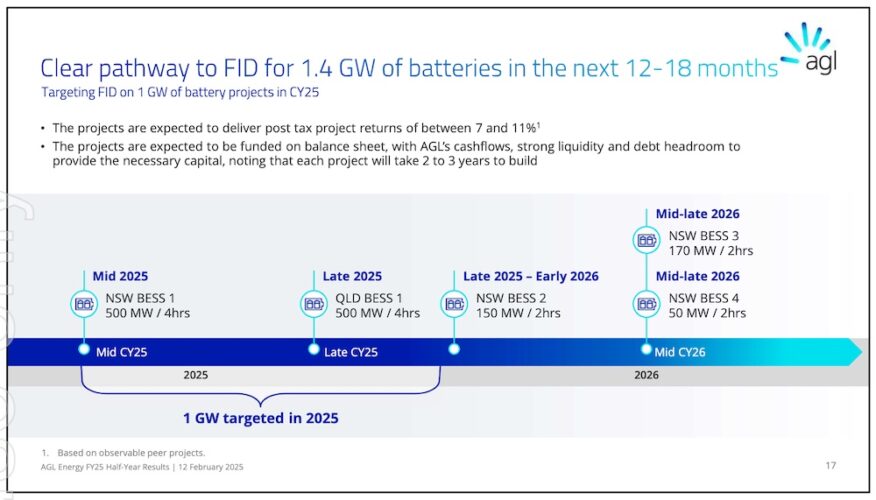

AGL Energy has outlined plans to lock in another 1.4 gigawatts (GW) of grid scale battery storage projects over the coming year, in the race to transform its electricity generation portfolio from its current mix of roughly 80 per cent coal to a majority of firmed renewables.

In an investor presentation delivered after the release of its half-year results for the 2025 financial year, AGL says it is targeting final investment decisions for four new big batteries totalling 900 MW in New South Wales and one 500 MW battery in Queensland. Most appear to be around two hours of storage, although this could change.

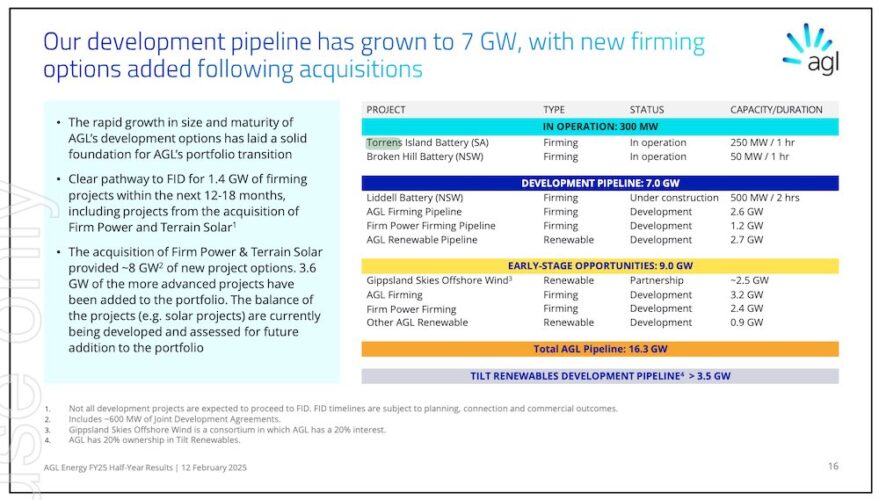

AGL already owns and operates the Torrens Island big battery in South Australia and the Broken Hill battery in NSW, is building the 500 MW, 1,000 MWh Liddell battery at the site of the shuttered coal plant and has contracted the second stage of the big Western Downs battery in Queensland being built by Neoen.

“As we seek to accelerate options and our decarbonisation pathway where possible, we now have a clear pathway to Financial Investment Decision (FID) for 1.4 GW of batteries,” AGL CEO and managing director Damien Nicks said on Wednesday.

“This will add to our current flexible fleet capacity of 7.6 GW, which grew by 200 MW over the half with the addition of a second 200 MW virtual battery agreement with Neoen, and enable our ambition to build and operate a leading battery portfolio in the National Electricity Market.

“Construction of our 500 MW Liddell Battery is on schedule, and we now expect the first 250 MW to be operational by early 2026, and the remaining 250 MW by April 2026,” Nick said.

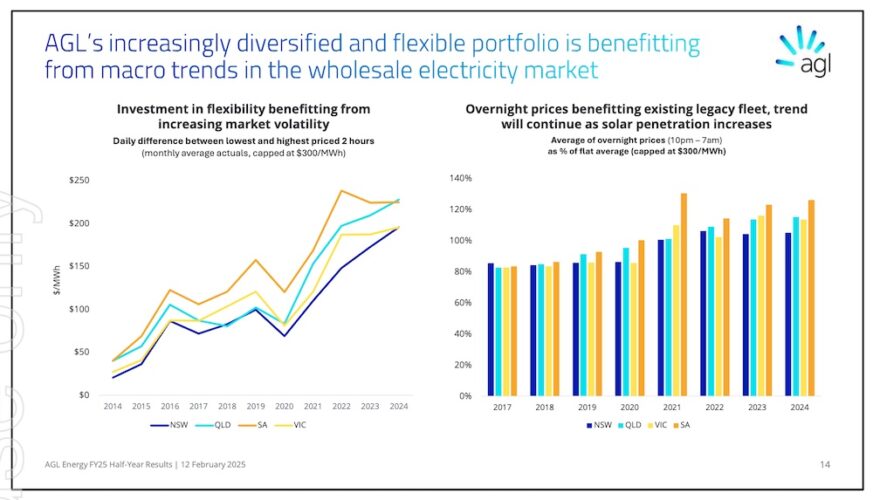

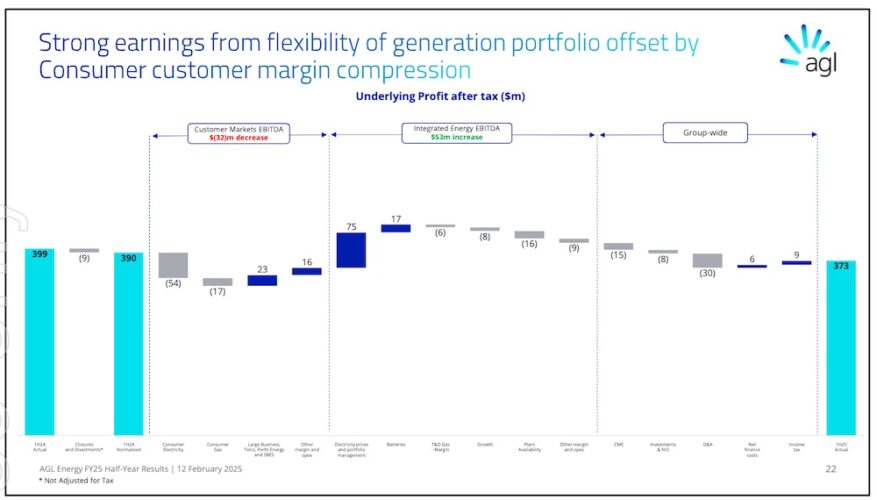

The push to batteries comes as AGL reports a “strong” first half result – including stable earnings (EBITDA) of $1,068 million – which Nicks attributes to the flexibility of its generation fleet and its ability to capture volatile electricity pricing – namely through its growing battery portfolio.

“We expect volatility to remain elevated as coal-fired generation comes to the end of its life and renewable penetration continues to increase, boding well for our growing portfolio of grid-scale batteries,” Nicks says.

“As solar penetration continues to increase in the NEM, there is an increasing divergence between pricing in the middle of the day compared to other timeframes over a 24-hour period.

“The graph on the right [below] shows that overnight prices are contributing more to average daily prices than in the past. This is benefitting both wind and the existing baseload fleet.”

AGL has been vocal about the success of its first operating big battery – at Torrens Island in South Australia – which was one of the star performers in the last financial year, delivering profits of $28 million (before tax, interest and depreciation) in its first nine months of operations.

Referring to the below chart, AGL CFEO Gary Brown notes that the 17-million-dollar bar for “batteries” reflects the full six months of operation of the Torrens Battery compared to only three months in the prior period, as well as the commissioning of the Broken Hill Battery in the half.

“Just as importantly,” Brown says in the presentation, “we can observe the premium that hydro, gas and batteries are able to achieve based on being very flexible assets. It is these asset classes that we continue to focus on delivering as we progress through the transition.”

Also driving the case for further investment in grid-scale battery storage are falling costs. In a Q&A session with analysts after the results presentation on Wednesday, Nicks said AGL was seeing “30 to 40% reductions across the board” since developing the Torrens Island battery.

“As we’re thinking about these new batteries, I would say … what we’re seeing is, you know, 30 to 40% reductions across the board. And I think we’ll continue to see more benefits from batteries going forward, in terms of where the cost positioning goes,” he said.

And the gentailer’s development pipeline is also looking healthy, with the key highlight for the reporting period being the addition of 1.2 GW of selected firming projects from the acquisition of Firm Power and Terrain Solar, announced last August.

“You will also notice that we’ve also added 2.4 gigawatts of firming projects from the acquisition to our early-stage opportunities, strengthening portfolio optionality. Additionally, there is approximately a further four gigawatts worth of projects from the acquisition that will be assessed in the future,” Nicks said.

“Overall, we are well positioned with the size, maturity and quality of our development pipeline – the focus now is on the continued timely execution of projects of the highest portfolio value, and it should be noted that the pipeline will continue to evolve as projects will come in, and where not economic, out of the pipeline.”

The half-year announcement also gives a nod to the increasing impact on the Australian energy market of electrification, both of households and vehicles, as consumer shift away from fossil fuels.

“It is interesting to note that for the first time in six years we are seeing growth in native demand,” Nicks says in the investor presentation.

“As we’ve discussed previously – the major driver of this expected growth is the electrification of the home, transportation and broader industry, and we continue to see growing demand for electrification products from our consumer and large business customers.

Nicks says one of the company’s core customer-focused strategic pillars is to “lead in electrification,” and he says AGL is “incredibly well positioned to leverage the opportunities presented by the near doubling of NEM demand projected by 2050.”

On electric vehicles, Nicks points to the “significant opportunity to orchestrate the ever-increasing flexible load of EV batteries,” including incentivising off-peak charging, which for AGL’s still coal-heavy fleet currently means shifting load to overnight through pricing signals.

“We also recognise the major growth opportunities of adjacent products and services such as EV subscriptions, fleet transitioning and public charging,” he says.

Nicks says AGL is capturing a “disproportionate share” of Australia’s growing EV market, through what he describes as a “compelling suite of EV plans, propositions and partnerships which will be the foundation of continued expected growth.”