Offshore wind in Europe got a bump last week with two billion-dollar Siemens turbine orders, one of them for a project that was the subject of the largest financing in non-hydro renewables so far in 2015.

Clean energy investors may have been less pleased to see Germany hand a lifeline to coal-fired power plants and the US Supreme Court deal a blow to the Environmental Protection Agency.

Last week, Siemens won an order from Dong Energy to supply turbines to a U.K. offshore wind farm. The deal may be worth as much as $1.2bn, according to Bloomberg New Energy Finance estimates.

Siemens will supply 91 of its 6MW turbines to the Race Bank farm to be built on Britain’s east coast, the company said in a statement on its website. Installation is expected to start in 2017 and the project set to begin working in 2018. The project may cost as much $2.6bn.

Earlier this week, Siemens said it received an order for 67 of its 6MW direct drive offshore wind turbines at the Veja Mate Offshore wind power plant in the German North Sea. Veja Mate was subject to a $2.1bn financing last week, involving a debt package from development bank KfW and six other lenders, mezzanine capital from Copenhagen Infrastructure Partners and equity from the project sponsor, Highland Group Holdings, and Siemens Project Ventures.

These two deals were not the only developments in offshore wind in late June and early July. Another project that could turn out to be even bigger than Race Bank and Veja Mate reached a milestone, with Dong saying that it had chosen Siemens as favoured supplier to its Hornsea Project One array off the UK coast. If the order proceeds, 171 of Siemens’ 7MW turbines will be installed, making the project the largest sea-based wind farm in the world.

Project investment for Hornsea may be as high as $6.36bn and the turbine deal worth as much as $2.86bn, Bloomberg New Energy Finance estimates.

The European offshore market will experience a 45% compound annual growth rate in 2014-20, reaching 30GW by 2020, according to Bloomberg New Energy Finance’s H1 2015 Offshore Wind Market Outlook.

Despite all the new wind capacity, Germany might miss its 40% emission reduction target by 2020 by as much as eight percentage points, according to an Analyst Reaction from Bloomberg New Energy Finance.

Last week, Germany’s coalition party leaders released details of a revised plan for achieving their 2020 emissions reduction plan. The controversial coal levy was replaced by a small lignite plant reserve, more energy efficiency and targets for combined heat and power.

Germany’s new plan to cut power-industry pollution would hand a six-year lifeline to some of the dirtiest coal-fired plants. Economy minister Sigmar Gabriel said 13% of power stations burning lignite, a cheap form of coal, would be phased out by 2021 under the programme. The government abandoned talks on proposals to impose a levy on coal plant emissions following strong resistance from utilities, coal worker unions and even leading members of the governing CDU.

In the US last week, the Supreme Court ruled against the Obama administration’s effort to limit toxic pollution from the nation’s coal-fired power plants, leaving the fate of a landmark environmental regulation in doubt.

The 5-4 decision went against an EPA mercury rule that forces utilities to shutter old coal plants or invest billions of dollars in equipment to clean up the emissions from their smokestacks. The Supreme Court ruled that EPA did not follow proper procedure in developing the Mercury and Air Toxics Standards.

Still, Bloomberg New Energy Finance says in this Analyst Reaction that this is far from a lifeline for coal. The decision is unlikely to change the end-game for the country’s coal fleet, which is already feeling the pain of low natural gas prices and diminishing revenues. What it does is give coal units more flexibility on when to pull the plug.

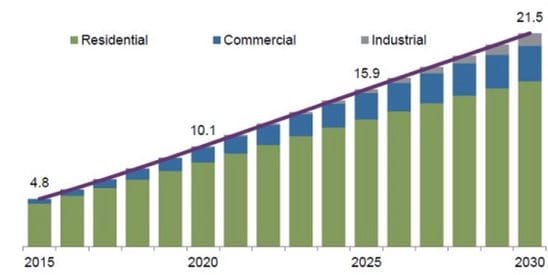

Australia small scale PV to exceed 20GW by 2030, says BNEF (GW of capacity)

Clean Power ‘Under-Insured’ in Emerging Markets: IFC

International Finance Corporation says many clean power projects in the developing world are under-insured against the risk of natural disasters.

“Many of the emerging markets are very heavily exposed to natural catastrophes and at the same time, very significantly under-insured,” Jan Mumenthaler, principal insurance officer at the IFC, told Clean Energy & Carbon Brief in an interview. Nevertheless, insurance premiums for renewable energy projects in emerging markets have been declining. This could change if reinsurers start to worry more about these risks.

Mumenthaler said that floods in Thailand in 2011 led to the withdrawal, for a time, of the insurance available to solar projects in that market. Projects would have to become resilient to these events to get insurance protection, he said.

The IFC is the arm of the World Bank that encourages private investment in emerging markets, and has committed its own funds to projects such as SunEdison’s 100MW solar plant in Chile, the $90m BMR Jamaica wind project and the transmission network expansion of the Power Grid of India. Its Insurance Services Group is involved with every project that the funding organization takes up.

Q: What is the broad direction of insurance premiums?

A: What we are generally observing, though it varies very much by market, is that the premiums have a downward trend, and that is driven by significant overcapacity in reinsurance. The tricky part is that many of the emerging markets are very exposed to natural catastrophes and at the same time, very significantly under-insured. As long as these markets do not get on the radar screen of the reinsurers, people are going to continue to enjoy very favorable premiums, but that could change very rapidly.

Q: If a project is covered with all the insurance bells and whistles possible, how much could it add to the cost?

A: If you are looking at a hydro power project in Nepal (significant earthquake exposure), you will be looking at very high numbers there. It is really driven by what the project exposures are, how well the risks are managed and reduced and the willingness of the developers and bankers to self-retain risk. About 5-6% of the project cost is probably the maximum insurance level for a project.

Q: Back in 2011, some solar generation projects in Thailand suffered production losses due to floods. So all future solar projects would require flood insurance?

A: I think it comes back to how people manage risk. In the case of natural catastrophes, unless projects adopt a strategy to become more resilient to these events, it will be really difficult for them to get insurance protection again, especially in the wake of climate change…

This is an excerpt from the Clean Energy & Carbon Brief published weekly. To subscribe to the Clean Energy & Carbon Brief, click here.

Source: BNEF. Reproduced with permission.