Electric car maker earlier this week surged through the $20 billion mark for market capitalisation earlier this week – the equivalent of $1 million of market value for every one of the $70,000 luxury sedans that it has so far delivered.

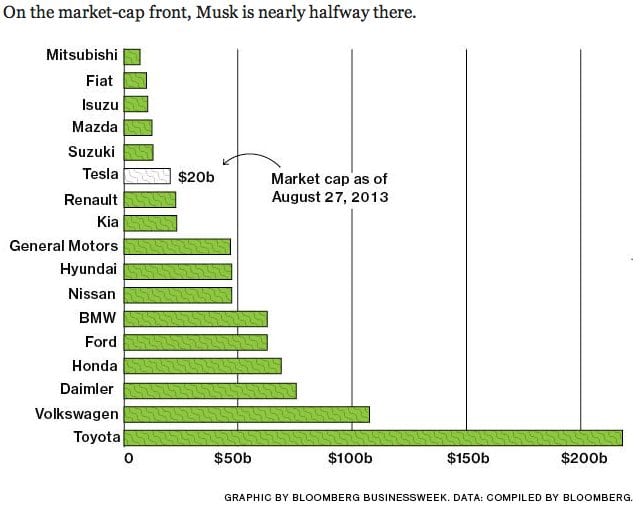

As BusinessWeek pointed out, the 10-year old carmaker has just one per cent of Ford’s US monthly sales, but nearly a third of Ford’s $64 billion market capitalization, and nearly one half of GM’s. It is already worth more than Suzuki Motor, Mazda, and Fiat, which know owns the fallen third pillar of the US internal combustion engine industry, Chrysler.

Tesla shares have risen nearly 400 per cent this year, and as Business Week noted, little has gone wrong for the company this year. Motor Trend maazine named the flagship S Model its 2013 Car of the Year. Consumer Reports in May admitted it was among the best cars it ever tested, it posted its first-ever quarterly profit, and then it made a secondary public stock sale that allowed the company to raise more than $1 billion. That money was used to repay a US Energy Department loan 9 years early.

The Model S is now the third-best-selling luxury sedan in California, and is outselling Porsche, Volvo, Lincoln, Land Rover and Jaguar in the state.

But CEO Eon Musk has more work to do, BusinessWeek reports. Last year, when Tesla was worth just $3 billion,Tesla’s board gave Musk options to buy 5.3 million shares at $31.17—they now trade at $168—but with a huge catch: He could exercise all his options only when Tesla’s market capitalization hit $43.2 billion, along with 10 specific “operational milestones” had to be achieved by the year 2022.