Australia boasts a pipeline of nearly $1 trillion of large scale renewable projects, encompassing technologies including onshore and offshore wind, solar PV, hydrogen electrolysers and storage, according to a new analysis.

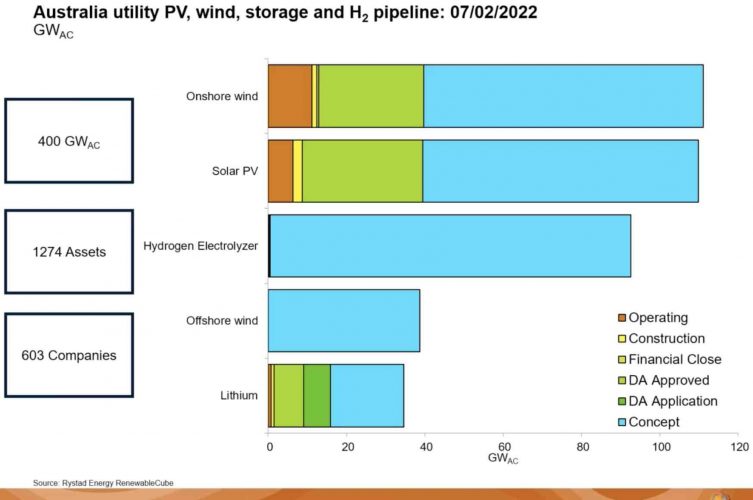

David Dixon, an analyst with Rystad Energy, says there are a total of nearly 1,300 projects put forward by around 600 different companies that amount to some 400 gigawatts of new capacity, worth around $830 billion at current costs.

That is more than enough to supply the amount of electricity in Australia – several times over – but it also points to mega projects that are looking to green energy exports in the form of hydrogen and ammonia, and to supply new domestic green industries such as green steel and other low carbon products.

The analysis is timely given that Australia is heading into a new federal election campaign where one side will be seeking to demonise the shift to green energy, claiming thousands of jobs and billions of dollars in fossil fuel investment are at risk from the transition.

But those claims fail to recognise the enormous potential of the green energy transition, and the significant licks of local and global capital that are queuing up for the opportunity to invest in Australia, a country that should emerge as a green energy superpower because of its unrivalled resources, including wind, solar, minerals and land.

The scale of what is being proposed is highlighted in the graph above. Orange shows the operating projects and yellow are those under construction. Green are those that have reached financial close or have long term contracts, but all are dwarfed by the “concept” projects in blue.

These include some of the world’s biggest projects, such as the 26GW Sun Cable project in the Northern Territory, including 32GWh of battery storage, and the massive 52GW and 26GW wind and solar projects announced by CWP Global in Western Australia, targeting the green hydrogen and ammonia markets.

There are also the newly unveiled 5.4GW wind and solar project, with 9GWh of battery storage, put forward by Andrew Forrest’s Fortescue Future Industries, and a bunch of other similar projects ranging from 1GW to 5GW across the country.

But even within the main grid the pipeline is surging. NSW reckons it has more than 135GW of project proposals for four of the five renewable energy zones it plans, and Queensland has more than 60GW of project proposals.

Dixon’s research identifies some 655 utility scale solar PV projects, some 290 onshore wind projects, and some 235 big battery projects. The list does not include rooftop or small, distributed assets.

He says one of the features of the market in 2022 is the arrival of the “giga-scale” projects – those of 1,000MW or more – some of which have already begun construction, such as the Macintyre wind project in Queensland and the first stage of the massive Goyder South project in South Australia.

The totals included in the near term outlook are less spectacular than the pipeline, because it all needs to find space on the existing grid, no mean feat given the challenges in securing supply chains, contractors, and connection agreements and negotiating commissioning hurdles.

In the past year, solar PV and some big battery projects have taken the lion’s share of new construction, but Dixon predicts wind to become the dominant force in new construction starts in 2022, reflecting the contraction of projects caused by the solar duck curve and plunging midday prices.

“In the wind space … we have approximately 2.5 gigawatts of capacity with power purchase agreements yet to start construction,” Dixon told a webinar on Tuesday.

“We do expect the storage is more specifically the lithium ion battery capacity to continue to flourish in Australia, a slowdown in utility PV.”

Another notable trend will be a re-boot in constructions tarts in Victoria, which has declined dramatically since 2018, around the time the last renewable auction was allocated.

“Some of the drivers for developments have come back into Victoria,” Dixon says. “One is that there are a number of assets within Victoria with power purchase agreements or or wind assets that we expect to start construction in 2022.

“And next is the result of the V-RET 2 auctions which will get announced sometime in the latter half of this year. And whether those assets start construction in 22 or early 23 is yet to be seen but that will bring in those 600 megawatts of capacity to be developed into the system.

“The wind and PV sector in Victoria is largely concentrated to the southwest and largely concentrated to wind so we do expect to see some diversification likely into utility PV and to the north. east part of the grid in the state.”

But commissioning challenges loom large. “So right now, of the top 10 largest assets being commissioned at the moment moment eight of them are in New South Wales,” he says.

“Prior to 2020 There was a 75% chance that commissioning for any asset would take less than 200 days beyond 2020. This is this has been reduced significantly, so only 50% of assets (are expected) to take less than 200 days. So the commissioning durations are actually getting worse, not better. ”