Based on preliminary figures for 2017, electricity from renewables grew by a record amount. Coal power production also fell noticeably even as nuclear power fell – despite record exports. But one big news item may have been overlooked amidst all the new records. Craig Morris takes a look.

Since the first nuclear reactor was shut down in 2003 as a part of Germany’s nuclear phaseout, electricity from renewables has increased almost twice as much as nuclear power has shrunk. Coal power – both from lignite and hard coal – has also dropped. The lights have stayed on.

Power exports also set a record for the fifth year in a row, reaching 53 TWh. Net power exports provide space for dispatchable conventional power generators (coal, gas, and nuclear). Renewable electricity has priority dispatch on the German grid, meaning that clean power is consumed before conventional power. Wind and solar in particular react to the weather, not to demand, so foreign demand cannot increase these sources.

Gas was once again slightly up in 2017 but has grown by more than a quarter since 2013. Hard coal has fallen by just over a quarter during the same time frame. The decrease in lignite is only 8% because renewables are not yet forcing those plants to ramp much.

Nuclear fell by nearly 11% in 2017. One reactor was shut down at the end of December, but that decrease was only slight. A bigger factor was the extended downtime at Brokdorf, a reactor that made history last year by being the first nuclear plant to shut down specifically because of damage caused by ramping. Other reactors, such as France’s Civaux, have also experienced difficulties possibly related to load-following, but ramping was never clearly reported as the cause for any other reactor.

The 29 TWh increase from renewables in 2017 sets an annual record. That growth is equivalent to around 5% of German power demand. If Germany were to continue to expand renewables at that rate, it would theoretically be 100% renewable in 20 years starting from zero.

But of course, Germany did not start 2017 at zero, but from around 30% renewables in 2016 as a share of generation (including exports). That number increased to 33% last year. More significantly, the target for 2020 is 35% renewables as a share of demand (excluding exports). Last year, Germany reached 36.5% renewables as a share of domestic demand. The country has thus surpassed its 2020 target three years early.

If Germany were to continue to add 5% renewables annually, it would reach 100% in only 13 years – by 2030. But this growth will stagnate over the next few years. The government recently adopted auctions to keep further growth in check; the volume tendered is limited, and time frames are generous. This year might not be so bad, but the wind sector is expected to dry up in 2019 and 2020 because so many recently awarded projects have until 2021 and 2022 to be completed. The share of renewables in 2020 may not look so different from 2017.

One main reason for this slowdown is technical constraints: going 100% renewable (or even 50%) is not trivial. Baseload plants will have to disappear completely even as sufficient dispatchable capacity remains available. Utility umbrella group BDEW is thus calling for more new gas turbines to be constructed (in German), and companies like Uniper (formerly Eon) is currently investigating its options (in German). So are municipal utilities, such as the one in Cottbus that recently announced plans to switch from locally produced lignite to natural gas (in German). Amidst all of the reports about records with renewables and power exports, this little news item deserves more attention: a municipal utility in one of Germany’s three largest lignite mining areas (Lausitz) is switching to gas.

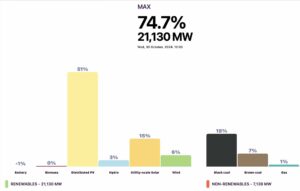

Perhaps the flashiest news item came just after the turn of the year, when the new German power markets platform (SMARD) showed that renewables briefly made up roughly 100% of demand.

In the chart below from that website, the red line (demand) scrapes across the top of the blue area representing wind power, with other renewable energy sources below it. From around 4 AM to 6 AM on January 1, demand was low and wind power strong. However, the other two main power sector visualizations – the Agorameter and Energy-Charts.de – show the share of renewables closer to 90%. The differences come about because of guesstimates. Previous reports of 100% renewables turned out to be overstated (also read this), but perhaps the new platform is more reliable and Germany truly had 100% renewable power for two hours.

In any case, 2017 was a good year for renewables in Germany, and 2018 has gotten off to a good start!

Source: Energy Transition. Reproduced with permission.