French renewable and storage developer Neoen has flagged delays in one of its flagship wind projects as it reports falls in revenue and profits in the first half, largely as a result of new projects moving off merchant prices and into fixed price contracts.

Neoen’s half year presentation reveals that the first stage of the 412 megawatt (MW) Goyder South wind project in South Australia – the largest in the state – is now not expected to reach COD (commercial operations date) until early 2025, instead of the last quarter of 2024 as advised three months earlier.

The latest slippage is not huge in the grand scheme of things, but is yet another illustration of the delays that – for a variety of reasons including connection agreements, supply chains and labour issues – continue to plague Australian wind, solar and storage projects.

Neoen is no stranger to these delays, despite being regarded as the most successful developer of renewable and battery storage projects in Australia. But it has been largely protected from such issues because of “liquidated damages”, penalties applied to building contractors if construction and connection delays lead to a loss of revenue.

In the latest half year, Neoen reveals that liquidated damages account for a hefty €71.5 million ($A118 million), up from €33 million in the same period a year earlier. That accounts for more than one quarter of the company’s first half revenue of €255.7 million.

Neoen did not reveal which projects were the source of the LEDs in the latest half, apart from noting that it affected solar and storage projects. It is very likely to include the delayed 100 MW/200 MWh Capital battery in the ACT, which forms part of a long term contract with the ACT government, as does Goyder South.

Neoen chairman and CEO Xavier Barbaro said liquidated damages are part of doing business.

“LEDs (liquidated damages) are there to replace in a way the revenue that we are not getting when a power plant is late to come online,” he told an analysts briefing on Thursday (Paris time).

“We are indifferent to them … for us it is equivalent to the electricity that is not there. We’re not making a business out of LEDs … we are fairly disappointed when the power plant is late, but we are immune to the delays with the contracts we have in place.”

The company’s overall revenue was down eight per cent from last year, which Neoen says mostly reflects the fact that key projects, such as the newly finished Western Downs solar farm and Kaban wind farm in Queensland have moved to their fixed long term power purchase agreements, which are lower than the recently lucrative merchant markets.

Its adjusted earnings also fell eight per cent to €231.9 million, and while wind, solar and battery storage revenue were down, solar earnings were up, and so were storage earnings, despite the reduction in earnings at Hornsdale, the original Tesla Big Battery, particularly in the FCAS market.

Neoen credited a 64 per cent increase in storage earnings in the first half to the initial contributions of several new batteries, including the Capital battery, which, given its modest output in the June half, must have included the liquidated damages.

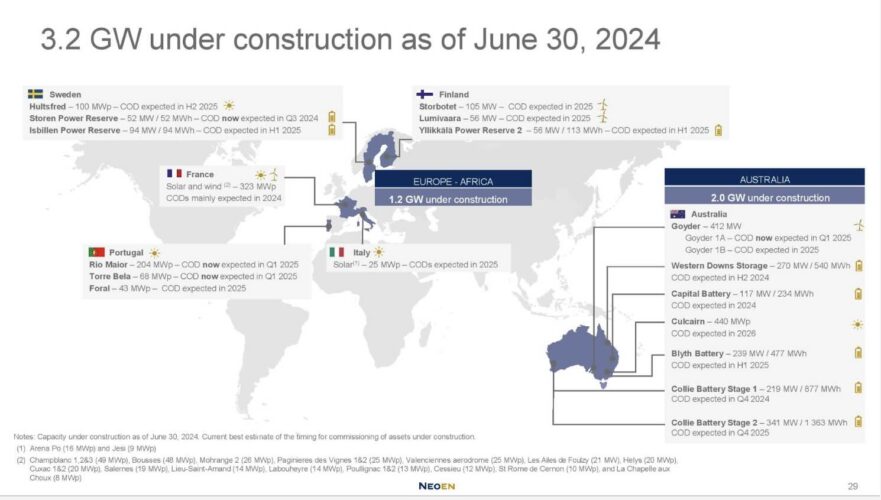

Neoen says it now has 3.2 GW of capacity under construction as at June 30, much of it in Australia, where it is building the country’s biggest battery – 560 MW and 2240 MWh at Collie in Western Australia – and a host of other projects (see map above).

These include the two stages of Goyder South, one part of which is mostly contracted to the ACT government and another part contracted to provide a “baseload renewable” contract to BHP’s massive Olympic Dam mine. The Blyth battery, also under construction in South Australia, will provide the “firming” to meet that contract.

Neoen is also building a battery next to the 400 MW Western Downs solar farm, and the Culcairn solar project in NSW.

The company is subject to a $10 billion bid by Canada’s Brookfield, which had previously had a bid for Origin Energy rejected by minority shareholders. Neoen’s major shareholders have accepted the Brookfield offer.

- The company says it is on course to its target of reaching 10 GW of capacity in operation or under construction in the course of 2025. It has just over 5 GW in operation now.

It says it is also on track to reach annual EBITDA of more than €700 million in 2025, with a big chunk of that coming from the lucrative contract for the Collie battery to time shift solar from the middle off the day to the evening peak.