The Clean Energy Regulator has warned Australia’s big three retailers will be “named and shamed” to investors and customers if they fail to meet their RET obligations, as the industry slouches towards the curtailed 2020 renewable energy target of 33,000GWh.

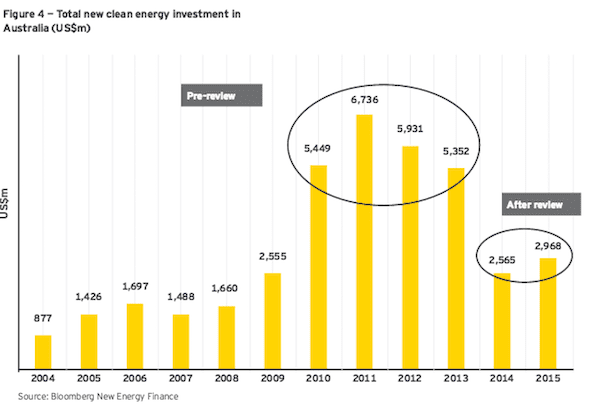

In a keynote address at All-Energy Australia in Melbourne on Wednesday, the CER’s head of scheme entry and entitlement, Mark Williamson told the conference that the target was achievable, despite the development pipeline getting off to a slow start in 2016, and depending on the pace of investment.

In a keynote address at All-Energy Australia in Melbourne on Wednesday, the CER’s head of scheme entry and entitlement, Mark Williamson told the conference that the target was achievable, despite the development pipeline getting off to a slow start in 2016, and depending on the pace of investment.

“In simple terms, what we said (in our first annual statement) was the 2020 target is achievable,” Williamson told the conference.

“We also said that half of that 6000MW need to be firmly committed …in 2016 to provide that liquidity along the way. And that financing will be the key determinate of the pace of future construction.”

But according to the findings of a newly published EY report, commissioned by the Regulator to gauge the progress of meeting the RET, the level of firmly committed new build to date is well below the 3,000MW the Regulator hopes to see.

And finance appears still to be constrained, with most of the funding for projects coming from governments or government-owned entities.

“The volume of projects being financed with commercial offtake agreements is a possible indicator of investment constraints in the market,” the report said.

“Projects that relied purely on a commercial PPA represented only 20 per cent of those reaching financial close since May 2015,” when the bipartisan deal on the RET was achieved.

“Half of the projects reaching financial close since May 2015 …have done so as a result of an offtake agreement with government or a state-owned company,” the report said.

Others, it noted, also had explicit capital cost support from the government via ARENA or the CEFC.

“It is unknown whether these projects would have reached financial close if a government offtake (or government support) was not available to purchase the LGC sand electricity,” the report said.

“Even allowing for transaction activity being a lag indicator, the above suggests that, despite the stability of the RET and the stated intentions of retailers, there are commercial investment constraints which could be creating barriers to funding greenfield projects.”

Nonetheless, Williamson remains upbeat about the scheme and its success in driving investment.

“We’re talking about $89/MWh, purely for the certificates, in terms of spot market price. And on top of that you get your price for electricity so that huge price signal will bring on the build and increase the probability of the target being met, and that’s why I argue that the scheme is working just as it should,” he told the conference on Wednesday.

But with the big three retailers responsible for around half of LGC demand, he concedes there is opportunity for further innovation in terms of financing the build-out.

“If the big three (retailers) are the only ones who can write an off-take agreement, we need to have other innovation come in to fund the other 50 per cent of build that is necessary to provide the liquidity for the smaller entities,” he said. “That’s where there’s great opportunity for further innovation.”

And Williamson had a warning for those retailers contemplating paying the penalty price, rather than meeting their RET obligation.

“If liable parties don’t surrender the right amount of LGS to us they pay a $65 penalty….It’s a penalty, it’s not tax deductible, whereas the input cost of certificates is. This is why you might hear the penalty price described as being post tax equivalent to around $93.

“Our messaging to the liable parties, to the retailers, is clear as the regulator: we expect you to comply.

“However, if some decide that the $65, if they’re not paying much tax, is the cheapest way out compared to paying the spot price, we do have the ability to name and shame, and we’ll name and shame in a way that makes sure their shareholders and customers hear exactly about it. And we’ll use social media if we need to.

“So, liable parties, do not try it. Your obligation is to find certificates, that brings on the new build, it’s absolutely non-compliance with the scheme to take the penalty option. And it’s not on as far as we’re concerned.”

Williamson also predicted that large-scale solar would “take a bigger slice” of the remaining target than most – including the CER itself – had anticipated.

“(Solar) can be built quicker, and with the support of ARENA to drive the price down, I think solar could be a dark horse both in terms of market share and potentially providing more liquidity along the way than most analysts currently think there will be,” he said.