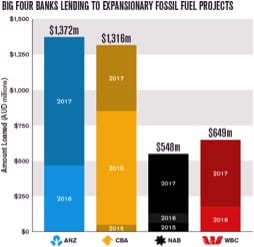

Just when you thought Australia’s banks had reached the nadir, new data shows that lending by the ‘Big Four’ to projects expanding the global fossil fuel industry spiked by 50% last year.

Lending to new fossil fuel projects jumped from $1.509 billion in 2016 to $2.265 billion in 2017. ANZ topped the list, loaning $905 million, a 93% increase on the previous year, to new projects ranging from gas fields in Indonesia’s North Sumatra, to Ichthys LNG off the north of Australia.

New fossil fuel projects are the most detrimental in terms of global chances of keeping the planet on track to meet its Paris climate targets and certainly places the banks in clear violation of any commitment to help hold global warming below two degrees, which the ‘big four’ have all made.

In fact, the carbon pollution enabled by these projects is equivalent to 924% of Australia’s total 2017 CO2-e emissions, enough to cancel out the gains made by Australia’s 2021-30 emission reduction target five times over.

There are however some positives to come from the new research.

Overall lending to fossil fuels by the ‘Big Four’ has decreased from $9.1 billion in 2016 to $7.4 billion and there has been no lending from any of the Big Four to new coal projects, either in Australia or abroad since October 2015. Adani of course, is also firmly out of the picture.

Digging deeper, the new data also shows a major divergence within the energy lending practices of the ‘Big Four’.

Whilst NAB and to some extent Westpac have made a clear pivot from dirty to clean energy, CommBank and ANZ’s loan books remain stocked with polluting deals.

Since making ‘two degree’ commitments in 2015, NABs lending to expansionary fossil fuel projects has enabled 192 million tonnes of CO2, 15 times less than the amount enabled by ANZ (2838 mt CO2) and CommBank (2918 mt CO2).

Overall though, the lending betrays a picture of Australia’s banks either misunderstanding what a two degree lending commitment requires, or simply not taking it seriously.

Author: Jack Bertlous, Market Forces Research Director