The 100MW Bomen solar farm near Wagga Wagga in south-west NSW has become the latest renewable project to be involved in liquidated damages payments after a fault with gear connected to a local substation led to a three-week outage in January.

Bomen is the first big solar farm project by listed network investor Spark Infrastructure, in what amounted to a significant change to its strategy and business model, and was completed on time, and under budget with mechanical works finished in February last year, and the commissioning process completed in late June.

In January, however, there was a three week outage attributed to a fault in the solar farm’s 33kV switch gear.

“The fault resulted in Bomen Solar Farm going offline for 20 days,” Spark said in commentary accompanying its interim results. “Restoration of the fault is complete and the farm recommenced generation on 31 January 2021.”

Because the solar farm is still in the Defect Liability Period under the engineering, procurement and construction (EPC) contract, the outrage resulted in liquidated damages to make up for the lost revenue of around $1 million.

Liquidated damages have become a common part of the renewable energy industry due to the sometimes lengthy connections and commissioning delays, and were one reason why big contractors like RCR Tomlinson collapsed and others got out of EPC business and now focus on less risky “balance of plant” contracts like roads.

Just last week, Decmil confirmed it had booked a $9.7 million loss from delays at the 200MW Sunraysia solar farm, also in NSW, although that project is subject to a number of claims and counter claims between the owners, the contractor, and the inverter supplier.

Spark said that apart from the outage, Bomen performed well in the first half of 2021, generating total revenues of $6.3 million (including the damages payment), from around 84MWh of output.

Most of this ($5 million) came from the fixed power purchase agreements struck with Westpac and Flow Power, which account for 95 per cent of its output. Another $0.4 million came from merchant revenue (selling electricity and renewable energy certificates into the spot market).

After operating expenses of $1.6 million, the solar farm delivered a $4.7 million profit for the six month period. Bomen is expected to deliver revenue of around $13.5 million a year for the first five years from average annual output of around 220GWh (or an average price received of just over $60/MWh).

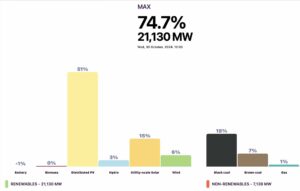

This table provided by Spark summarises the results of Bomen solar farm, and we are publishing it because it is one of the rare instances where the financial details of an individual project is released.

There will be little public insight into such projects given that Spark is now likely to be taken private by KKR and Ontario Teachers in an agreed $5.2 billion bid, and following the sale of two Australian solar farms by the listed New Energy Solar, and buyouts and removal from public listings of companies such as Tilt Renewables, Windlab and Infigen Energy.

The experience at Bomen has now inspired Spark to put together a pipeline of more than 2.2GW of wind, solar and storage projects, including the Dinawan renewable energy hubtm, an expansion and storage addition to Bomen, and a big battery (300MW/580MWh) at Deer Park on the outskirts of Melbourne.

The main EPC contractor to Bomen is Beon Energy Solutions, also partly owned by Spark, and which lifted its revenue by 37.5% to $143.2 million in the first half, due largely to a number of new solar farm projects. Its overall margin earned increased by $3.6 million to $11.5 million.