It’s been one of the big themes at the World Energy Future Conference here in Abu Dhabi. Solar, and other technologies such as wind power, are no longer more expensive than traditional fossil fuels in many parts of the world. Indeed, they are cheaper.

The big oil and gas players recognise this. Dr Adaba Sultan Ahmed al Jabber, the minister of state of the United Arab Emirates, said at the lavish opening on Monday that the cost of solar was competing with traditional sources of energy, and would not be derailed by the plunge in the oil price.

He saw that as an opportunity to call for the removal of fossil fuel subsidies, which he noted outstripped those of renewables by a factor of 5:1 in 2013. “If we have courage and opportunity to saying yes to thinking differently, could deliver better future,” he told the conference. This from a country which is in the top eight oil producers in the world, and the top seven in gas reserves.

A day earlier, the International Renewable Energy predicted that solar costs would fall substantially in coming years, underlying its competitiveness with fossil fuels. If government policy makers did not understand this, IRENA said, then they risked making bad decisions about their energy future.

Last week, the Saudi Arabian power company ACWE, with some $24 billion in assets, set a world record low for the price of solar in the world’s largest tender. Its CEO, Paddy Padmanathan, told RenewEconomy in an interview on Monday that the price of solar will fall by at least a third in coming years. He expects at least half of the 140,000GW of power capacity to be installed in the Middle East and north Africa in the coming decade to be solar.

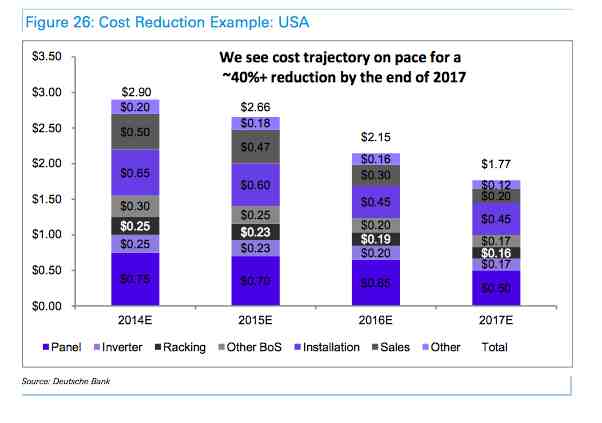

Padmanathan’s prediction accords with our story from Deutsche Bank last week, which said that solar could extend its reach of “grid parity” to 80 per cent of global markets within the next two years, assuming a 40 per cent cut in solar costs by the end of 2017.

We will have more from the Padmanathan interview in coming days. But first, since our story about Deutsche Bank’s predictions of solar grid parity attracted such interest, we thought we would go into more detail about where Deutsche Bank analysts see the 40 per cent fall in solar.

The prediction is not really that outlandish, because of most manufacturers talk of efficiency and cost improvements all the time, and the likes of Padmanathan talk of economies of scale and the fall in financing costs.

So here’s a summary of what Deutsche Bank’s Vishal Shah, one of the leading and best connected analysts in the industry, says about the future of solar module costs. Much of it is focused on the rooftop market, but many of the learnings are the same for utility scale. And, in any case, most of the solar installed in developing countries with no grids will be distributed solar, and the big turning point in established energy markets in the arrival of parity for rooftop installations. (All $ are $US)

The cost of production today

Deutsche notes that total module costs of leading Chinese solar companies have decreased from around $1.31 a watt in 2011 to around $0.50/W in 2014. It says this was primarily due to the reduction in processing costs, the fall in polysilicon costs and improvement in conversion efficiencies.

That represents a fall of around 60 per cent in just three years. Deutsche Bank says total costs could fall another 30-40 per cent over the next several years, with the greatest cost reductions are likely to come from the residential segments as scale and operating efficiencies improve.

It sees a precedent for this in the oldest major solar market in the world – Germany. “Costs today are well below costs in the United States and other less mature markets, and total installed costs have declined around 40 per cent over the last 3 years in the country. The exact drivers behind cost declines may vary between countries, but we believe the German example continues to prove that overall system costs have yet to reach a bottom even in comparatively mature markets.”

Total cost reduction will not come from polysilicon

While much of the cost reduction over the last 5-10 years has resulted from polysilicon price reductions, future cost reductions will necessarily come from non panel related balance of system costs. Polysilicon price reductions have accounted for significant portions of cost reductions, and were once the largest single cost component in panels, but this has changed drastically and rapidly over the last decade. It now represents no more than 10- 11 cents per watt so even if costs are halved, the effect on the total system cost would be incremental – not revolutionary.

Panels to fall in price to $US0.50/watt

Deutsche Bank says that while overhangs like trade cases or minimum price agreements could cloud the near term, market inefficiencies will be worked out over the long term and the clearing price will reach $0.50 or lower within the next several years.

Companies like SunEdison have publically targeted $0.40 cent per watt panels by the end of 2016, and many Tier 1 Chinese manufacturers are achieving sub $0.50/w already in 2014. :Given that most manufacturers are improving 1-2 cents per quarter, less than ten cents improvement (to reach $0.40) over the next 12 quarters is likely conservative.

If panels are sold at a 10 cent gross margin for a total cost of $0.50/w, manufacturers would achieve 20% gross margin – well above recent historic averages. Furthermore, transportation costs and ‘soft costs’ which inefficiently raise the price of panels should gradually improve as governments work through trade issues

Inverter and racking cost are also declining

Inverter prices typically decline 10-15 per cent per year, Deutsche Bank says, and it expects this trend to continue into the future. Large solar installers are already achieving $0.25/w or lower on large supply deals, and additional savings will be found over the next several years. Component cost reduction, next generation improvements, and incremental production efficiencies will drive savings on the manufacturing side, while new entrants and ongoing price competition will keep margins competitive.

Racking and other balance of system costs are often overlooked as a source of cost reduction, ongoing efficiency improvements, streamlining, and potential advances in materials to lead to incremental improvements, from around $0.25/w to around $0.17/w.

Installation costs will fall by one third in the US

Cost reduction on the installation side will come primarily from scale benefits, and could fall from $0.65/w to $0.45/w. In fact, solar installation jobs are likely to increase substantially to keep pace with demand, but more experienced installers using better tools and techniques on larger systems are likely to more than offset any wage growth through efficiency gains,” Deutsche Bank says.

Sales/Customer Acquisition Cost will fall even further

Deutsche Bank sees substantial room for improvement over the longer term in cost per watt terms – from $0.50/w to $0.20/w – as solar gains mainstream acceptance, is recognized as a cost competitive source of electricity, and companies develop new/improved methods to interact with customers.

“Already, we are seeing domestic US firms develop automated online systems for customer sourcing, and these systems alone should allow substantial further automation as solar begins to ‘sell itself’. Although adoption is still in the early stages in most markets, we think costs could reach the level in the next several years where homeowners begin to recognize inherent value of solar self generation.

“We believe this will have two effects: 1) customers who prefer to own their own systems and have the ability to do so could finance their solar installation through multiple types of solar loans which are already gaining in popularity and 2) customers who focus on the monthly electricity bill will continue to sign PPA’s for solar priced below the retail electricity price curve.

“Furthermore, the wild card for a third prong of the solar explosion lies in the regulatory environment. If utilities begin to offer competitive solar installations regardless of credit quality (under a third party ownership model), this would open the market to another vast source of potential customers.

Giles Parkinson travelled to Abu Dhabi as a guest of Masdar.