China’s wind power capacity has reached 140GW, up 8.5% from the end of last year. However, the average time windmills spent generating power dropped to 917 hours in the first half of the year, compared to 1,002 hours last year, according to the latest data from the National Energy Administration (NEA).

Even with double the installed wind capacity, China is producing less electricity from turbines than the US. While curtailment is one part of the problem, the NEA has also flagged faulty equipment as an issue. China’s wind industry has grown fast but “the quality of equipment needs to be improved,” said Li Peng, an official from the new energy department of the NEA. The nation will “improve the monitoring and evaluation system” for the sector, he said.

China’s cumulative grid-connected solar capacity crossed 65GW, with as much as 22GW added in the first half of this year. Bloomberg New Energy Finance expects 6-8GW to be added to the grid in the second half of the year. Will the government reduce the 2020 solar target of 150GW? The issue is discussed in the note: China added more than 20GW PV in H1: what next?

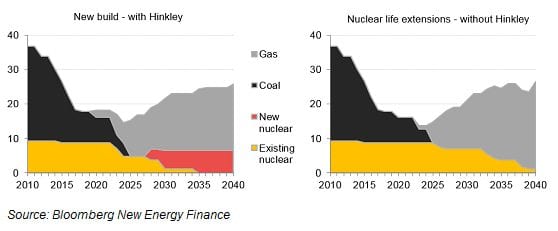

China figured in news last week from the UK, where it emerged that Prime Minister Theresa May had raised security concerns over the Chinese investment in the Hinkley Point C nuclear power project when it was discussed during her predecessor’s premiership, a report in the Sunday Telegraph said. Last Thursday, May’s government said it would review the GBP 18bn ($24bn) project of Electricite de France with support from Chinese investment, just hours after the company’s directors approved proceeding with construction. The impact of a delay or cancellation of the project can be read in the note: UK government puts emergency brake on Hinkley C.

Across the Atlantic, Tesla Motors has finalised the designs for the $35,000 electric Model 3, and will start producing the car next summer, chief executive Elon Musk announced last week. Last month, he shared his ‘master plan, part deux’, which included electric trucks and buses.

Mercedes-Benz, meanwhile, outlined plans to start selling an electric heavy-duty truck in about five years. The ‘Urban eTruck’ will have a range of about 200 kilometres (120 miles) per battery charge and capacity for loads of as much as 26 tonnes, parent company Daimler said in a statement.

Chile attracted 84 bids in its largest auction of electricity supply contracts last week, a spokeswoman for the National Electricity Commission said, raising optimism that it will lead to lower electricity prices in the Latin American nation. The commission is auctioning contracts to supply 12,430GWh a year, a third of supply to regulated consumers, according to its executive secretary Andres Romero. The winners of the auction will be announced on 17 August.

In Australia, state-owned investment manager QIC said the annual return from its new AUD 3bn ($2.3bn) clean energy fund will be more than double the yield of government bonds. The Powering Australian Renewables Fund will be the largest owner of clean domestic energy capacity, with 10% of the total, QIC said in a statement. Expected returns are in line with a 5% yield target, according to QIC, which is run by the Queensland state government and manages more than AUD 78bn in assets.

Taiwan unveiled plans to expand solar capacity by 1.4GW in the next two years – a plan which is expected to attract investment of almost $3bn, the Taipei-based Commercial Times reported.

Mytrah Energy is weighing up whether to become India’s first company to list an infrastructure investment trust, or InvIT, to help the wind-farm developer tap rising demand for green power. Mytrah, traded on London’s Alternative Investment Market, may seek as much as $400m by listing an InvIT, chairman Ravi Kailas said in an interview.

In Africa, there was a setback for the $12bn Inga 3 hydroelectric project in the Democratic Republic of Congo, as the World Bank suspended funding due to the government taking “the project in a different strategic direction to that agreed” with World Bank in 2014.” Some 6% of the $73.1m granted by the World Bank in March 2014 has been disbursed so far.

The proposed Hinkley project in the UK could end up costing more than originally planned, if the country’s government doesn’t make a final decision by early autumn and re-negotiations with suppliers have to take place, according to BNEF analysis.

The graph above shows that if Hinkley Point C were to be cancelled it could signal a delayed phase-out of existing nuclear plants, in the mid-to-late 2030s, to make up for the capacity gap. This would lead to less gas-fired build in the 2020s and hence more time for new flexible generation technologies, such as renewables, to become competitive.

Source: Bloomberg New Energy Finance. Reproduced with permission.