Big three Australian gentailer AGL Energy says large-scale battery storage is rapidly becoming a core part of its business, and will be a key building block for future profitability, as the grid shifts to renewables and success in the business of generating and retailing power depends increasingly on agility and flexibility.

AGL reported a much boosted $399 million profit at its half-year results presentation on Thursday, a 359 per cent jump, year-on-year, partly driven by improved plant availability – or fewer crippling coal plant outages – and flexibility of its asset fleet, which for part of the reporting period included the Torrens Island battery in South Australia.

And while the 150MW, one-hour Torrens Island battery made just a modest $7 million contribution to earnings before tax for the period to December 31, AGL notes that this is from just three months of operation, and says the battery’s achievements so far – detailed in the chart below – illustrate why batteries are high on the utility’s agenda.

“We’ve been really pleased with the Torrens battery,” AGL managing director and CEO Damien Nicks told RenewEconomy on Thursday.

“It’s been in operation for roughly three months and we’ve actually put out to the market the profit we made in that three months. And the reason we’ve done that is to demonstrate, if you like, the investment thesis of why we’ve done it.

Nicks says the battery earned its keep between providing services of arbitrage, FCAS (frequency control ancillary services) and capacity, with the largest profit made through capacity, as the charts show.

“Another reason we’re also talking to the market about that is we took FID [final investment decision] on the Liddell battery in December, as well,” Nicks adds.

“We see this as a core part of our business going forward. Having firming in the portfolio is incredibly important.”

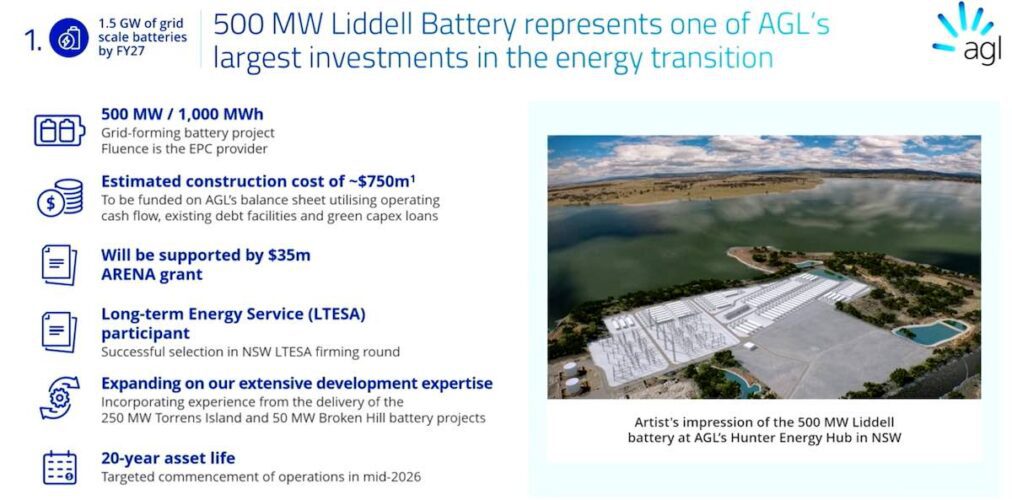

Accordingly, AGL is spending a decent chunk on batteries, including the “grid forming” 500MW, two-hour Liddell battery – at the site of the shuttered Liddell coal plant – although that project now has the support of joint funding by the NSW and federal Labor governments, through last year’s capacity tender.

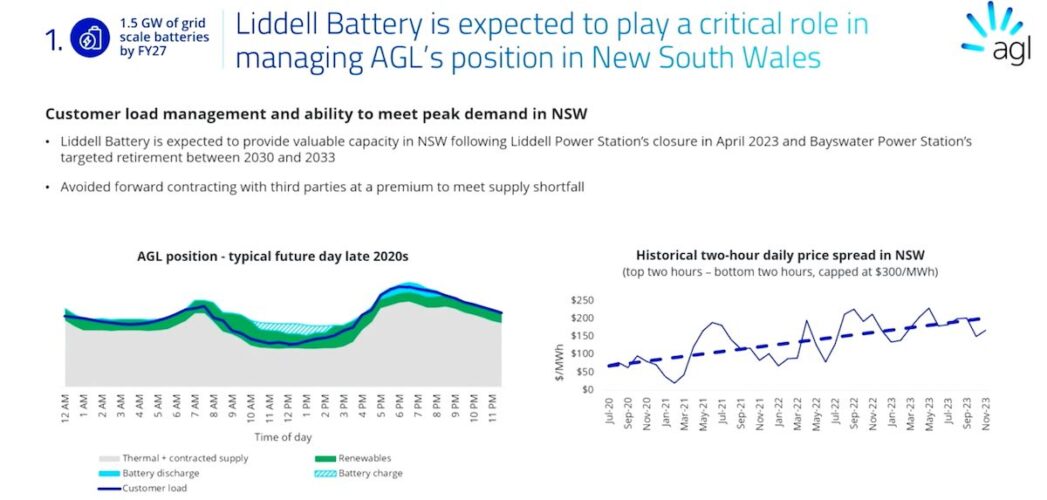

In a webcast on Thursday morning, Nicks said AGL expects the Liddell battery to play a critical role in managing the gentailer’s customer load in New South Wales, especially falling, particularly in the wake of the targeted retirement of its 2.6GW Bayswater coal plant, between 2030 and 2033.

“The battery will help reduce a short capacity position in NSW and bolster our ability to meet peak customer demand as energy consumption profiles become more segmented,” Nicks told investors and analysts.

“More specifically, it allows us to modulate our customer load during evening peaks and charge during daytime periods where wholesale spot pricing is typically low or negative.

“The battery is also expected to contribute positively to portfolio value by ensuring we optimise the sourcing of cap products on market to meet the capacity shortfall, potentially in illiquid markets.

“Arbitrage revenue is expected to increase with greater price volatility as variable renewable energy grows in the NEM [national electricity market],” Nicks said, with additional benefits including “portfolio insurance” for the company’s other assets, including for planned generator outages.

AGL counts 800MW of grid-scale battery assets either in operation, in testing or under construction, including Torrens, Broken Hill – currently in testing – and the Liddell battery at the Hunter Energy Hub.

AGL COO Markus Brokhoff says the next battery on which the company expects to take final investment decision will be in Queensland, for a project he says is “just at the mature approval stage.” Already in Queensland, AGL operates the 100MW/150MWh Wondoan South battery, under a 15-year contract with its owner, Vena Energy Australia.

But plenty more has to be done, including the build-out of more renewable energy generation capacity, to replace the capacity of coal and gas fired generators have been, or are being retired in the coming decade.

In its presentation on Thursday, AGL said it has expanded its renewables development pipeline from 3.2GW to 5.8GW since September 2022, which means it has already met its interim target of 5GW by 2030. From there it aims to get to 12GW by 2035.

There are any number of critics – not least major AGL shareholder Mike Cannon-Brookes – who argue that none of Australia’s big utilities have invested anything near enough to do their part.

So what’s the hold up? While some might point the finger at, say, prioritising generous executive bonuses, AGL says a great deal of time is lost in the permitting and connection processes for new grid-scale assets – and argues this could be improved.

According to AGL, the planning process for renewable and firming projects can take longer than three years at the moment and the connection process commonly takes one year or more in some cases.

“What you’re seeing us do right now is bring those assets in we can bring the most quickly,” Nicks told RenewEconomy. “They’re often the ones on our sites where the network connections are, which means we don’t have some of the same planning and connection issues we do with some of our other assets.

“So for me, you know, I want to see some of the connection planning issues improved, so decisions get made more quickly.

“Whether it’s a yes or no from a social licencing perspective, that’s really important. But I also want to see, let’s get the assets built, where the infrastructure is there, today… That will keep the market moving forward while, say, longer duration assets such as new transmission can happen over a period of time,” Nicks said.