G-20 governments and state-owned bodies provided $US1.1 trillion in fossil-fuel support in 2022, the highest in at least a decade, according to a new assessment from BloombergNEF (BNEF).

According to BNEF’s latest Climate Policy Factbook, commissioned by Bloomberg Philanthropies and published on the eve of this year’s COP29 United Nations climate summit, G20 countries have continued to expand coal-fired power generation capacity, which grew by 3 per cent between 2019 and 2023.

The G20, which comprises 19 sovereign countries, the European Union (EU), and the African Union (AU), currently operates around 2TW of coal-fired power generation, with another 600GW in the pipeline.

The increase in capacity has been backed, in part, by $US1.1 trillion ($A1.67 trillion) in fossil fuel subsidies in 2022 alone.

This massive level of subsidisation has been driven largely by the global energy crosis, however $US500 billion went to producers and utilities – some of whom, unsurprisingly, saw record profits in 2022.

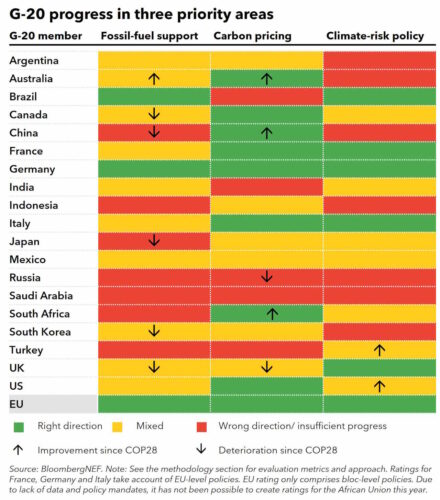

BNEF’s Climate Policy Factbook also ranks countries across three priority areas – support for fossil fuels, carbon pricing, and climate-risk policy. This latest edition saw China and Japan reclassified as making insufficient headway on fossil fuel support, while Canada and the UK have moved down to “mixed progress”.

Good news for Australia, however, having been reclassified as achieving “mixed progress” thanks to a reduction in coal-fired generating capacity in recent years and lowered fossil-fuel support in 2022.

There remains an unfortunate discrepancy between developed economies and emerging markets, according to BNEF.

By 2023, G20 members also in the Organisation for Economic Co-operation and Development (OECD) had cut coal-fired generating capacity by an average of 22 per cent relative to 2019 levels, whereas non-OECD economies had achieved a 6 percent increase.

While 2023 fossil fuel subsidy figures are not yet available on a country level, BNEF currently estimates that the G20 provided $US945 billion in support for the fossil fuel industry.

And though this marked a 19 per cent decrease on 2022 support levels, it remains well above historical levels even though, as BNEF highlights, “the acute phase of the energy crisis generally ended in late 2022.”

An increasing number of G20 members now have multiple carbon taxes and markets either in place or on the horizon, resulting in compliance carbon pricing now covering 29 per cent of G20 emissions – a share which is expected to climb as programs are expanded and new schemes are implemented.

Progress on Australia’s compliance baseline-and-credit program, called the Safeguard Mechanism, and the domestic offset program, known as the Australian Carbon Credit Unit Scheme has been slow, and emission baselines for individual facilities have yet to be set, though the reform has introduced a 4.9 per cent reduction rate per year to 2030.

Even with this sluggish progress, however, the BNEF Factbook pushed Australia to moving in the “right direction” for carbon pricing.

However, in terms of its climate-risk policies, Australia remains in the red, indicating “wrong direction” or “insufficient progress”.