Australia’s energy market rule maker has received advice to lift price caps on the wholesale electricity prices, prompting what could be one of the biggest reforms to the market in years.

In a final report the the Australian Energy Market Commission, the 2022 Reliability Standard and Settings Review recommends a steady lift to the wholesale market price cap, and also the administrative price cap – the latter from $300/MWh to $500/MWh.

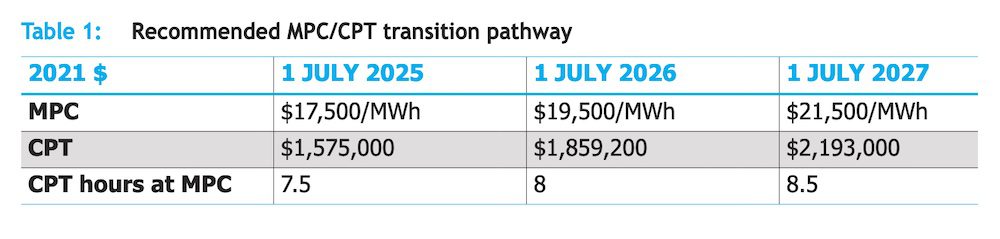

On the Market Price Cap the panel recommends three progressive annual increases, to achieve an MPC of $21,500/MWh (up from $15,500) by the end of the 2025-28 regulatory period – an increase the AEMC says aims to support investment “new entrant” power system resources.

The changes to the administrative price cap are a response to the soaring cost of fossil fuels, and gas in particular. The $300/MWh administrative price cap was set because that was above the most expensive form of generation of last resort – diesel generators. But now most gas plants can’t afford to produce at such a price.

The lifting of the market price cap comes as the Reliability Panel advises against the further tightening of the reliability standard – it has already been cut to 0.0006 per cent (the tightest in the world) in an interim measure.

Reliability Standard and Settings Review (for 2025-28) has landed! Highlights:

– Reliability Standard stays at 0.002%

– Market Price Cap ⬆️ $21,500

– Cumulative Price Threshold ⬆️ $2,193,000

– Administed Price Cap ⬆️ $500

– Floor Price stays at -$1,000https://t.co/YAXqf4Sgfg— Craig Memery (@recentralised) August 31, 2022

The decision in Australia to increase market caps comes as authorities in Europe decide to do the opposite, in a desperate attempt to isolate the soaring cost of gas generation from the rest of the grid, and to allow consumers to benefit from the growing share of much cheaper renewables.

In Spain, where the price of gas generation has been deliberately capped at a much lower price, consumers are already benefitting. But it is not yet clear how the EU will choose to separate the markets.

In Australia, $300/MWh price caps were imposed by the Australian Energy Market Operator in June, first in the Queensland electricity market after cumulative prices over one week averaged more than $674/MWh, and then across the rest of the NEM.

But AEMO was then moved to take the unprecedented step of suspending the entire market, due to mass withdrawals of capacity and because it became “impossible” to manage and guarantee supply. Consumers were asked to moderate their energy usage.

The situation sparked allegations that some generators were “gaming the market”, and particularly the two competing compensation schemes that are designed to ensure generators do not operate at a loss.

In turn, coal and gas generators complained that the current level of the market price ceiling was insufficient to cover the cost of purchasing supplies of coal and gas fuel, particularly during the current global energy crisis.

A request for a fast-tracked doubling of the administered price cap – from $300 per MWh to $600 per MWh – was submitted by Alinta Energy, one of Australia’s largest operators of thermal generators, but that was for the current market period, from now until 2025.

The Reliability Panel behind the 2022 review – which it noted had been undertaken in “an unprecedented environment” – said its decision to call for a $200/MWh increase in the APC from 2025 was justified to minimise undue reliance on the compensation scheme and to rein in pass-through costs to consumers.

“The Panel has given particular consideration to consumer concerns regarding increases to the market settings and hence further increases in electricity costs,” the report says.

“The final recommendation seeks to limit end-user bill impacts to the minimum level possible while still supporting future outcomes consistent with the reliability standard.”

Interestingly, however, the report notes the two Panel members representing consumers did not consider the increases to the administrated price cap as necessary.

The argument of these panels members against the price cap increase is that the cost to consumers of different settings under administered pricing is not yet known, and that there may be other tools to better promote the interests of consumers.

“The view of these Panel members is that once compensation cost outcomes and generator behaviour of the recent APP become known, further analysis, consultation and consideration of alternative solutions could be the basis of a subsequent review to ensure that the recommendation remains appropriate,” the report says.

“The Panel noted that several stakeholders suggested changing the form of the APC from a fixed to a dynamic value in recognition of the links between gas and electricity prices.

“The Panel recommends this is further considered in the follow-up review that has been recommended by the Panel and includes consideration of links with the gas APC.”