In the face of a global and domestic energy crisis of shortages and hyperinflation in all fossil fuel commodities, the AGL leadership farce continues.

It’s an ongoing trainwreck where both the chair and CEO have resigned, but refuse to get out of the control room and off the train, stymieing the long overdue board and leadership renewal, now deferred another three months to mid-November.

AGL on Friday reported FY2022 net profits of just $225 million, down 58% year-on-year and at the bottom of guidance and market consensus.

The results confirm the bungled and now cancelled demerger cost to shareholders of $145 million. This builds on the carnage of multi-billion dollar write-downs over the last few years relating to failure to account for rehabilitation, onerous contracts in renewable energy and the failed Crib Point LNG re-importation development.

It is yet another clear example of a board unable to respond to the climate science, the speed of technology transition nor global experience of the energy transition, replicating the demerger debacles of the RWE and E.On experiences of 2016-2018.

AGL has almost entirely missed the huge ongoing investment opportunities to deliver on our market’s urgent need for new firmed renewable energy capacity, belatedly trying to acquire exposure having dismantled its in-house expertise.

The ongoing outperformance over the last decade of global energy transition leaders like NextEra Energy, Orsted and Enel are clear, and more recently for the now vertically integrated RWE targeting €50 billion of new renewables investment this decade to help solve the combined energy and climate crises smashing Europe.

The AGL Energy result also clearly articulates the key factors driving the unprecedented energy chaos in east Australia in 2022.

All the key factors relate to fossil fuel hyperinflation, coal supply chain disruptions and increasing unreliability of end-of-life coal-fired power plants, and the legacy of policy interference that has undermined investor confidence in committing to new low cost zero emissions capacity.

A greater reliance on renewable energy would have better insulated our domestic market from this ongoing global energy crisis.

AGL delivered a bottom of guidance net profit result of $225m, down 58% year-on-year (yoy). Earnings before interest, tax, depreciation and amortisation (EBITDA) was down 27% yoy to $1,218m.

Management did not provide guidance for FY2023 except to say they are a lot more cautious than what is implied by the market’s 90% consensus growth forecasts.

Driven by both the collapsing profitability and the board’s incompetence at buying back existing shares near record high prices and then issuing new shares at record lows, AGL’s return on investment more than halved to 3.7%, a third of its cost of capital.

At a time of record high wholesale electricity prices, AGL’s coal-fired power plant fleet is underperforming, with FY2022 outages across all three plants – Liddell, Bayswater and Loy Yang A.

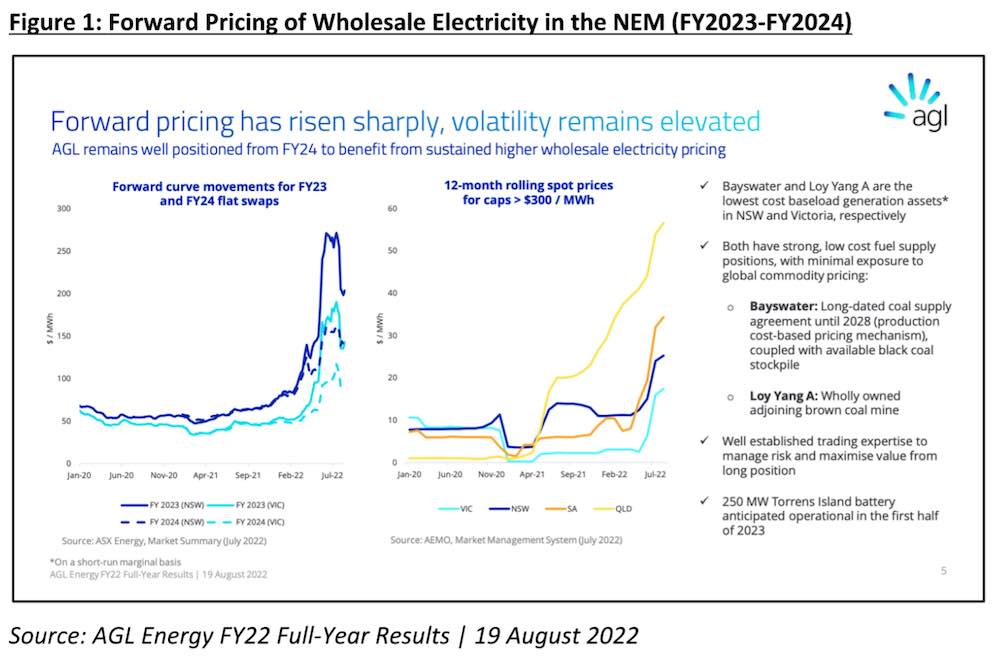

AGL’s management is very cheerfully hoping wholesale prices remain double the last decade average to $100-150/MWh into FY2024 (Figure 1), given AGL is more than 80% hedged via contracts and vertical integration in FY2023 (Figure 2), limiting the upside on generation at time when most other parts of AGL’s business is under severe pressure.

AGL has avoided the biggest landmine hitting Origin Energy in FY2022, of not having sufficient contracted coal supply to run its coal-fired power plants, given the unprecedented eightfold rise in spot export thermal coal prices to upwards of US$400/t over this last year.

For Bayswater and Liddell, AGL’s re-profiled supply contract has provided consistent production cost-linked coal supply so that AGL was unaffected by rail logistics and price rises.

Similarly, in Victoria, AGL’s owned and operated lignite mine adjacent to Loy Yang A power station provided an advantageous cost position and security of supply – Figure 3.

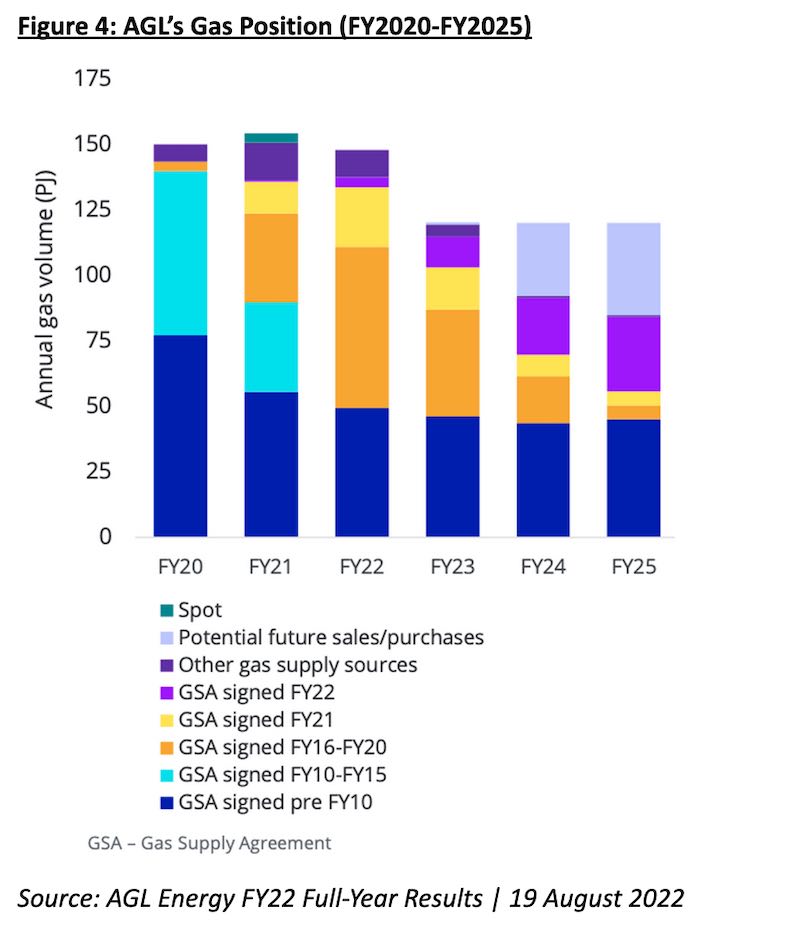

AGL has also survived the progressive rundown and recontracting of its methane gas supply for its 1.5 million gas customers (Figure 4).

Given the more than trebling of wholesale gas prices in the last two to three years, AGL faces a major profit headwind as higher priced gas supply agreements (GSA) signed in FY2016-20, FY2021 and FY2022 impact from FY2024.

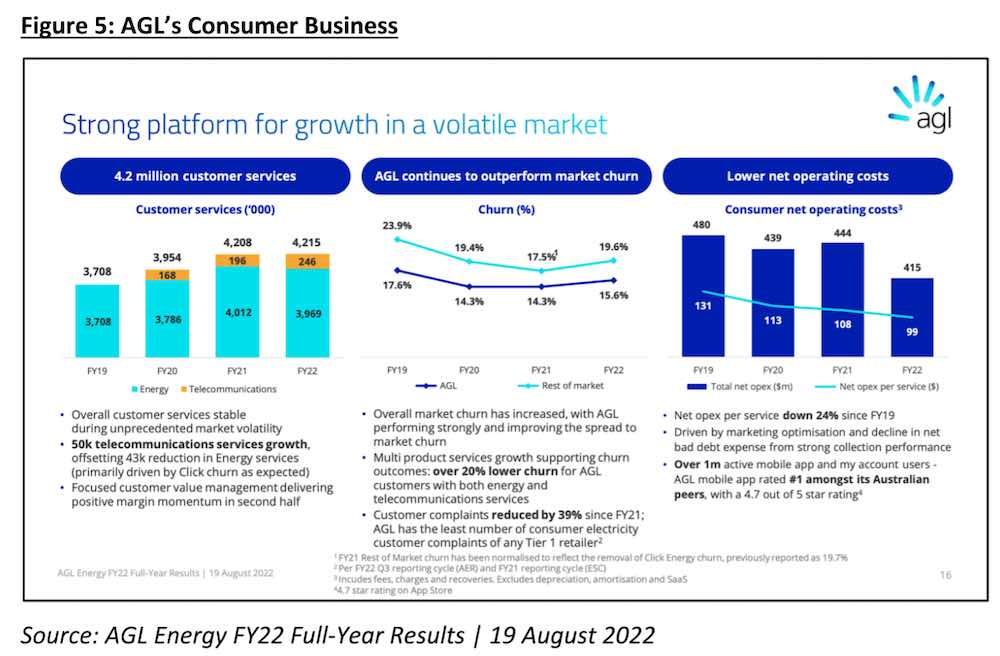

A highlight of the AGL result was evident from the energy retailing division, with the ongoing roll-out of the Ovo Energy’s Kaluza software platform. AGL’s Net Promoter Score, a measure of customer loyalty, remains at historical year-end high at +6, continuing to trend up from the trough of -23 in June 2018.

Consumer operating costs per customer has also dropped 30% since FY2019.

The core energy retailing business declined by 43,000 (-1% yoy), despite a number of competitors going bankrupt. Total customers were stable at 4.2 million given 50,000 (+25% yoy) growth in telco customers.

AGL also flags domestic gas customer demand is expected to decline ~20% yoy or 30PJ in FY2023 due to the extreme price hyperinflation – and the gas substitution plans in Victoria and ACT suggest this will accelerate over time.

Another highlight was the sustained focus on cost discipline that has resulted in a 24% decline in net operating costs per service since FY19. This has been driven by a continued focus on marketing optimisation, digitisation and a reduction in net bad debt expense due to strong collection performance.

There is also now 215MW of decentralised assets under orchestration, +65% yoy vs FY2021, including the monitoring and management of 140MW of commercial solar facilities.

This portfolio provides flexibility to reduce peak demand on the energy system, access supply during peak times, decrease emissions, and provides financial value to customers.

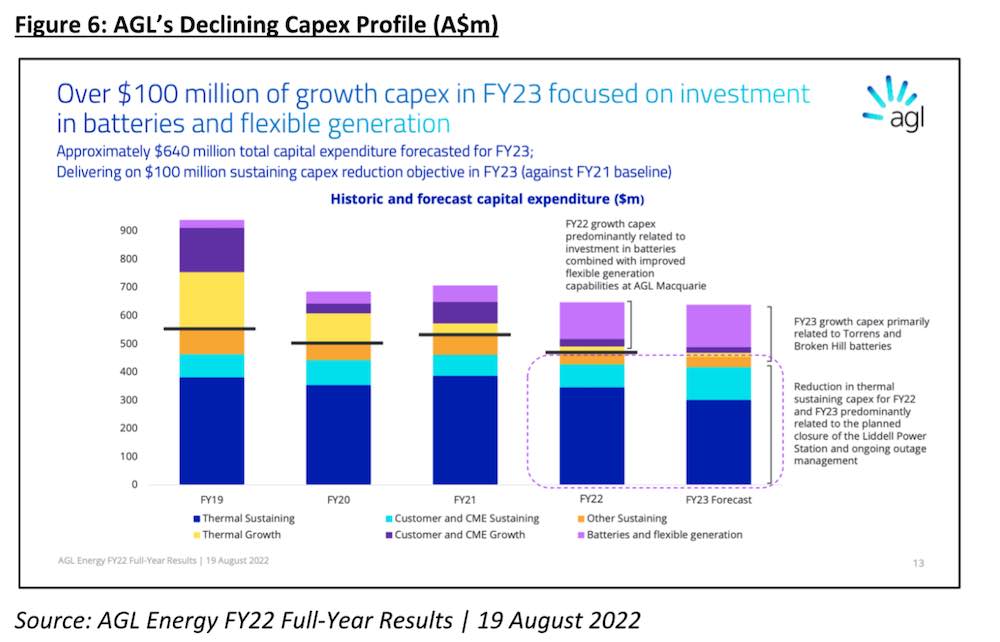

AGL’s declining capital investment (Capex) profile

Excluding acquisitions, AGL’s capex profile highlights how the vast majority of the firm’s capex has been to try to maintain its oversized exposure to increasingly unreliable, end-of-life thermal power generation.

Some 85% of capex over the five years of FY2019-FY2023 has been to thermal power generation, with no development of new renewable energy capacity, and only a minor investment in new battery firming capacity of late.

As Sentient Impact and Climate Energy Finance presented in our Strategy Paper in June 2022, AGL Energy could play a leading role in driving the Australian energy transition, driving electric vehicle roll-out, consumer electrification and decarbonisation and investing in zero emissions replacement capacity for the high emissions, high cost aging thermal power fleet.

However, in the face of massive shareholder wealth destruction, board and senior management renewal has been sorely lacking, as Australasian Centre for Corporate Responsibility has also noted.

The warning today that the board will allow AGL continue to be leaderless for six months post the resignation of the Chair, Peter Botten and CEO, Graeme Hunt, is a total failure of corporate governance.

Tim Buckley is director at Climate Energy Finance