The huge rooftop solar potential of Australia’s commercial and industrial sector should be a key focus of the energy transition, a new report has found, particularly for the use of “buildings as batteries” as coal plants are ushered off the grid.

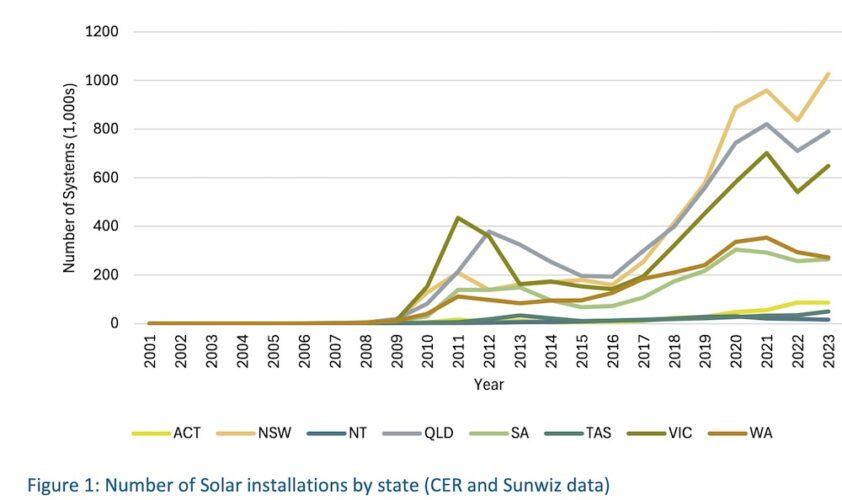

Rooftop solar has been a huge success story for Australia, already supplying up to 11.2 per cent of National Energy Market (NEM) capacity in 2023, but the vast majority of this has been installed on households.

According to estimates by Nexa Advisory, another 28GW of rooftop solar could be installed on commercial and industrial roof spaces across the NEM, offering significant power reductions to businesses and huge potential benefits to the grid.

“We’re in an energy transition that is very, very slow. We’ve had to catch up with many years of inaction, and building large projects is very difficult,” says Nexa Advisory founder Stephanie Bashir.

“It means our coal power stations can’t close on time, our ministers are fearful of reliability risks and the lights going out. Meanwhile energy bills are going up.

“It’s time for federal and state ministers to pay attention to consumer energy at the small and large end.”

The report identifies New South Wales – where the massive Eraring coal plant has been recently contracted to keep running for two years past its use-by date, just in case – as having some of the greatest C&I solar potential, based on its lead in the market for PV installs of 15kW and over.

Nexa suggests the state has a potential to install 7 GW of new capacity of this type of CER – significantly more than the aging 2.88 GW Eraing coal plant.

Source: Nexa Advisory

When that’s coupled with batteries, as commercial property owner Dexus is doing at a cost of $25 million in its new warehouses, the ability of C&I rooftop solar to meet demand on the grid becomes significant.

Massive savings vs wall of deterrents

The report cites numerous benefits, but also a wall of barriers that are depressing attempts by businesses to reap the same, and bigger, benefits as homeowners.

The benefits to C&I businesses include cheaper energy costs as their energy needs usually coincide with peak solar period during the day; simpler orchestration measures as larger systems are less complex and costly; and tapping under-used distribution lines rather than building out new transmission for mid-sized generation and storage.

Dexus says a 200 kilowatt hour (kWh) battery in a new 20,000 sqm warehouse will cut energy costs by $92,000 a year.

Furthermore, last year software company NEAR found there is 10 GW of spare capacity across the National Energy Market in distribution networks – meaning there is a lot of space in the grid that smaller scale renewables such as those hosted on C&I buildings could easily tap into.

And yet unlike the swathe of rebates and subsidiaries for Australians to pop a solar array on their home’s roof, the barriers to entry for businesses to do that same are greater.

Aside from the usual issues of tenants versus owners and buildings that can’t physically host a large solar array, there are structural policy, regulatory and market-based issues that homeowners don’t need to deal with but C&I companies do.

Long term energy retail contracts can prevent C&I customers from installing CER by locking them in, and governments do not provide similar financial incentives for installations as they do for homeowners.

C&I is where VPPs will actually work

But it’s network tariffs and the lack of flexibility options in the market today which are some of the biggest impediments to C&I CER takeup.

“We haven’t had network tariff reforms for C&I customers for 10, 15 years. There is a need to pay attention to some of those tariffs and make sure that they are just as innovative, if not more, to ensure they encourage the take up for consumer energy resources,” Bashir says.

“This is where demand response comes into it. Large C&I customers can put their energy from a battery into the market when it’s needed, they can reduce their consumption when it’s needed. With the right tariffs, it could be quite a good incentive to support the network.

Bashir says there is a missing market for services such as demand response and virtual power plants (VPPs) for C&I businesses today, so they can’t recognise the full benefits of excess solar power or of a battery.

“A virtual power plant also comes with a commercial benefit for C&I… they are commercially viable.”

“Origin Energy has committed to their commercial and industrial VPPs because they can see there is a huge benefit not just for them but for their customer’s stickiness.”

Flexible demand for C&I is an area that ARENA is tipping $1 million into, after a report found that using “buildings as batteries” could save the country $1.7 billion a year.

And all of these add up to a low awareness among C&I businesses of the potential bill savings, because the barriers to getting there are so high.

NSW could lead the way

With NSW leading the country on solar rooftop installations, and confirmation that end is not quite nigh for the coal fired power plant Eraring, the Nexa report pointedly directed its recommendations to that state.

“Given the pending exit of remaining coal-fired power stations – including Eraring – NSW would benefit from the rapid deployment of a well-designed policy program to accelerate private investment in CER,” the report said.

“A comprehensive policy approach should also leverage the existing grid and explore the deployment of VPP schemes where possible.”

The state is already putting together a Consumer Energy Roadmap and is reforming the Peak Demand Reduction Scheme, which offers financial incentives to participants to reduce demand, but the NEXA report says the latter should explicitly bring C&I into that regime as well.

The state should stop limiting the Small-scale Technology Certificates (STCs) to systems under 100 kW and instead open that up so larger systems can benefit.

Given C&I batteries are significantly larger than those used for homes, these should be deployed via VPPs – which themselves should be allowed to bid in future Capacity Investment Scheme (CIS) auctions or be included in Long-term Energy Service Agreements (LTESA).

And tariffs need to be reviewed in order to incentivise C&I CER installations and ensure the equipment is used as part of a flexible load.