The US Energy Information Administration has released some interesting forecasts for renewable energy technologies out to 2040, under a bunch of scenarios that range from a $25 carbon price, to extended tax credits, falling renewable technology costs and varying costs of fossil fuels.

The “reference” case scenario painted by the EIA, generally regarded as highly conservative on technology costs and with a bias towards fossil fuels, presents a disappointing future for renewables, which would only account for 16 per cent of US generation by 2040. That is based on a continuation of policies, but most of its other scenarios are much more positive.

The includes the carbon price (GHG25), a resumption of expired tax credits (No Sunset), lower renewable technology costs, higher oil and gas costs and resource growth, high and low economic growth, and low oil and gas costs.

Interestingly, though, while the growth of renewables is capped under most scenarios, the EIA says as renewable generation sources become increasingly competitive after 2025, a favorable shift in assumptions may result in an impact that does not have a limit on the upper bound.

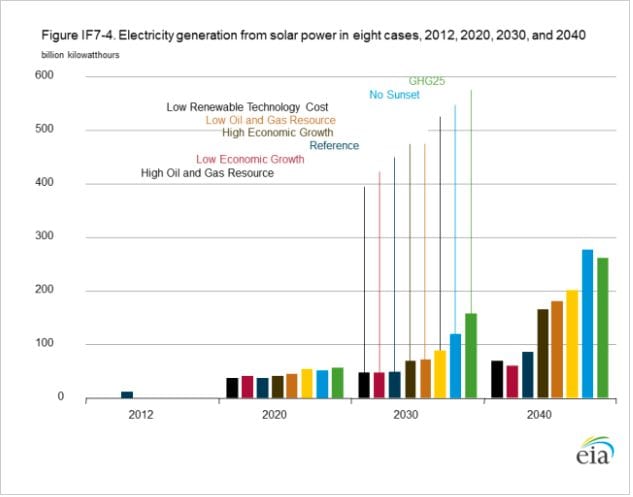

In the case of solar, that technology is expected to be the fastest growing in any scenario, although its growth is quite spectacular in the various favourable scenarios (see graph below)

The EIA admits that PV costs are difficult to forecast. “Technologies, there is enough variation among current projects in terms of geographic locations, technologies, developer experience, and regulatory frameworks that even the most carefully developed estimates will overstate actual costs for some projects and understate costs for others. While PV capital costs have declined over the past decade, there is continuing uncertainty about both the degree and pace of future cost declines.”

Wind is the other major renewable technology that will grow quickly, even from a higher base, although its most positive forecasts rely on their being a carbon price and a continuation of the tax credit that has currently been suspended in the US.

The graph below shows the EIA reference case, which paints a relatively bleak picture of the energy mix if nothing else changes.

But in the graph below, the results vary significantly, particularly in the later years of the projection. For example, in the GHG25 case total non-hydropower renewable generation in 2040 is 83 per cent higher than in the Reference case, and in the High Oil and Gas Resource case total non- hydropower renewable generation in 2040 is 12 per cent lower than in the Reference case.

In its assessment of renewables, however, the EIA, admits that it is not yet factoring in storage costs, because it considers that technology to be immature. And its low technology cost assumptions only anticipate a 20 per cent fall below its reference forecasts. If, for instance, those technology costs fall 50 per cent below its reference forecasts, as much of the industry possibly anticipates, then the growth in renewables would be much higher.

“Solar and wind energy are expected to remain the primary sources of renewable capacity growth,” the document says. “Although geothermal, waste, and biomass resources have some favorable characteristics compared to wind and solar, such as the ability to provide operator dispatched power, each has significant limitations.

“Solar and wind energy are expected to remain the primary sources of renewable capacity growth,” the document says. “Although geothermal, waste, and biomass resources have some favorable characteristics compared to wind and solar, such as the ability to provide operator dispatched power, each has significant limitations.

“The limitations include a limited resource base (geothermal, waste) or relatively high capital and/or fuel costs (biomass). Although wind and solar will continue to be capital-intensive technologies, they are expected to achieve cost reductions that—along with a larger resource base—result in higher growth than other renewables under favorable conditions (such as placement of an explicit or implicit value on CO2 emissions, or high natural gas prices). However, solar and wind resources also vary in availability and quality by region, and generation facilities are likely to be concentrated in the more favorable regions.”

More graphs can be found here.