A leading energy executive who once described rooftop solar tariffs as a hidden “scam” has now concluded that Queensland’s nearly 4.5GW of distributed PV has helped displace 1GW of coal and gas generation and has proven to be “welfare enhancing.”

Paul Simshauser, a former AGL chief economics who is currently CEO of the Queensland state-owned transmission network operator Powerlink, and remains a professor of economics at Griffith University, pointed to his newly published paper “Rooftop Solar PV and the Peak Load Problem” on LinkedIn late last week.

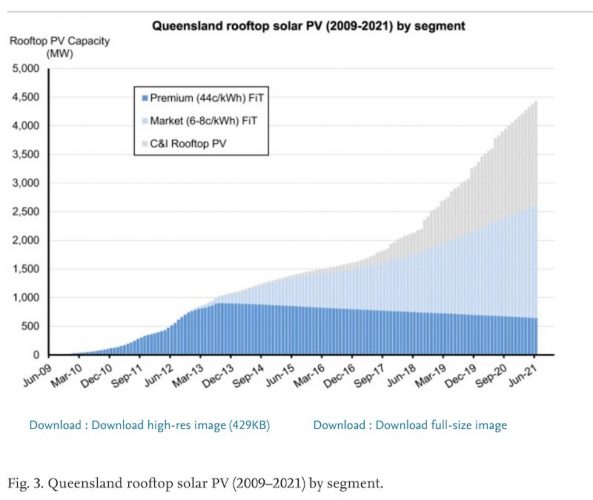

The extensive and highly technical paper, published on Science Direct here, examines the supply-side impacts of rooftop solar in Queensland, an energy market market historically dominated by coal plants, but where household solar uptake now leads the world at 41.8% penetration.

Simshauser finds that Queensland’s 4430MW of installed rooftop solar capacity, at the household level, creates a mismatch between peak load and solar output. But at the whole-of-system level, it has driven 1000MW of utility-scale plant “dis-investment,” with 500MW of this being baseload coal.

“Driven by sharply rising rooftop solar PV grid-exports, falling minimum demand has serious implications for inflexible baseload plant (along with system strength violations and high volts),” he writes in explanation.

“In the case of Queensland at the wholesale market level, rooftop solar has a positive impact on the peak load problem and proved to be welfare enhancing (setting aside subsidy costs).

“While the initial subsidies were very material (i.e. comprising a generous premium Feed-in Tariff and a capital subsidy), all premium FiT’s have been abolished and upfront capital subsidies have been reduced significantly.”

The findings are in stark contrast with some of Simshausers previous views on rooftop solar, such as in 2014, when as chief economist at AGL he argued that non solar households were subsidising solar households to the tune of billions of dollars.

“This is a scam, but it’s hidden,” Simshauser told the AFR at the time. “If you don’t fix the problem, the rot will only get worse.”

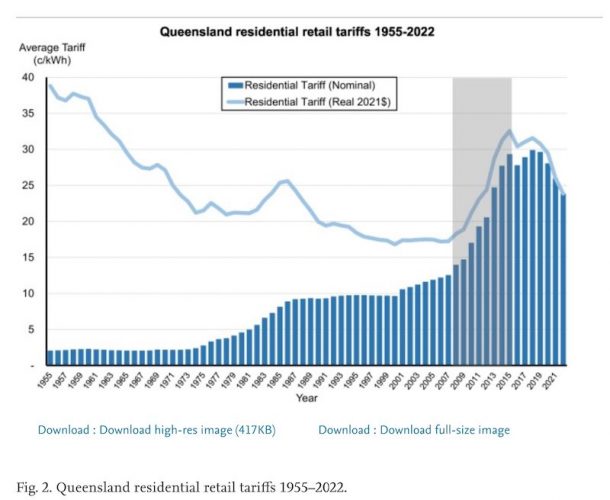

A year later, in his role as head the Queensland government’s Department of Energy and Water Supply, Simhauser published another paper, further attacking the “transfer of wealth” from households without solar to those with rooftop solar.

As RenewEconomy reported at that time, the thrust of Simshauser’s arguments were that rooftop solar tariffs needed to be changed, preferably to “demand” tariffs so that they became more “cost reflective”.

But Simhauser has now acknowledged the evolution of his opinion of rooftop solar, which was duly pointed out by a commenter on his LinkedIn Post.

“Guilty as charged,” he wrote in response to the comment last week, which noted that earlier papers would have included sentences like: ‘rooftop PV is NOT welfare enhancing’.

“All I can do at this stage is defer to the master, Lord Keynes – when the facts change…(!!!),” Simshauser wrote. “I did caveat in the article, subsidies aside (being sunk as they are). But your substantive point is on the money.”

Simshauser’s paper also stresses that, as more and more variable renewable energy is added to an energy market like Queensland’s, “seamless coal plant dis-investment” becomes crucial to “maintaining a tractable equilibrium. And as coal plant was divested, peaking plant expanded in equilibrium.”

As David Leitch wrote here last week, this is not an easy equilibrium to achieve – particularly when “the thermal sector starts behaving like the ‘the wounded bull’ in what is perhaps now… Simshauser’s most enduring image.”

Simhauser explains it thus: “Sensitivities showed any equilibrium was fragile – if coal plant dis-investment did not occur system average cost increased due to utilisation effects, and spot prices began to collapse due to merit order effects, with the net gap reaching $25/MWh in a c.$55/MWh power system. Importantly, the gap was not missing money, it was merely low prices due to structural oversupply.

“The NEM’s energy-only market and its $15,000/MWh price cap proves tractable through to a 50% renewable market share, but relies critically on frictionless coal plant divestment and bounded negative price offers,” he concludes.