Australian households can look forward paying roughly $77 less for their electricity in 2024 than they did this financial year, as cheap renewables continue to push down wholesale power prices, and despite the closure of more fossil fuel generators.

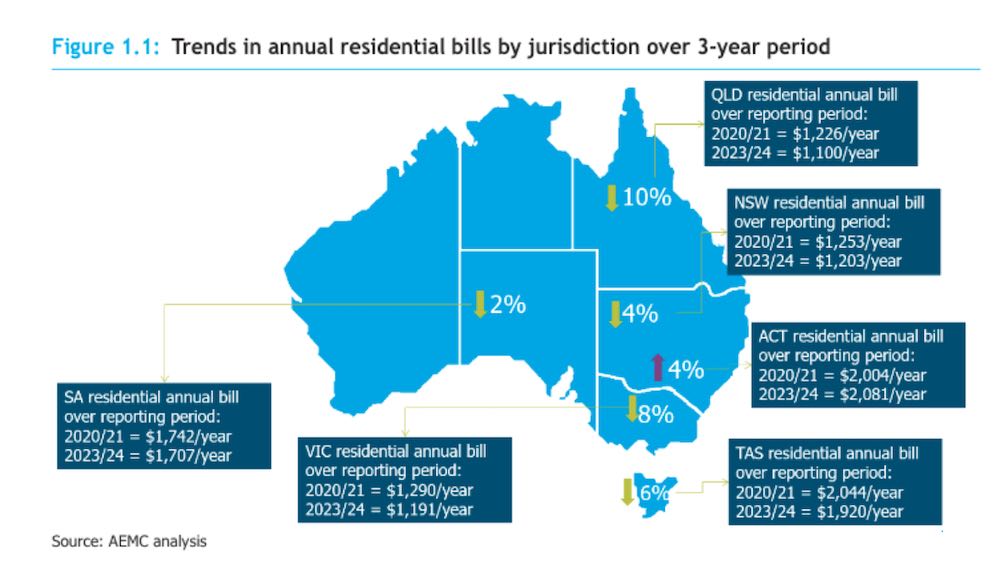

The Australian Energy Market Commission’s 2021 annual residential electricity price report, which tracks the movement of power prices over the coming three years, shows household electricity bills trending down in all states, with a small rise in the ACT.

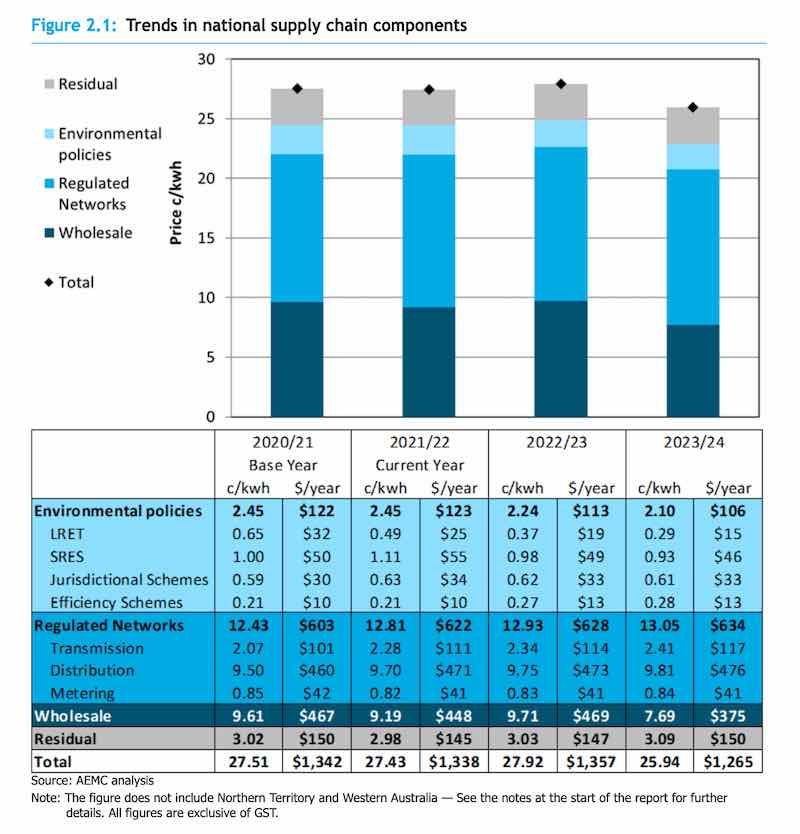

The report shows that, based on current trends, retail electricity prices are headed to below 26 cents per kilowatt-hour by June 2024 for the first time since 2016/17, offering a 6% or $77 discount on the annual power bills of the average Australian household in 2020-21.

This will be largely driven by a projected 19.7 per cent (or $92) fall in wholesale electricity prices – wholesale prices make up just over one-third of the cost of residential power bills – over the reporting period, driven by an influx of new mostly renewable generation, detailed below.

In fact, the only costs expected to increase over the three-year period are network costs – by about $31 out June 2024 – due to spending on upgrades to transmission and distribution networks to accommodate the changing shape of the NEM.

Everything else is going in the other direction, as the chart above shows, including environmental costs, which are expected to drop by $16 out to the 2023-24 financial year, due to a decrease in large-scale renewable energy costs as more generation comes online.

The only blip on the horizon comes in the 2022-23 financial year, when power prices are expected to jump slightly (by roughly $20 for that year) in the immediate aftermath of the closure of AGL Energy’s Liddell power station in New South Wales, as well as Torrens Island A1 and A3 and Osborne in South Australia.

But the AEMC says that the impact of the Liddell closure – despite its position as Australia’s largest remaining coal plant – is likely to be short-lived, before prices fall again as lost capacity is replaced by a combination of solar, wind, batteries and gas.

According to the AEMC, the total capacity of committed new energy generation projects for the periopd includes 2,671MW of solar, 1,393MW of wind, 470MW of large-scale battery storage, and 904MW of gas fired capacity committed across the NEM.

This new capacity has a bearing on most jurisdictions, the report says, with New South Wales adding 2,287MW, Queensland adding 1,557MW, Victoria adding 1,354MW and South Australia adding 240MW.

“While we have just under 2,500MW of generation expected to exit the grid over the next three years, there are almost 5,500MW of committed new large-scale generation and storage projects coming online over the same time period,” AEMC chair Anna Collyer said on Thursday.

“This is in addition to 4,130MW of new rooftop solar PV capacity, which will also influence prices by lowering demand and through exports.

“This diversity of generation and storage puts us in a strong position to manage the forecast retirement of Liddell in NSW and the closure of gas fired generators in South Australia and Queensland.

“Understanding what’s driving prices highlights the importance of being smart in how we connect resources to the grid and ensure the back-up needed for a secure supply, so the benefits of low cost and low emission generation aren’t eroded,” she said.

“Everything we’re doing at the AEMC and ESB is about making the most of renewables. That means maximising the benefits through reforms to distributed energy resources such as solar, minimising the emerging costs of planned network investments to connect renewables to consumers, while ensuring we have electricity when and where we need it to keep the lights on.”

The forecast and even the message of the report jars with the federal Coalition government’s long-term narrative that coal is cheap – and could even help lift the developing world out of poverty – while cutting emissions through the installation of renewables is expensive.

“This illustrates how integrating renewables in a smart way makes it possible to have both lower emissions and lower costs for consumers,” confirmed Collyer.

“We can now see far enough into the future to be confident that power prices paid by consumers will continue to trend downwards over the next three years, despite the staged exit of Liddell power station … one of the biggest coal-fired generators in the national electricity market.

“But while wholesale costs and environmental costs are trending lower, we are starting to see increases in the cost of network investments, and this is likely to accelerate over the next decade as more network investment is required to connect dispersed new generation to the grid,” she added.

“There are also regional differences across states and territories in the national electricity market that will affect price outcomes. And what energy offer you have, how much you use and whether you also have solar or gas will also affect your bill.”

On gas – the Morrison government’s other favourite electricity source – the report notes that LNG netback prices have been trading at record levels in recent periods, and that increases in gas prices are also a contributor to higher wholesale prices in the 2022-23 period (Figure 2.3).