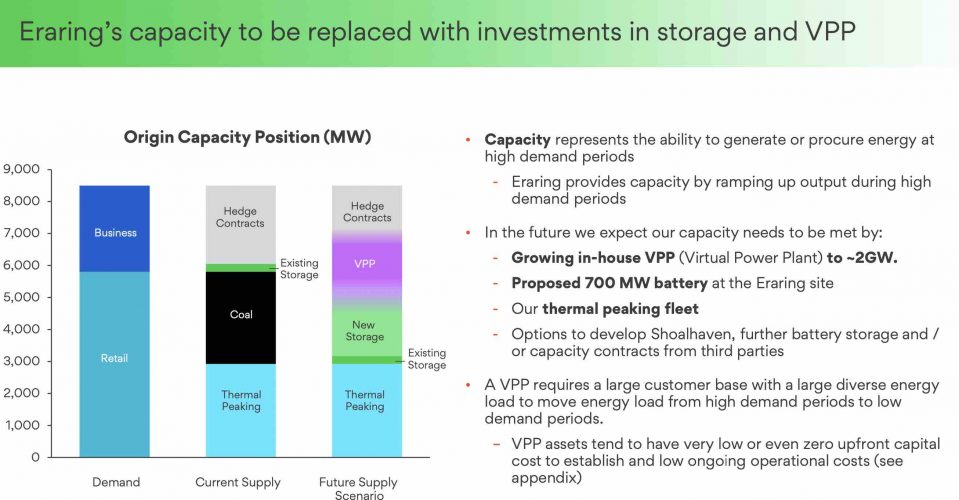

Origin Energy says it will build the massive Eraring battery over two stages, and is also aiming to grow its in-house “virtual power plant” to 2GW or more to provide a “very low cost” replacement for the country’s biggest coal generator.

The plans were outlined in Origin’s “Strategy Refresh” presentation to investors and analysts on Wednesday as it looks to a future beyond coal after fast tracking the closure of the Eraring coal plant to 2025 from 2032.

Two key announcements were made. The first was the decision to build the planned 700MW Eraring battery over two stages, the first to be a 460MW and 920MWh installation, and the second to be another 240MW.

The second key announcement was Origin’s plan to grow its “in-house” virtual power plant (VPP) from around 200MW to 2,000MW, which CEO Frank Calabria says could be achieved over the next four years.

Calabria says VPPs – basically rooftop solar, battery storage and demand management resources, along with pool pumps and electric vehicles installed in its customer base – could deliver “very low cost” replacement capacity to Eraring.

“A VPP is a capital and cost-efficient tool to create capacity,” Origin’s presentation said. “VPP assets tend to have very low or even zero upfront capital cost to establish.”

Calabria said VPP assets are just like a peaking power plant, and part of its value is its ability to avoid the cost of hedging contracts, one of the most expensive products in the electricity market.

“At scale, a very large number of distributed assets can be controlled in a similar nature to a battery, either by moving energy or reducing peak energy,” Origin says.

“Ultimately, the orchestration of distributed assets helps Origin to replace part of the capacity provided by Eraring and firm renewable assets at a very low cost.”

On battery storage, Calabria said there are now several different value propositions – grid services like frequency control, arbitrage (shifting the output of wind and solar to more profitable periods), and lowering the cost of market caps. “So two hour options could be extended to four hours as cost come down.”

And according to Calabria, the costs have come down.

“We have seen dramatic reductions in (battery) costs coming through, you are seeing the technology learning curve come down,” he said, adding that he had seen quotes falling to around $400/kWh, which suggests a cost of below $400 million for the first stage of that battery.

However, Calabria added that due to recent market volatility, including in lithium markets, and thanks mostly to events in Ukraine and elsewhere, “I would not be certain about that pricing today.”

The Eraring battery is one of the key investments Origin will make to help replace the existing capacity at Eraring, the country’s biggest coal generator at 2.88GW, whose closure is being fast-tracked to 2025 from 2032 because Origin says there is no longer business case for “baseload” fossil fuels.

Origin – and most market analysts – point out that Eraring’s main contribution to the National Electricity Market is not its rated maximum capacity, but its ramping capacity, the ability to relatively quick move its capacity up and down, and this is the part that needs to be replaced.

Much of it will come from battery storage and VPPs, which combines storage and demand response.

Origin’s announcement on the Eraring closure came amidst a flurry of activity from corporate and government players, with tech billionaire Mike Cannon-Brookes and Brookfield lobbing an $8 billion plus bid for AGL with the view of fast-tracking the closure of their coal fired generators.

AGL has rejected their bids, and the Cannon-Brookes and Brookfield have “downed pens”, likely waiting to see if AGL shareholders to decide to approve the controversial demerger.

Meanwhile, the NSW government is fast tracking and expanding the creation of its renewable energy zones, and the Victoria government has announced the country’s first offshore wind target, aiming for 9GW by 2040, and 2GW by 2030.

Calabria said the timing of the Eraring closure “could be managed” if the market did not respond with enough replacement capacity, but he said it was clear that energy transition was taking place and creating “very exciting tailwinds” in terms of growth for the company.

Origin has a net zero target for 2050, and has been widely criticised for its pursuit of the Beetaloo Basin gas project in the Northern Territory, dubbed a “carbon bomb” by analysts.

Origin says it will update its emissions reduction target to be consistent with a 1.5°C pathway, and will deliver that to shareholders by the annual general meeting this year. It will be interesting to see what role projects such as Beetaloo, and its extensive and profitable LNG investments, have in that scenario.

Calabria said Origin is also looking at developing “multiple gigawatts” of new renewable energy capacity, but did not provide details, suggesting that at least part of it will be contracted from 3rd parties, which has been the company’s strategy to date.

However, he warned that power purchase agreements – supply contracts from wind and solar farms – were likely to be much shorter than they have in the past, mostly due to avoid being locked into fixed prices that might end up being much higher than prevailing prices down the track.

See more details in our story: “Amazing:” Origin bowled over by rush of offers from solar and wind projects

In other news from the presentation, Origin said it hoped to have 5,000 electric vehicles “under management” by 2026, and also outlined plans for a green hydrogen hub in the Hunter Valley.

It also announced a $250 million share buyback. “Origin is in a strong financial position, with a robust outlook for the business and a capital structure comfortably within our target range,” Calabria said in a statement.