and the state is a leader in utility-scale renewables,” Rystad analysts say in a new report.

What seems clear is that the fate of the renewable energy industry will lie in an internal battle within the LNP between the more moderate members (including premier David Cruisafulli) and the far right of the party, which is already agitating for a change in its opposition to nuclear.

The LNP had argued that the renewable targets were impossible to meet, but outgoing energy minister Mick de Brenni noted last week the latest assessment by the state Energy System Advisory Board (QESAB), shows Queensland is on track to achieve about 60 per cent renewable generation by 2030 – exceeding the original target by around 10 per cent.

“Overall, the LNP’s energy policy remains unclear, leaving the future direction of Queensland’s renewable initiatives uncertain,” Rystad says.

“Queensland is Australia’s second-largest state for electricity generation, producing 65 terawatt-hours (TWh) in 2023, second only to New South Wales, which generated 68 TWh.

“The state has recently become the hive of utility-scale renewables and battery activity in Australia with 2.9 GW starting construction in 2024. The key question is: Will the high levels of activity continue or will the LNP take Queensland in another direction?”