When Australian solar pioneer Dr Muriel Watt was appointed as a Member of the Order of Australia last week, tributes noted that her founding role at the Australian PV Institute (APVI) was largely spent convincing others of solar’s potential, and explaining how it could be realised with the right policy settings.

Many years later, and with Watt in the process of “trying to retire,” she and APVI are still in the business of convincing investors and policy makers about solar’s potential – but these days the focus is on its potential to be made in Australia.

To this end, the APVI on Friday released its first round of findings from the landmark $1.2 million Silicon to Solar Study – a huge feat of research and consultation distilled into a comprehensive 34 page report that presents the federal government with a “road map” to set Australian on the path to make its own solar.

The ARENA backed S2S study was developed by APVI working with Deloitte and a group of key industry stakeholders including The Australian Centre for Advanced Photovoltaics (ACAP), AGL, Aspiradac, Energus, Siemens, SunDrive, Tindo Solar and 5B.

It finds that establishing manufacturing capability of 10GW of poly-silicon – a key raw material for making PV – in and 5GW across the other steps of the value chain – ingots/wafers, solar cells and solar panels – is “credible and feasible” with the right government policy support.

Not all parts of the solar value chain come up equal in scheme of manufacturing potential – the report says government should balance factors including vulnerability/criticality, industry interest, competitive advantage and economic benefits to help guide its strategy.

But crucially, the S2S study recommends development of all steps of the solar value chain, having found “keen industry interest to build up manufacturing capability at each step, including through international partnerships and contracting arrangements.”

“With appropriate government support provided to all steps in parallel, a fully integrated domestic value chain can be developed to service domestic demand for modules and an export market at the poly-Si and ingot/wafer steps,” the report says.

On costs, Watt says the study compared manufacturing costs in China and Australia for current state-of the art technology and explored ways of overcoming cost gaps in each of the manufacturing stages. As the chart below shows, it won’t be a cheap exercise. But then again, not as expensive as, say, nuclear submarines.

As the chart above shows, the report estimates the need for an initial capital investment of $A1.3 billion to get a 10GW poly-silicon supply chain up and running, and much less to get 1GW each of the ingots/wafers ($119m), solar cells ($155m) and modules ($56m).

Total support needed to develop a fully integrated domestic manufacturing capability of minimum viable scale across the value chain is estimated at $A3.2 billion over a 10-year production period.

As the charts both above and below show, these costs are all much greater than they would be in China – a cost gap ranging from 93% to 19%. But China has had a massive head start.

Indeed, China’s almost complete dominance of the global solar supply chain – thrown into stark relief by the dual disasters of the Covid-19 pandemic and Russia’s invasion of Ukraine – is behind a good deal of the renewed policy interest in whether Australia can set up its own onshore supply.

But Watt says to get to the right answers on manufacturing solar in Australia means asking the right questions.

For instance, the question “How can we compete with China?” is not helpful.

“We’re not trying to compete with China. We can’t. It’s just not something that you would set yourself to do,” she says.

A better question is, how are we going to reduce our dependence on China while shifting to 100% renewables and decarbonising industry?

“We’re going to be meeting 70% of our energy needs with solar. So let’s manufacture some of that here,” Watt tells RenewEconomy.

“And if we’re going to be an renewable energy superpower, what are we going to need? We’re going to need solar. If we’re going to have green steel and green aluminium and green glass and everything else that’s being talked about, we’re going to need solar to do it.

“So whatever way we look at it, you can set up all sorts of bits and pieces of manufacturing, but solar’s the main game… It’s the key bit. If you don’t have it, then you know, everything else becomes a lot more reliant on that imported product.”

“The findings [in this report] present a roadmap for the development of a PV manufacturing value chain in Australia to increase our energy security, along with policy levers that can be used to facilitate this.”

Getting the right policies in place – all along the supply chain and at different levels of government – will be vital. And a setting national strategy for solar manufacturing is a top priority.

As the APVI report notes, there are a number of existing government priorities and funding programs that are critically reliant on access to abundant solar power – and yet no plan to manufacture solar at home. There is a National Battery Strategy, a National Hydrogen Strategy and Headstart Program, a Future Fuels Strategy and a Green Ammonia Roadmap – but no National Solar Manufacturing Strategy.

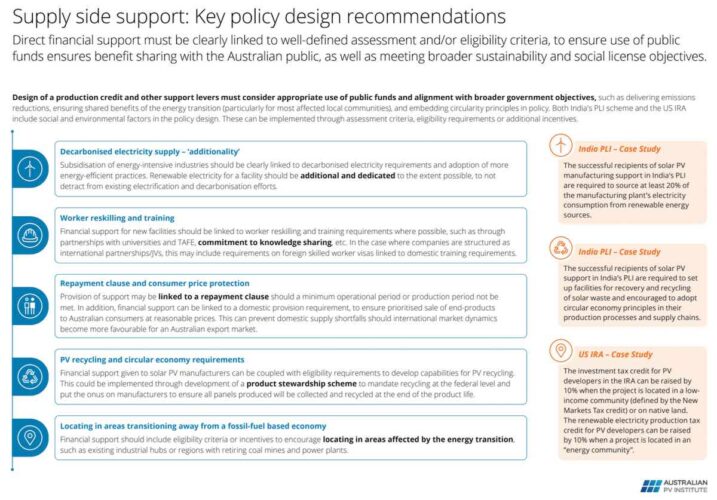

The report also recommends a broadly supportive political ecosystem comprising a combination of supply, demand and enabling policy levers to address the range of barriers identified by industry to establish solar manufacturing in Australia.

Key barriers at the project development stage are among those that most urgently need to be addressed for successful industry establishment. “Without this, direct or indirect financial support will unlikely be effective at attracting private investment to Australia,” the report says.

“We need to look at how can we facilitate … foreign companies who are successful overseas, particularly in China, coming to Australia, rather than, you know, creating massive hurdles for them to invest here,” Watt says.

“How do we get the permitting right? That’s what companies ask us. They can get a whole factory built in China in nine months. It would take three years just to get the permits through in Australia.”

Alongside good policy, political diplomacy will also be valuable, says Watt, because ideally, Australia needs to work with China, rather than against it, on establishing its own solar supply chain.

“You know, they’re using our technology, or they started with using our technology and our experts, and we still have a lot of their R&D happening here and interplay between people coming and going. And so I guess we think we should be be trying to use diplomatic skills to build on that and and have them help us set up an industry here.

“So, whereas [China] is finding it very difficult to work in the US – because the US finds it very difficult to work with China – Australia has got better relations, particularly in the solar sector, so it should be trying to work with them rather than sort of competing.”

Cooperation between the states of Australia will also be important.

“It would be really good for everyone to work towards a common strategy of what we see happening in Australia and how the different strengths in each state can play to that and and how we cooperate in terms of developing bits that other people can then use.

“[The states] have got different support program for manufacturing. So it’s a matter of, you know, how do those support strategies get used to advance an overall strategy.”

ARENA CEO Darren Miller says the S2S Roadmap provides a clear vision for Australia’s role as a nation that can manufacture cutting edge solar technology across the supply chain, leveraging its competitive advantages.

“Australia has already demonstrated its capacity to manufacture advanced technology in other sectors. Solar PV represents an enormous opportunity to apply our skills to a sector that will play a critical role in Australia’s clean energy economy,” Miller said on Friday.

“A number of Australian companies have already stated their ambitions to develop local manufacturing of solar PV at scale, and ‘Silicon 2 Solar’ illuminates the policy and investment pathway to make these bold plans a reality.”

APVI says the next phases of the S2S study will assess the manufacturing technology chain.

“The Techno-Economic Assessment and subsequent Business & Policy Assessment will be carried out with a wide range of industry partners and collaborators,” the report says.

“This will include assessment of the production scale and investment required at each stage, the parties which may be interested in investing as well as the opportunities available across Australia to support the development of a baseline manufacturing industry.”