The scale of battery storage and large scale solar projects seeking connection to Australia’s main grid has soared in the past 12 months, and the capacity of new projects actually working through registration and commissioning has also more than doubled.

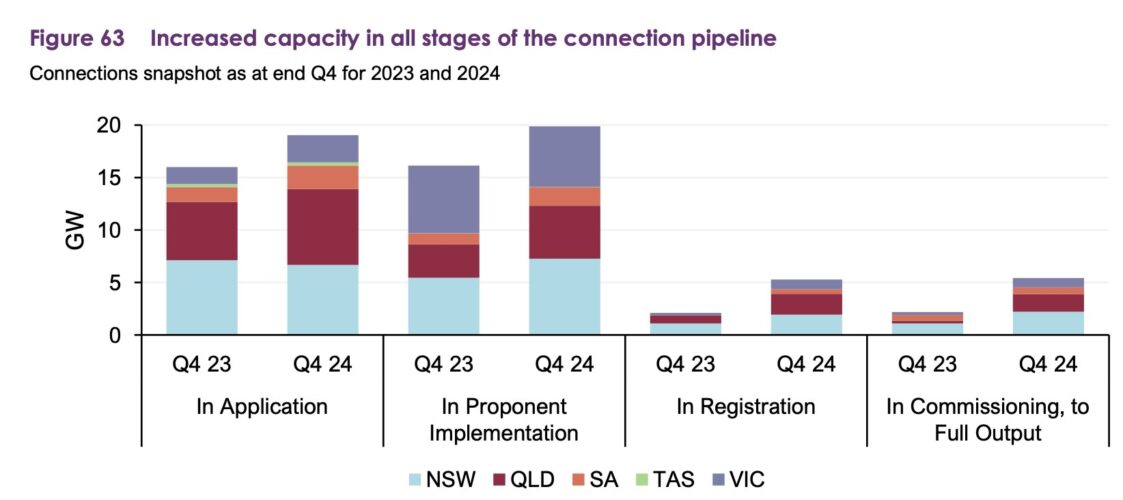

The latest Quarterly Energy Dynamics report released by the Australian Energy Market Operator on Thursday reveals that there was 49.6 gigawatts (GW) of new capacity progressing through the “end-to-end” connection process from application to commissioning.

This is up significantly from the 36.4 GW at the end of 2023, and comes mostly from a doubling of battery projects to 18.2 GW from 9.2 GW a year earlier. Solar also increased significantly, to 18.7 GW from 15.3 GW, while wind appeared to be relatively static.

These numbers refer mostly to very early stage projects. But the growth in battery storage and solar – the two technologies that have achieved significant cost reductions over the last two years – is significant. Wind has been stifled by both rising costs and planning issues.

Of more comfort to the industry – and to consumers – will be the more than doubling in the capacity of projects working through the registration and commissioning phases.

According to AEMO, there were 5.3 GW of projects working their way through registration – meaning that they are built or in the process of being built and are seeking to meet the often strict grid connection requirements – compared to just 2.1 GW a year earlier.

The capacity of projects working through commissioning – working their way through various “hold points” and testing and to full output – has also jumped to 5.4 GW from 2.2 GW.

AEMO says a total of 19.9 GW of new capacity is finalising contracts and, or under construction, compared with 16.1 GW at the end of 2023.

The Australian federal government has set a target of 82 per cent renewables by 2030, compared to its current share of around 40 per cent over 2024. The December quarter delivered record renewables share of 46 per cent, according to the AEMO QED.

Federal energy minister Chris Bowen is still confident that the target can be reached, and is currently running the second of a series of major tenders – each one running at more than 6 GW of capacity.

The biggest risk, however, is often cited as a lack of grid capacity, particularly in some of the renewable energy zones that have been targeted for new wind and solar projects and where construction of transmission links has been delayed.

However, the AEMO quarterly report makes clear that the states with more wind and solar capacity, and less reliant on ageing coal fired generators, have enjoyed average wholesale prices almost three times cheaper than those states – NSW and Queensland – still dependent on coal.

“Our research shows the only way to cut power bills is to accelerate the build out of renewables combined with storage,” said Nexa Advisory’s Stephanie Bashir.

“That means building the transmission as it continues to be the missing link in Australia’s energy transition. “