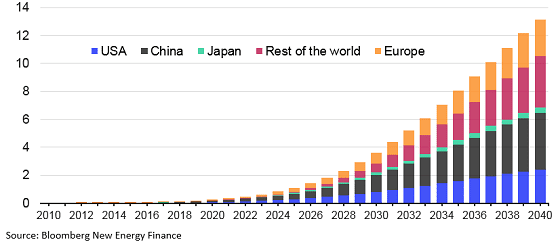

When Bloomberg published a story under a version of the above headline at around this time last year, it was based on data predicting that by 2040, 35 per cent of new cars worldwide “would have a plug.” Last week, a new graph based on new data by Bloomberg New Energy Finance has updated the details on how such a global shift electric vehilces might play out for the oil sector.

According to the graph, featured below, some 13 million barrels of oil per day will be displaced by electric vehicles by the year 2040 – an amount, BNEF says, that is equivalent to 14 per cent of the Energy Information Agency’s estimated global crude oil demand in 2016.

On the same trajectory, BNEF says, electric vehicles will displace 1.1 million barrels per day by 2025. For the record, that’s slightly down on what BNEF forecast last year: that electric vehicles could displace oil demand of 2 million barrels a day as early as 2023. But we will leave you with Tom Randall’s closing comments on the February 2016 BNEF analysis:

“One thing is certain: Whenever the oil crash comes, it will be only the beginning. Every year that follows will bring more electric cars to the road, and less demand for oil. Someone will be left holding the barrel.”