Which fuel is setting the price of electricity in Australia? It seems pretty obvious, from all the official reports and anecdotal evidence that it is gas. And because the price of gas has more than doubled in recent years, that means that the price of wholesale electricity has also doubled over the same period.

It is one of the quirks of the wholesale pricing system that the price is set by the last generator into the market, and that is always the most expensive. And it is not just that generator that enjoys that price – all the generators benefit.

Imagine going into a supermarket and buying five apples for 50c each, and then deciding you want to buy one more. The vendor says that the price of the sixth apple is $10. And you have to pay a total of $60 for all six apples if you want it. That’s kind of how the electricity market works.

(And in the electricity market the vendors often hide the apples in the back room to give the impression of scarcity).

But here’s a curious thing. It was not so long ago, just two years ago, that most of the pricing in the wholesale market was set by hydro plants, which can easily be turned on or off.

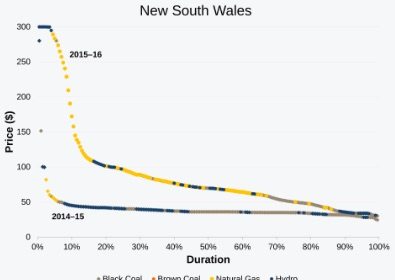

This graph below – from the gas statement of opportunities report prepared by the Australian Energy Market Operator – shows the preponderance of price setting by hydro (which is supposed to be cheap but often is reserved for peaking generation) in 2014/15.

For some reason, just one year later, in 2015/2016, the hydro plants all but disappeared from the price setting, and only made an appearance in most states at the very highest prices, which used to be set by gas.

What’s going on?

Analyst David Leitch had a go at highlighting the issue with his analysis of the Wivenhoe pumped hydro storage facility in Queensland – the bit little pumped hydro that didn’t – noting that it was rarely used by its owners, who seem to favour gas, and only switched on when really high prices could be obtained.

Dylan McConnell from the Climate and Energy Institute in Melbourne notes: “That gas is setting the prices more often and at high price makes sense,” given that the price of gas has jumped. “It’s less clear why hydro would be setting the price at a high level.”

Basically, it all comes down to those apples, and the ability of those vendors to control the market. They have no ability to do that when there is plenty of wind and solar energy being generated, but when the wind don’t blow and the sun don’t shine, they can charge what they want for gas and hydro, and (mostly) get away with blaming it on renewables.