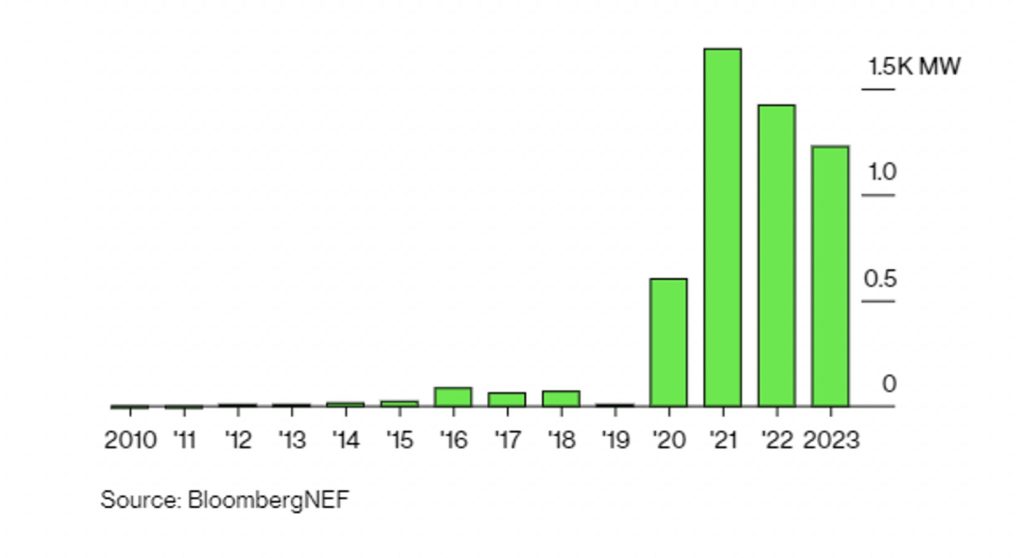

In an effort to stave off a repeat of 2020s summer blackouts, California is planning to install 1.7GW worth of new battery storage by August, according to new figures published this week by BloombergNEF, more capacity than China is expected to install.

A recent report published by Bloomberg Green citing new BloombergNEF numbers revealed that the leading power analysts expect California to not only install 1.7GW worth of new battery storage in 2021, but another 1.4GW in 2022 followed by 1.2GW in 2023.

But this will need to be only the start of a decades’ long push to ramp up energy storage deployment across the state.

A report published in March by three California agencies that regulate energy and climate issues – California’s Air Resources Board, Energy Commission, and Public Utilities Commission – concluded that 48.8GW worth of battery storage will be necessary by 2045 to achieve the state’s plan to eliminate greenhouse gas emissions.

This, on top of 69.4GW worth of solar power plants, 28.2GW worth of rooftop solar, another 12.6GW worth of onshore wind, and a further 10GW of offshore wind.

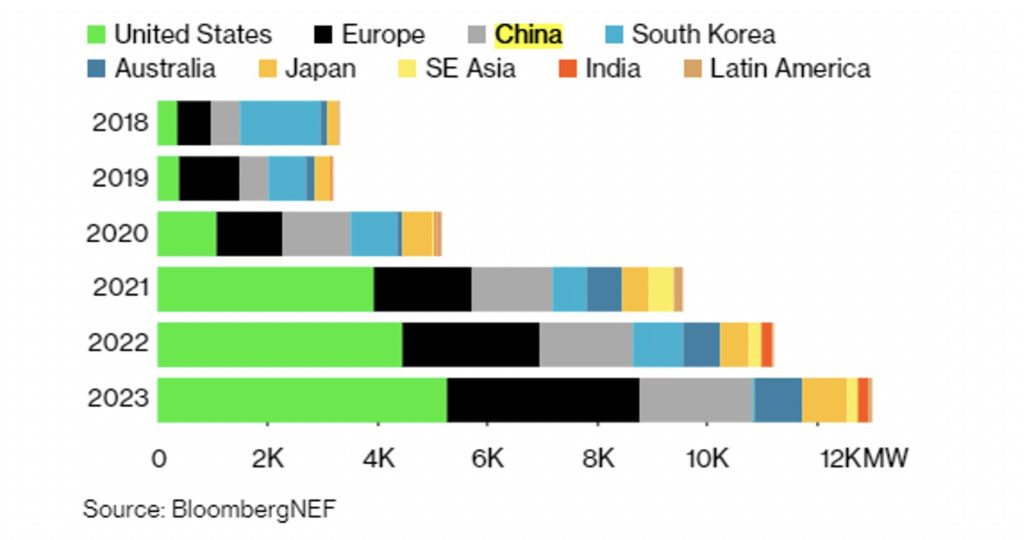

BloombergNEF also highlighted other countries that are doubling down on battery storage, pointing to China which is on track to increase battery storage capacity to 222GW by 2050, up from 1.4GW in 2019, while according to BloombergNEF, Australia has a pieline of grid-scale battery projects totalling over 11GW.

Thanks in large part to California’s outsized plans for energy storage, the United States is unsurprisingly currently set to install more energy storage capacity than any other country.

According to Bloomberg Green, utility-scale batteries currently have two major limitations – time and cost.

A recent BNEF Short analysis highlighted the plummeting costs of battery storage projects – which BNEF expects to drop by 68% by 2050, from $320 per kilowatt-hour in 2020 to $US104 per kilowatt-hour in 2050.

As for the duration of current battery storage projects, the 4-hour duration now commonly deployed in the US would be effective in a situation like California’s 2020 blackouts, when electricity supplies are stretched in early summer evenings after solar power shuts down and air conditioners are blaring.

However, such projects would not have been helpful during the multi-day outage seen in February in Texas.

“If batteries last four hours, then that’s not really going to do the job,” said Kit Konolige, senior analyst with Bloomberg Intelligence. “It’s still somewhat unproven, using batteries for a large portion of capacity.”

During the California blackouts in 2020, a host of critics lambasted the state for retiring a lot of gas-fired peaker plants which have commonly been used as a backup when demand is high.

Currently, building a new gas-peaker plant would cost around $US109 compared to $US125 per megawatt-hour for a battery plant, according to BNEF.

However, batteries are a lot faster to permit and build, have dramatically less impact on the environment, and also provide a range of other grid services like stabilising.

The Bloomberg Green article finishes by pointing to the effectiveness of batteries elsewhere preventing blackouts, such as in Australia, were the Hornsdale Power Reserve, which has already saved South Australia from several major blackouts since its was brought online in late 2017.

Despite this, however, California has delayed planned closures for some gas plants and increased some demand response programs, in an effort to further stave off any future blackouts.