An intense battle for access to the main electricity grid in what has shaped up to be a landmark tender in the transition to green energy in Australia has apparently been decided, but not yet announced.

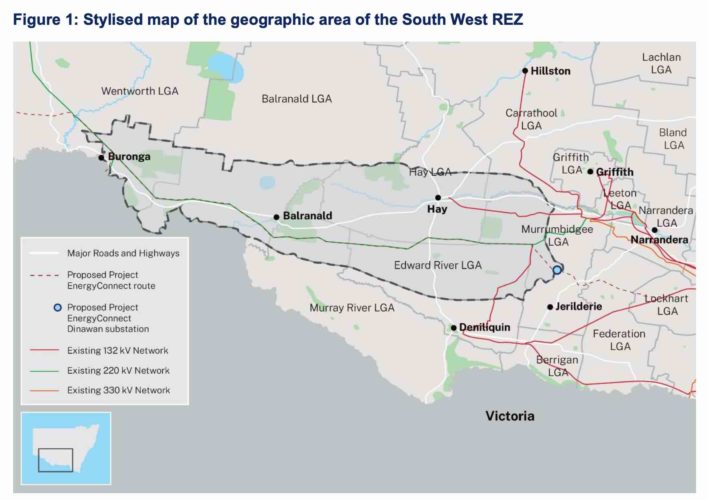

The tender for access rights to the newly created South-West renewable energy zone was launched in May last year, and was swamped with proposals equivalent to four times the available capacity – more than 15 gigawatts (GW) of wind, solar and battery plans for a part of the grid with capacity for just 4 GW.

It is presumed to have attracted some of the biggest players in the industry – Origin, AGL, Engie, Spark, Squadron and a host of smaller players, either in partnership or on their own. Some, however, are thought to have withdrawn.

An announcement on the winners is expected in February, along with the results of an equally keenly awaited tender for long duration storage, which sought capacity of 1 GW but got proposals for more than twice that sum.

The results of the SW REZ access tender are being tightly held. It is thought that AEMO Services has made its recommendations to the state government agency EnergyCo, which is charged with completing the contract work. It is also thought that those projects most advanced in state government approvals have fared best.

Access rights to newly created renewable energy zones are a key part of the renewable infrastructure roadmap adopted by the NSW government as its blueprint to shift the country’s biggest grid from its dependence on ageing coal fired power station to one based around renewables and storage.

But not everyone is a fan of the process, and the shift to central control over what is built and where has sparked debate. Some argue the process has been “overcooked” by bureaucrats, and suggest some companies have placed big bets on a single project and seen their work evaporate with a stroke of a pen.

Paul Simshauser, the head of Queensland’s Powerlink, has been highly critical of so-called “priority access” regimes in all their forms, and has deliberately targeted smaller zones that – at least until the new LNP state government took control – was underpinning a record amount of new developments.

See: “They will be stranded:” Energy chief lets fly at proposed grid access scheme for wind and solar

Access, and control of it, remains one of the most contentious debates in the Australian energy industry.

Some developers have said that they deliberately avoid bidding into the REZs, noting that there remains capacity elsewhere in the grid. The access rights give chosen projects priority within those zones, and are designed to protect them from high levels of curtailment.

But the south-west REZ is also being held up as an example of poor planning, largely because Project EnergyConnect, the new transmission line that will form the backbone of the zone, is not powerful enough. It has been built with a 330 kV rating rather than the 500 kV rating that could have supported much more capacity.

Some have argued, including Engie, that the addition of big batteries – acting as kind of “shock absorbers” at each end of the line, like the Waratah Super Battery and the Victoria Big Battery – could lead to more capacity being built.

Interestingly, only one of the 19 projects announced last year as winners of the federal government’s first 6 GW tender for wind and solar under its Capacity Investment Scheme is located within the SW REZ.

That project is the 585 MW Junction Rivers wind project, with an 800 MWh battery near Balranald that is owned by Windlab, itself majority owned by Fortescue chairman Andrew Forrest, and one of the lesser known of the iron ore billionaire’s vast portfolio of renewable and storage projects.

It is not known if it has secured access rights. Other projects in the SW Zone, such as Origin Energy’s giant Yanco Delta wind project and battery, were not named winners of the first CIS tender.

If these or other projects do get access rights, then they have another opportunity to gain an underwriting agreement – the CIS tenders offer a price floor and price cap – in the new tender that has commenced and which is due to be concluded later this year.

Some developers have argued that government tenders should focus only on the price of electricity fed into the grid. “It is driving bad outcomes,” said one, who declined to be named. “It shouldn’t be about bidding for price, not for access. That’s why a lot of developers have staid away from it.”

Renew Economy reached out to AEMO Services and to the state government. They declined to comment.

Update: In a later statement, AEMO Services confirmed that the winning bids – and the losers – had been chosen and notified.

“AEMO Services, as the Independent NSW Consumer Trustee, has recently concluded the tender for South West Access Rights according to the timeline published on our website. Successful and unsuccessful proponents have been notified,” it said in a statement sent to Renew Economy.

“AEMO Services in its role as the Consumer Trustee provides recommendations to EnergyCo as the Infrastructure Planner.

“AEMO Services understands that following the relevant statutory processes, EnergyCo expects to make a decision on the grant of Access Rights around mid-February, as planned. They will notify successful proponents once the decision has been made.”