The Australian Energy Market Operator (AEMO) has issued what is becoming a routine annual warning of potential future gas supply shortages in Australia, with the release this week of its latest Gas Statement of Opportunities (GSOO).

According to AEMO’s 2024 summary of gas supply and demand, published on Thursday, new investment in the fossil fuel is “urgently needed” for supply to keep up with demand “from homes and businesses, and for gas-powered electricity generation.”

“Flexible gas-powered electricity generation is an essential component of the energy mix into the future,” AEMO chief Daniel Westerman says.

“Gas, along with batteries and pumped hydro, will enable higher rates of renewables and support electricity reliability as Australia’s coal-fired power stations retire.”

The report says that despite years of declining domestic demand for gas, there are risks of peak-day shortfalls on some days under “extreme winter conditions” from as early as next year and the potential for “small seasonal supply gaps” from 2026 in southern states.

And “for the first time” the 2024 GSOO factors in a range of investment options like pipeline upgrades, new domestic supply, and LNG import terminals, to keep the gas supply flowing.

“While each individual investment could delay shortfalls for a number of years, a combination of these options will be needed to fully address gas supply issues,” Westerman says.

Westerman says that while domestic gas consumption from residential, commercial and industrial consumers is forecast to decline over the next 20 years – driven by electrification and the transition to net zero – gas production is likely to fall faster than demand, driven by declining production from Bass Strait.

“From 2028, supply gaps will increase in size as Bass Strait production falls significantly,” he says.

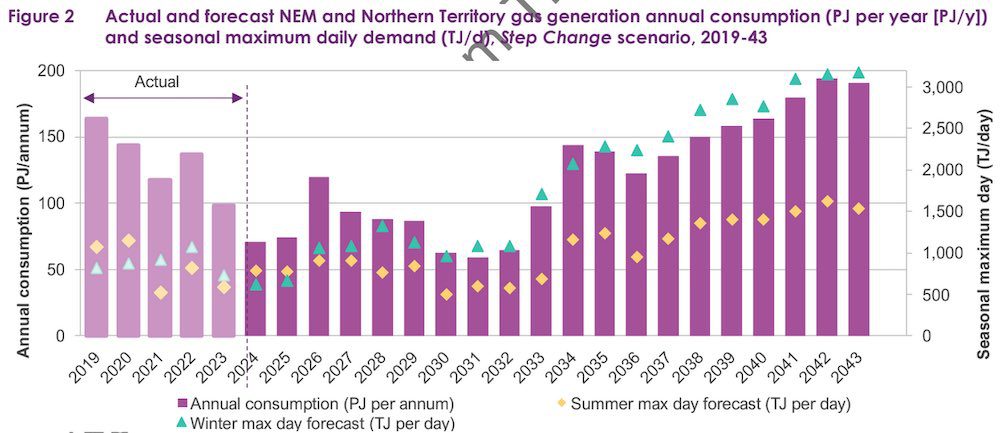

Meanwhile, as the chart below shows, AEMO is forecasting that by 2040 – 10 years past the date set for Australia to be powered by 82% renewables – there will be a near doubling in the annual consumption of gas power on the national electricity market and Northern Territory grids compared to 2023.

So where does the demand for all this future gas power come from?

AEMO says that analysis from its 2024 draft Integrated System Plan (ISP) reinforces the important role gas power will play managing extended periods of low renewables and providing firming support for the grid. It says the above chart highlights, in particular, the potential escalation in demand for gas in winter.

It says the role of gas power may also extend to providing critical power system services for grid security and stability as coal plants retire.

“Forecast gas consumption is highly weather dependent, and will be influenced by retirements of coal generators in the NEM and the capacity that replaces them,” the report says.

Analysts are not convinced. And as IEEFA’s Kevin Morrison notes, AEMO has got it wrong before.

“AEMO could be setting themselves up for another year of over estimating demand,” says Morrison, an energy finance analyst specialising in Australian gas for the Institute for Energy Economics and Financial Analysis.

“The GSOO forecast of NEM-wide gas for power generation (GPG) was 73 PJ or 54% higher than actual 2023 total GPG consumption. This overestimation could be repeated this year.”

In particular, Morrison says AEMO is neglecting to properly factor in the impact as more and more batteries and other energy storage solutions come online to compete with gas peaking plants.

Tim Buckley, the founder and director of Climate Energy Finance is less forgiving.

“I think they’re actually just blatantly wrong in their forecast,” he told RenewEconomy. “Why does AEMO have gas use in the power system actually higher in 2040 than they do today?

“That’s the gas industry giving the most optimistic view that they can about the future of their industry, and it’s just not going to happen.

“AEMO is still failing to understand the massive structural shift of scale and scope for batteries – including of utility scale, behind the meter and in electric vehicles for V2G, plus grid orchestration – to permanently diminish the need for gas peakers, which play a small, critical but diminishing role in grid firming, particularly in season peaks in winter.

“We have AEMO doing a gas statement of opportunity that ignores the obvious opportunity, which is to electrify everything and reduce demand.

“It reads like a fossil fuel industry report,” Buckley says.

“The number one they thing they should be saying is, if we’ve got limited supply available for the domestic market, is to prioritise use so that we reduce demand in the areas that are easily substituted with electrification.

“The best solution would be to immediately nationally ban new gas connections in all homes, and then plan an accelerated phase out from existing homes to permanently reduce demand. AEMO fails to articulate this as even an option.”

But analysts also question AEMO’s assumptions on dwindling gas supply.

“AEMO’s GSOO 2024 estimates the perennial forecasts of shortfalls that rarely eventuate due to the fact that there is no shortage of gas in eastern Australia given three-quarters of the gas produced in the region is used as feedstock for LNG exports or is consumed in converting gas to LNG,” says Morrison.

“AEMO makes no mention of the closure of the country’s largest gas-fired gas plant and its subsequent impact of reducing demand,” he adds pointing to AGL’s plan to close the remaining three units of its Torrens Island B gas plants (600MW) on June 2026.

“There are several gas projects that are deferred or delayed that could still come onstream in the scenario of a shortfall in 2028, with Beach Energy’s Enterprise and Thylacine fields, expected to get the go ahead later this year.”

“There is no gas shortage,” says Buckley. “We are producing five times as much gas as is used in the domestic economy outside of the gas industry in eastern Australia.

“Now the inevitable outcome of starving and gouging the domestic industry by the gas cartel is that we will accelerate electrification of everything and that will be a permanent demand destruction and yet, AEMO fails to actually come to that obvious conclusion.”

Jay Gordon, an energy finance analyst also with IEEFA says AEMO’s forecast of higher supply shortfalls is mostly driven by these mysterious forecasts of increasing gas power generation.

“These assumptions come from AEMO’s draft 2024 ISP,” Gordon says, pointing to the market operator’s latest Integrated System Plan, its highly regarded roadmap for the future development of the NEM.

“They carry significant uncertainty and are inconsistent with recent trends that show that gas generation has halved in the past decade.

“AEMO themselves have stated: ‘there are many considerations […] to be assessed before this role for gas powered generation becomes firm. These GPG forecasts, particularly late in the GSOO horizon, are therefore uncertain’.”

Gordon says IEEFA’s analysis of the 2024 GSOO has found significant changes in modelling assumptions on gas generation and competing technologies like big batteries compared to those in AEMO’s draft ISP. “They need further qualification,” he says.

And then there is the cost of gas.

“[The GSOO warns that meeting such a high future demand for GPG will require additional supply and infrastructure developments. It’s not clear whether high levels of GPG would still be cost-effective for energy consumers if the costs of these upstream developments are taken into account,” says Gordon.

“The gas price in Australia is 400% of what it is in the US. How is that competitive for Australia? It’s actually priced itself out of the market,” adds Buckley.

Meanwhile, he says, “the prices for batteries have dropped 40% in the last three months and 50% year on year and you ask, well has AEMO modelled that 50% reduction in battery prices when they’re modelling demand up? I somehow doubt it.”

“AEMO’s GSOO only considers supply-side investments as options to address future supply shortfalls,” adds Gordon.

“However, previous IEEFA analysis found that cost-effective demand-side measures like electrification and energy efficiency could more than eradicate the supply gap reported in last year’s GSOO.

“Given the declines AEMO have reported in domestic gas demand, and considerable uncertainty around the future role of gas power generation, demand-side measures still present a highly attractive option to avoid future gas supply shortfalls.”