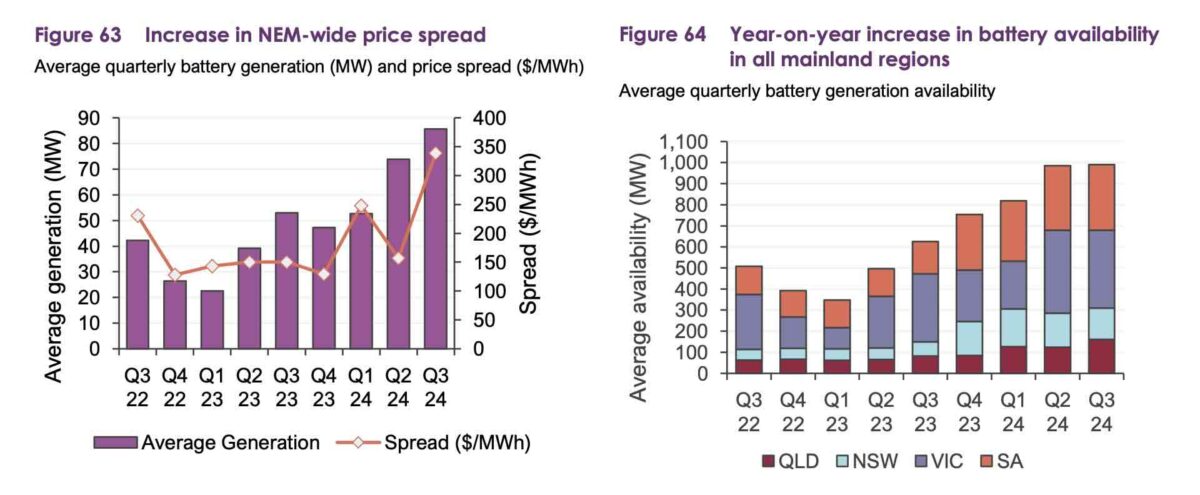

Revenue for Australia’s growing fleet of big battery projects nearly trebled in the September quarter, compared to a year ago, helped along by a big increase in price volatility, including being paid to charge when wholesale prices fell below zero.

Data released by the Australian Energy Market Operator in its latest Quarterly Energy Dynamics report shows that the net revenue for big batteries leaped to $76.3 million in the latest quarter, up from $32.5 million in the same quarter in 2023.

While the first big battery projects pocketed much of their revenue from providing key services such as frequency control, they now source most of their market returns from arbitrage, where they time-shifting electricity – mostly excess rooftop solar – when prices are low or negative, and send it back to the grid when demand and prices are high.

The AEMO report says gross energy revenue jumped to $78 million, boosted by a three fold increase in arbitrage revenue to $64.1 million as the average price spread – the difference between high and low prices – more than doubled to $339 a megawatt hour (MWh) from an average $150/MWh.

The batteries were also paid at times to charge, often in the middle of the day when wholesale prices fell below zero.

This is mostly the doing of the impact of rooftop PV and bidding by coal fired power generators, who would prefer to pay to keep their units running rather than having to switch them off completely, although this may change in the future.

AEMO noted that of the $78 million in energy revenue, $43 million was earned by dispatching at prices exceeding $300/MWh.

Batteries had been expected to bring new competition to the market, but many are owned, or operated, by the same legacy utilities that have dominated the market for decades.

South Australia, which is one of the most concentrated markets in terms of market power, but which also has the biggest share of renewables, offered a price spread of $492/MWh to the state’s four operating batteries, up from $190/MWh in the same quarter last year.

The market revenue does not include fixed contract payments for some big batteries – such as the original Tesla big battery at Hornsdale, and the Victoria Big Battery near Geelong – which provide significant capacity reserve as a standby for any network problems.

Some of those revenues are significant, and helped underpin the construction of Hornsdale and VBB, but also the new Waratah Super Battery in NSW, which is being paid to act as a kind of giant shock absorber for the grid, and the country’s biggest battery projects – both 2 GWh or more – under construction at Collie in Western Australia.

Revenues from the frequency control and ancillary services (FCAS) market fell nearly 20 per cent to average $12.2 million this quarter, and made up just 16 per cent of their total revenues, compared to 46 per cent in the same period last year.

That’s because this market has now being more or less flooded by the sheer number of battery projects on the grid, with 16 operating on the main grid and more than 30 under construction.

See Renew Economy’s Big Battery Storage Map of Australia for more information.