The Australian government will seek at least 24 gigawatt hours of storage under the Capacity Investment Scheme that is to be rolled out across the country, and big batteries appear to be sitting in the front seat to fill much of the $10 billion of targeted investment.

A consultation paper released late last week reveals some key details of the scheme, including that it will be “technology neutral” – at least among zero emissions storage technologies – and will seek 6GW of capacity with an average “medium” storage of four hours.

And it seems that battery storage is best placed for the tenders, because of their speed of deployment, the storage duration period being sought, and because of the soaring costs of large civil engineering projects like pumped hydro.

The CIS is kicking off in NSW, where the biggest capacity crunch is looming with the impending closure in August, 2025, of the 2.88GW Eraring coal generator, the country’s biggest.

The NSW scheme has effectively already started, with the federal government stepping in to nearly triple the capacity sought by the state government in its own “firming tender” from 380MW to 930MW. This is to try and ensure there is no reliability gap looming after the closure of Eraring.

Financial bids for that tender have been extended to late August from late July to take into account the added capacity on offer that will be funded by the federal government.

The consultation paper makes says the next tender will kick off in October, focused on Victoria and South Australia. The capacity sought is not revealed, but it makes clear that one third will go to Victoria projects, one third to South Australia, and another third to either state depending on bids.

It notes, also, that the South Australia and Victoria tenders require commissioning dates by 2027 as “this reflects the timing of reliability requirements in those jurisdictions.”

It says projects unable to meet these requirements are expected to be ineligible. That appears to restrict these coming auctions to battery technologies.

Pumped hydro projects, the document notes, take an average of at least five years to be built. It also notes that the allowable technologies include green hydrogen. Projects must be at leat 30MW in capacity.

The documents suggest that the 6GW/24GWh target is based on the Australian Energy Market Operator’s Integrated System Plan, and its central Step Change scenario that models 82 per cent renewables by 2030, now adopted as the federal government’s target.

“The 6GW is likely to represent a substantial contribution to the overall capacity requirement but is not intended to be sufficient to meet 100% of Australia’s need for both dispatchable and non-dispatchable (e.g. VRE) capacity,” the document notes.

“Substantial volumes of dispatchable and non-dispatchable capacity are also expected to be built outside of the CIS, including by investors responding to market price signals and potentially through state and territory government support in each jurisdiction.”

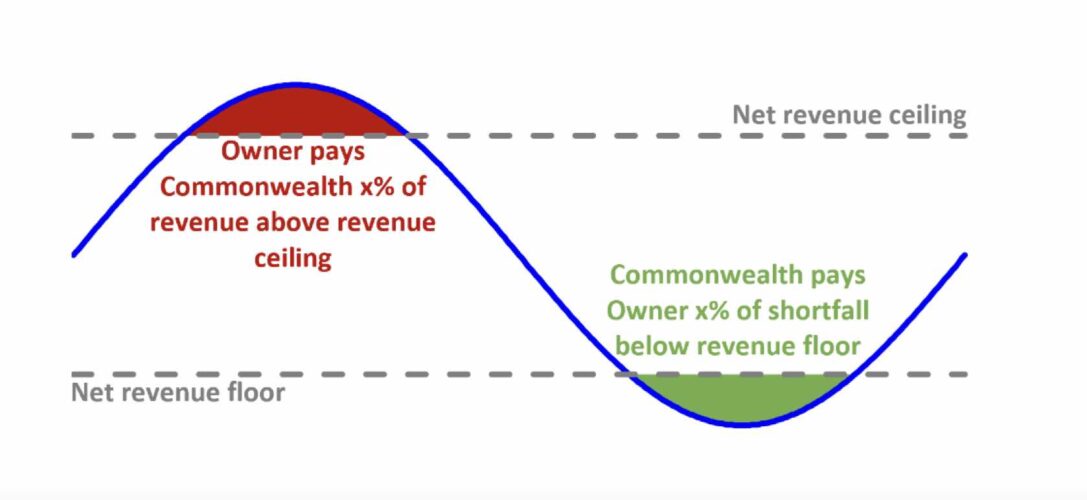

The CIS will seek to underwrite storage projects through what is effectively a combination of a floor price, and a ceiling price, and it is seeking advice on how this is best structured, and how the CIS can be adapted to support pumped hydro, which is proving difficult to do because of its soaring costs.

The floor price is there to guarantee minimum revenues, and while the structure will allow for successful projects to play in the various wholesale markets , as well as meeting contracted capacity for peak demand needs, there will be a cap after which excess profits are returned.

It warns that penalties will apply, and damages will be sought, if projects are delivered late, or are unable to respond to their contractual demands, such as offering a stated capacity when electricity supply is short.

It is also seeking advice on how best to support pumped hydro projects, and if the model proposed would be suitable to those projects.