Global energy demand grew above its 10-year average in 2017 and carbon emissions increased after three years of little-to-no growth, according to BP’s 67th annual Statistical Review of World Energy.

BP’s annual Statistical Review of World Energy is sometimes looked at askance by some, but with now 67 editions under its belt it has at least proven itself worth considering in an effort to get an idea of the current state of play in the global energy sector, if not its forecasts.

While some of the findings can benefit from comparisons to other similar reports, the findings from the 2018 edition are concerning enough.

“2017 was a year where structural forces in the energy market continued to push forward the transition to a lower carbon economy, but where cyclical factors have reversed or slowed some of the gains from prior years,” explained Bob Dudley, BP group chief executive.

“These factors, combined with rising demand for energy, has resulted in a material increase in carbon emissions following three years of little or no growth.”

The Review does a tremendously thorough job of doing exactly what it’s title suggests – reviewing the statistics of the world energy sector.

Unfortunately, despite a few years’ worth of promising movement in the global sector, the Review paints a disappointing picture.

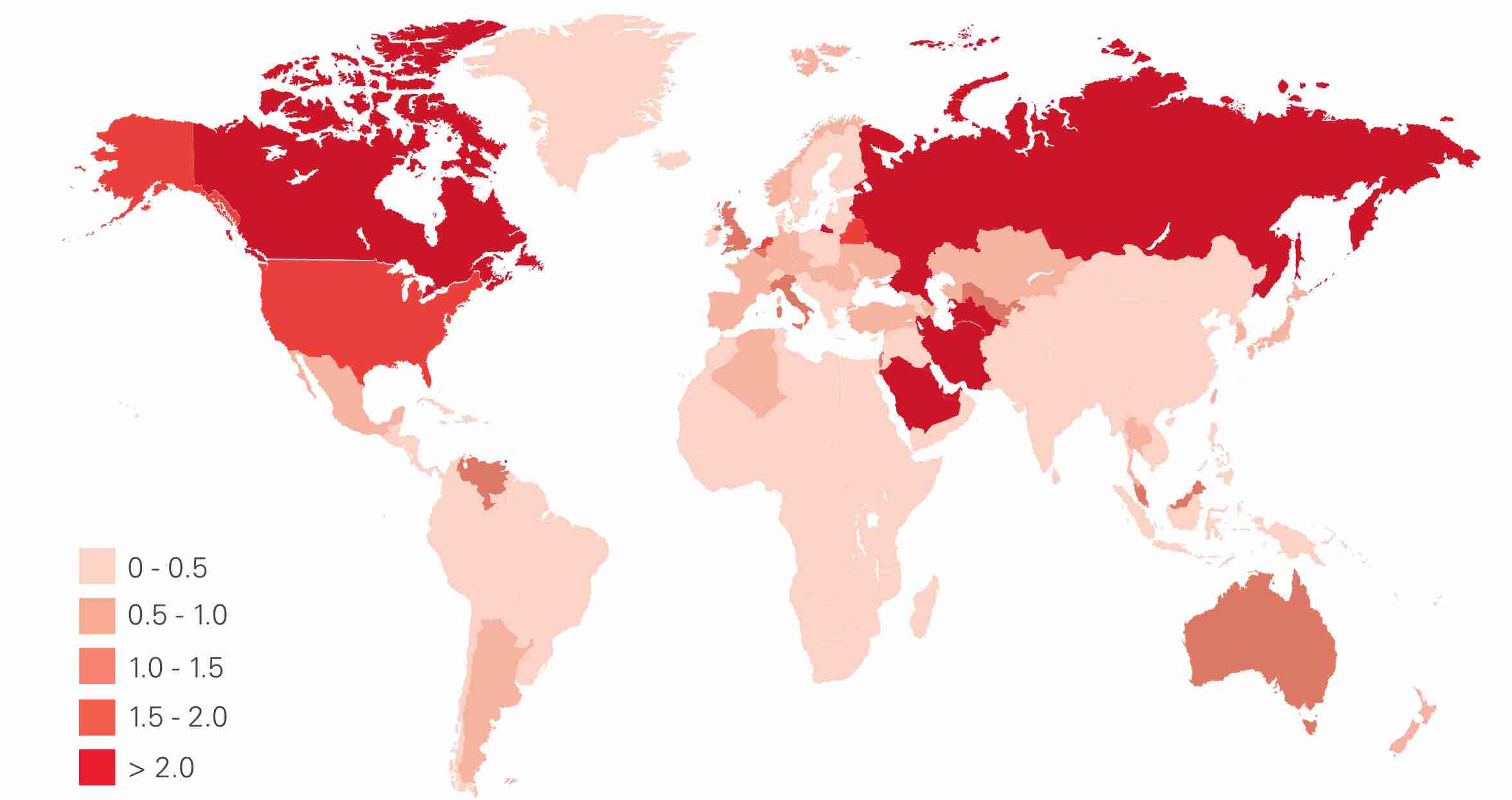

Global energy demand grew above its 10-year average, growing by 2.2% compared to the average of 1.7%, driven primarily by stronger economic growth in the developed world as well as a slight softening of the pace of improvement in energy intensity.

Carbon emissions were similarly estimated to have increased by 1.6% after little or no growth over the previous three years (2014-16).

Speaking directly to carbon emissions from energy consumption, BP’s group chief economist Spencer Dale said, “The backward step in last year’s data is most stark in carbon emissions from energy consumption, which are estimated to have increased by 1.6% in 2017.

That follows three consecutive years of little or no growth in carbon emissions. So, on the face of it, a pretty big backward step.”

Somewhat unsurprisingly, natural gas accounted for the largest increase in energy consumption, amounting to an increase of 96 bcm, or a 3% increase, the fastest increase since 2010.

Much of the growth was driven by China which saw its natural gas consumption increase by 31 bcm, as well as the Middle East (28 bcm) and Europe (26 bcm), while consumption in the United States fell by 11 bcm.

Gas exports also increased, driven largely by Australian and US liquefied natural gas (LNG) – increasing by 17 bcm and 13 bcm respectively – as well as exports from the Russian pipeline (15 bcm).

“The single biggest factor driving global gas consumption last year was the surge in Chinese gas demand, where consumption increased by over 15%, accounting for around a third of the global increase in gas consumption,” explained Spencer Dale.

“Much of this rapid expansion can be traced back to the Environmental Action Plan announced in 2013, which set targets for improvements in air quality over the subsequent five years.”

Despite widespread attempts to diminish the use of coal in global energy production, coal consumption increased by 25 million tonnes of oil equivalent (mtoe), or around 1%, the first growth since 2013 and driven largely by India.

Nevertheless, coal’s share in the global primary energy mix fell to its lowest level since 2004 of 27.6%. Coal’s increase in consumption but decrease in share is due to increases in both natural gas and renewable energy sources.

Specifically, renewable power grew by 17%, an increase above the 10-year average and its largest increase on record. Wind energy provided more than half of renewable energy growth, and solar accounted for slightly more than a third.

Renewable power generation increased by 25 mtoe in China – a record for the country and the second largest contribution to global primary energy growth from any single fuel and country, behind only natural gas, also in China.

“The increase in global power generation was driven by strong expansion in renewable energy, led by wind (17%, 163 TWh) and solar (35%, 114 TWh), which accounted for almost half of the total growth in power generation, despite accounting for only 8% of total generation,” explained Spencer Dale.

“Although wind continued in its role of the bigger, more established, elder cousin, it was solar energy that made all the waves.

“In particular, solar capacity increased by nearly 100 GW last year, with China on its own building by over 50 GW – that is roughly equivalent to the generation potential of more than two-and-a-half Hinkley Point nuclear power plants. Global solar generation increased by more than a third last year.

Much of this growth continues to be underpinned by policy support. But it has been aided by continuing falls in solar costs, with auction bids of less than 5 cents/KWh – which would have been unthinkable for most projects even just a few years ago – now almost common place.”