The German transmission service operators (TSO) have published several studies that make up their medium term forecast for 2015-2019. Based on their findings, we take a look at what we can say about the power mix in 2019.

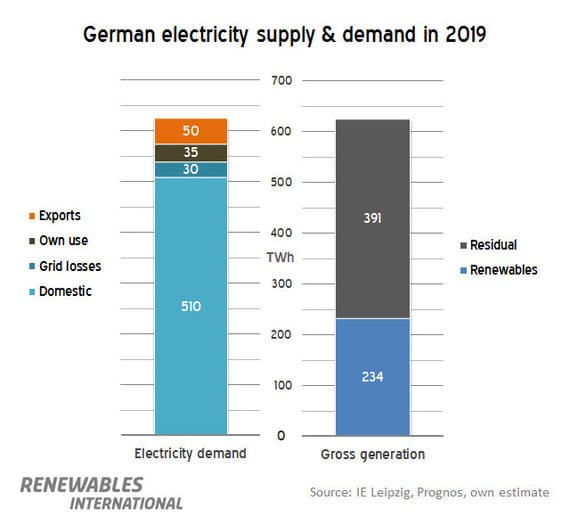

The amount of electricity that will be generated in 2019 mainly depends on domestic electricity consumption. In addition, the electricity supply also has to make up for grid losses and the electricity consumed directly by power plants. The sum of these three parameters is called gross domestic electricity demand and is usually the reference value for the share of renewables. On top of this, electricity generated in Germany is also sold to neighboring countries; thus, net exports also increase the amount of electricity that has to be generated in Germany.

In a recent article, we looked at the forecast for domestic electricity consumption, estimating a moderate reduction from 528 TWh in 2013 to 510 TWh in 2019. For our 2019, outlook I’ll assume that system losses remain almost stable, with grid losses increasing slightly to 30 TWh (2013: 27 TWh) and power plant own-use slightly decreasing to 35 TWh (2013: 37 TWh).

Electricity exports will probably continue to go up in the coming years. However, studies show quite a range of possible increases. For example, one study by the EWI from late 2013 estimates that net exports will rise to 70 TWh by 2020 (from around 34 TWh in 2013), while a more recent study co-authored by the EWI has net exports only rising to 41 TWh. Since there appears to be significant uncertainty, I chose a lump sum of 50 TWh, somewhere in the middle of the plausible range for net exports.

These assumptions put the total electricity demand at 625 TWh in 2019 (see chart above). According to the current TSO medium term forecast, renewables could provide as much as 234 TWh by 2019. That is a 40.7% share of gross domestic demand.

This year’s amendment to the EEG has introduced a target of 40-45% renewable electricity by 2025. If this forecast becomes a reality, Germany could meet its minimum target of 40% a whopping six years ahead of schedule. This is surprising, since this outcome would be the result of both wind & solar power capacity growing almost according to the newly introduced corridors that set targets for capacity additions for each technology.

Since the corridors appear to surpass the percentage target by design, the question arises which of the targets will be adjusted in the near future: the corridors for capacity additions, which would put even more renewable industry jobs at risk, or the apparently arbitrarily chosen 40-45% target, which is mainly political?

Continue reading about our German power mix estimate for 2019 in the second part of this series.

Source: Renewables International. Reproduced with permission.