Just days after calling in administrators, Carnegie Clean Energy has revealed hopes to resurrect the company’s wave power business, while selling or winding down its fully-owned solar and micro-grid subsidiary, Energy Made Clean.

In an ASX statement on Monday, Carnegie said it had secured “in principle” funding support to pursue a recapitalisation of its core CETO technology, in a deal with company director and shareholder Grant Mooney – through Mooney & Partners – and key stakeholder Asymmetric Credit Partners.

Carnegie – which started out as Carnegie Wave Energy – also noted that while it had placed the company and its subsidiaries into voluntary administration with KordaMentha, the CETO wave energy subsidiary companies were not in voluntary administration.

“The appointment of the voluntary administrators provides the mechanism and pathway to recapitalise the Company and for it to return to its core business of wave energy,” the statement said.

Carnegie said the recapitalisation proposal being developed would offer shareholders an opportunity to participate in an equity raising for the wave energy business, while “dealing with the current creditor build-up and legacy issues associated with the solar-battery business.”

The Energy Made Clean business would be sold or wound-down, the company said, and no further losses from it would be funded by shareholders.

“The board and management team is progressing with the recapitalisation proposal in earnest to enable shareholders the ability to show their support for the clean energy potential and intellectual property it has developed,” the statement said.

The interim funding support remains subject to finalisation of documentation and other approvals, it added.

As we have reported, Carnegie Clean Energy went into voluntary administration late last week, just days after the Western Australia state government pulled out of a $16 million contract it had signed with the home-grown company to build a wave farm off the coast of Albany.

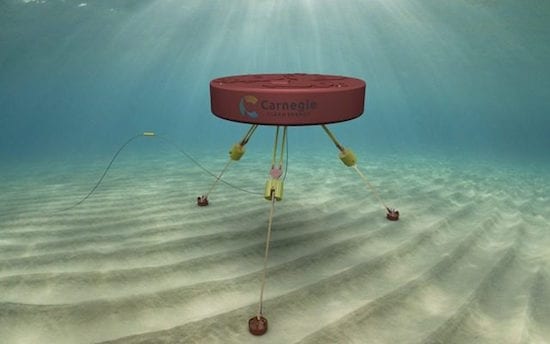

The proposed 1MW – and then potentially 20MW, and even possibly 100MW – Albany wave project was to use Carnegie’s CETO 6 technology, which is considered among the most advanced in the world, to tap what is said to be one of the most consistent wave power resources in the world.

The state government said its decision was informed by the “unexpected proposal to change Federal R&D tax concessions” which it said created an environment of uncertainty that had destabilised Carnegie’s finances.

For Carnegie, the blow was the final straw after what had proved to be a disastrous foray into the solar and micro-grid business – clearly paying way too much for Energy Made Clean, a company it had hoped would provide the cash flow to develop the wave energy business, and be a partner in wave-solar micro-grids, particularly in island markets.

The EMC acquisition proved a disaster, and a drain on funds, but Carnegie – and what remains of its board – clearly still has faith in the CETO technology, and its ability to be what it once promised would be the world’s cheapest, most robust and widely adapted wave energy generation system.

The evolution of Carnegie’s CETO technology has taken place over the course of a decade, with around $140 million invested along the way, including the recent $15.75 million grant from the WA government, and another $11.6 million of ARENA funding, reallocated for the Albany deployment.

In 2017, Carnegie updated its CETO 6 design to boost the nominal capacity of each unit to 1.5MW, up from 1MW, to make it more cost competitive with other mainstream renewable technologies.

Mooney – pictured above on the far right, at the 2014 launch of Carnegie’s CETO 5 240kW units – is an Associate Industry Professor with the University of Technology Sydney (UTS), and a director of several other ASX-listed companies, as well as being principal of Mooney & Partners, a corporate advisory form based in West Perth.

Another key investor is former AFL footballer and chairman Mike Fitzpatrick, whose private investment funds also offer a potential funding lifeline for the technology. It had previously tipped it $2 million of funds to keep the company afloat.