Delays in key transmission and battery storage projects had led the Australian Energy Market Operator to forecast a potential breach of reliability standards in NSW in 2025/26, in an update that could be used by the state government to justify a controversial extension to the country’s biggest coal generator.

The unscheduled update to the market operator’s 10-year reliability outlook, known as the Electricity Statement of Opportunities, warns of a potential breach in the reliability standards in NSW in coming summers, and in other states in certain scenarios.

The change from the most recent special update released in October last year is blamed on a year-long delay to Project Energy Connect, the biggest transmission project in Australia that will link NSW and South Australia, and which was flagged by Transgrid CEO Brett Redman in last week’s episode of the Energy Insiders podcast.

One of the country’s biggest battery projects, the 400 MW, 1660 MWh Orana big battery in the central west of NSW, is also delayed – according to AEMO – and is now expected in late 2026. However, the project owner Akaysha Energy later insisted it was on track for completion in the second quarter of 2026.

The ESOO is a complicated beast, and was originally devised as a forecast of future energy needs that serves a signal for developers and investors on where to build new plant, and when they would be needed.

But it is now often interpreted by mainstream media as a “blackout” forecast, and has become a centre stage event, intensified by the deep political polemics around the pace and purpose of the green energy transition.

AEMO CEO Daniel Westerman says in a statement that the green energy transition is on track, but more needs to be done to ensure projects are built and delivered on time.

“Industry and governments are responding to the reliability risks from retiring coal by investing in new infrastructure to ensure a reliable and secure electricity supply going forward,” Westerman says.

“The urgency for the timely delivery of transmission, generation and storage, and use of consumer electricity resources to support the grid, remains to meet consumers’ energy needs.”

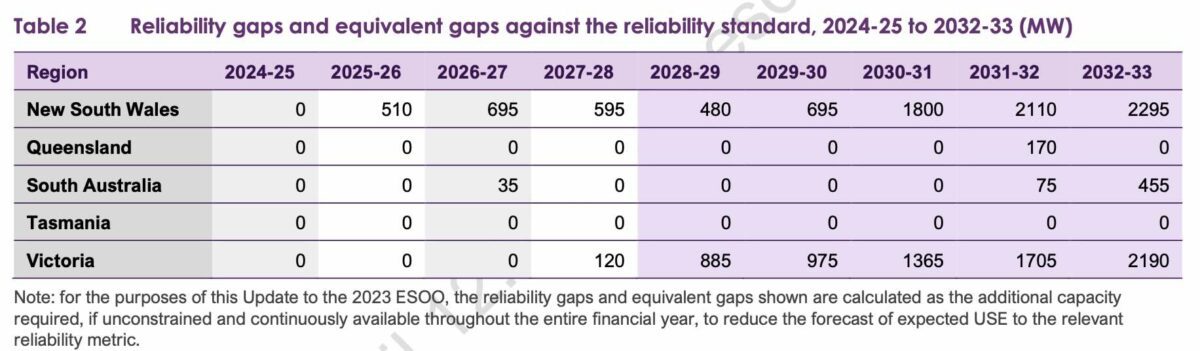

AEMO is at pains to point out that the lights are not about to go out. Its “central scenario” – which forecasts varying reliability gaps in all mainland regions over the next 10 years, only considers existing, committed and anticipated projects.

It does not include federal or state government energy programs, or the approximately 280 GW of proposed generation and storage projects in the development pipeline, equivalent to 4.5 times the size of today’s main grid.

The scenario that includes the federal and state energy programs means that only NSW facing a small risk of breaching the reliability standard in the next two years.

That interim reliability standard aims to limit any outages to 0.0006 per cent of the time, while the reliability standard aims to limit “unserved energy” to 0.002 per cent of the time. Most outages suffered by consumers are the result of local network failures due to storms, fire, or falling trees.

So, to meet the standard, NSW needs another 510 MW to be delivered in time for the 2025/26 summer, just after the current scheduled closure of Eraring.

The state will need 695 MW the following year, but AEMO believes it can fill these gaps – which will only occur on rare days of low wind and solar output, or in the case of a fossil fuel plant failure – with its interim reliability order, or its emergency reserve system.

It stresses that it does not need – at this stage – to invoke the retailer reliability obligation through the Australian Energy Regulator, which would signal a deeper concern about reliability.

Still, the changing circumstances, coupled with Eraring owner Origin Energy’s failure to build any new capacity since flagging the early closure of Eraring more than three years ago, is widely expected to lead to an announcement – possibly this week – of an extension to the Eraring closure date.

There has been speculation that the extension could be limited to one or two units for another two summers, at least to get the state Labor government passed the next election in early 2027, or even a full extension for up to five years.

Amusingly, as revealed by Renew Economy last week, Origin Energy revealed in an EPBC application for what would be the biggest battery in Queensland, that the Eraring closure date had been delayed three years to 2028. The company insisted the 2028 date was an error, but it seems the market speculation has now settled around that time-frame.

The question for the NSW government is whether it wants to risk unserved energy or, more to the point, high wholesale electricity prices as it heads to the next election. Premier Chris Minns clearly does not. The next question is how long the extension should last, and how much Origin should be paid.

The ESOO report shows that if projects are delivered on time, then the reliability risk in NSW will be within the reliability standard, even the incredibly tight interim reliability standard of 0.0006 per cent, at all times apart from 2025-26.

“In 2025-26, there is a benefit from additional firming infrastructure from the firming infrastructure tender (NSW) and additional Capacity Investment Scheme support (federal), alongside the Waratah Super Battery project,” AEMO writes.

“However, the additional risks from the retirement of Eraring Power Station and revised distribution of demand across New South Wales load centres mean that the risk exceeds the reliability standard.”

It says that in the longer term, between 2026-27 and 2032-33, the anticipated commissioning of the HumeLink and Hunter transmission projects, as well as the much delayed Snowy 2.0 project, and the long duration storage projects, will reduce the risks of unserved energy to well within the standard.

In response, NSW energy minister Penny Sharpe said in a statement: “The ESOO report shows the risk of energy reliability gaps over the next three years has increased in NSW.

“This confirms that there are risks associated with new projects being delayed and reinforces the need for the action that the NSW Government is taking to support more renewables, deliver critical transmission infrastructure and speed up the connection of big batteries to the grid.

“As the report says, the energy transition is well underway, and we will continue delivering our renewable energy plan to ensure a reliable supply of low-cost power for NSW homes and businesses.”

One of the interesting additions to this update ESOO is the observation from AEMO that to best meet reliability needs in critical events, capacity needs to be sited close to the major load centres. Facilities built on interstate transmission links or in areas such as the further flung renewable energy zone will have no benefit.

It also notes that gas turbines, six- and eight-hour batteries, and 12-hour pumped hydro projects are shown to have the highest relative reliability benefit, particularly in related to unplanned outages.

“Wind and solar generators are found to have low relative reliability benefits, which are likely to decline further, as reliability risks are increasingly concentrated outside of periods with wind or solar availability,” it says.

It also notes that the grid will need more than just replaced energy, and will need critical grid services such as system strength. It says network providers are already working through those needs, and will fill them with programs that could see more synchronous condensers installed, or big batteries with so called “grid forming” inverters.

While the “central scenario” shows reliability standard breaches in most states, the scenario that takes into account federal and state schemes suggests that only Victoria will face issues, later this decade, and there is plenty of time to address these through further investments.

South Australia, which leads the country and the world with a 75 per cent share of wind and solar, and a fast-tracked target of 100 per cent net renewables in 2027, is forecast to remain within the reliability standard as new projects are delivered and the new connection to NSW completed.

Queensland, which has the lowest renewable share in the country and an 80 per cent renewable target for 2030, is also forecast to remain within the standard, largely because state ownership allows it to control the closure dates of its fossil fuel generators as it rolls out new wind, solar and storage projects.

See also: Barnaby effect? Mystery surrounds late three-year delay for huge New England renewable zone